- ZCX breaks resistance, signaling strong momentum with a $5.626 target ahead.

- Volume surges suggest accumulation before a possible major breakout.

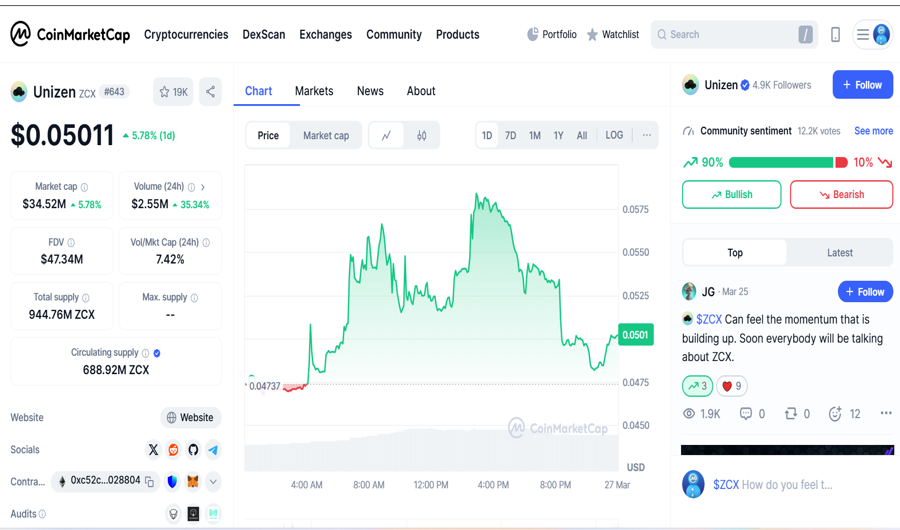

- Market confidence grows as 90% of traders remain bullish on ZCX.

Unizen (ZCX) confirmed a bullish divergence on a macro timeframe, signaling a major upward shift. With prices breaking resistance, traders watch for a larger rally. If momentum holds, ZCX could reach $5.626.

Key Technical Findings

Despite multiple rejections at resistance levels, recent price action deviates from past patterns, hinting at shifting market sentiment. The breakout from a prolonged downtrend has sparked renewed interest among traders. Sustaining upward movement requires strong volume support and confirmed resistance flips.

According to Javon Marks, ZCX has established a regular bullish divergence, which typically signals strong buying pressure. He noted that prices have already breached a major resistance trend, increasing the likelihood of a sustained rally. His analysis suggests that if the breakout holds, ZCX could reach $5.626, representing nearly 100x growth from current levels.

Examining trading volume fluctuations, Marks highlighted that this breakout mirrors past pre-rally price patterns in similar assets. Maintaining momentum above resistance levels is critical for continued upward movement. He also cautioned that failing to hold key supports could lead to temporary pullbacks before any sustained bullish continuation.

Market Performance and Liquidity Shifts

Keeping an eye on market trends, ZCX currently trades at $0.05011, up 5.78% over the previous 24 hours. Market cap is now at $34.52 million, as the 24-hour trading volume grew by 35.34% to $2.55 million. The fully diluted valuation (FDV) stands at $47.34 million, highlighting long-term valuation potential.

Observing liquidity shifts, 688.92M ZCX tokens ensure stable market availability. A total supply of 944.76M allows flexibility for future adjustments. A 7.42% volume-to-market-cap ratio reflects strong participation.

Volatility and Market Sentiment

Analyzing price trends, intraday fluctuations saw movements between $0.04737 and a peak above $0.0575 before stabilizing near $0.050. This is speculators capitalizing on price movements as the asset consolidates. Sentiment metrics indicate that 90% of community voters continue to be bullish, affirming belief in the token’s trend.

Observing the trading activity, the latest sessions have been more volatile with sharp price swings indicating active market involvement. Rising trading volumes align with price surges, suggesting accumulation phases ahead of potential breakout attempts. The asset’s ability to sustain key support levels will determine whether the bullish trend continues.

Source: CoinMarketCap

Market interest in ZCX continues rising alongside broader crypto trends. The recent pullback appears to be a correction, not a reversal. Consolidation near $0.050 remains crucial as traders anticipate the next move.