Bitcoin price dynamics have been closely watched as it hovers around the $57,000 mark. Despite this, numerous holders remain at a loss, while long-dormant wallets have shown activity and analysts predict potential dips based on emerging patterns. So what’s next for Bitcoin price, will it surge or drop?

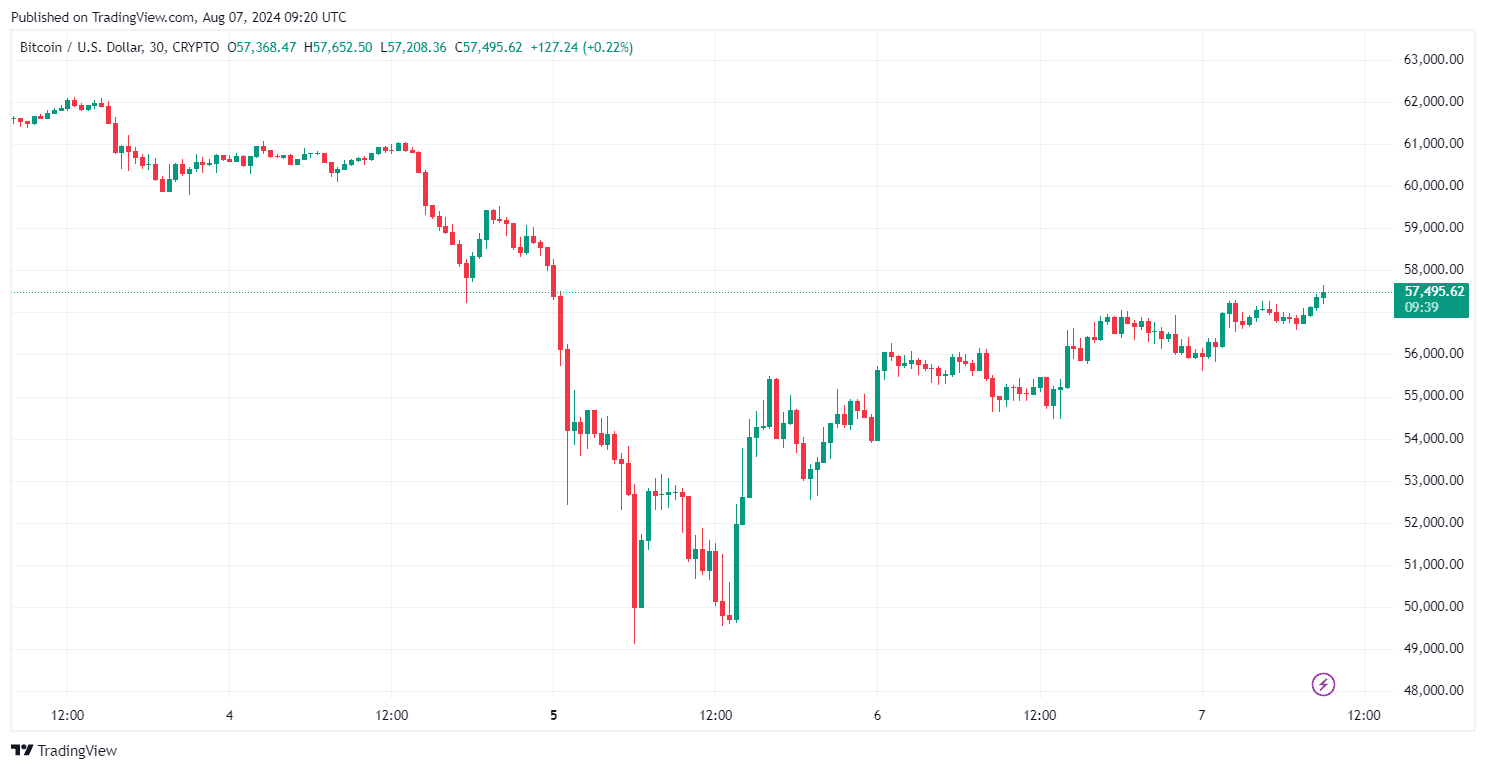

By TradingView – BTC Price Performance (24h)

Bitcoin Price Nears $57k Amidst Mixed Holder Sentiments

Bitcoin price has seen a quick recovery to the $57,000 level, shaking off the broader market fear. As of the latest update, Bitcoin trades at $57,495, with its market cap surpassing $1.1 trillion and a daily trading volume of $47.4 billion. Despite this surge, data reveals that 9.87 million Bitcoin addresses are still at a loss. Most of these addresses acquired Bitcoin at an average price of $66,441 or $59,978. Conversely, 42.24 million addresses are enjoying significant profits.

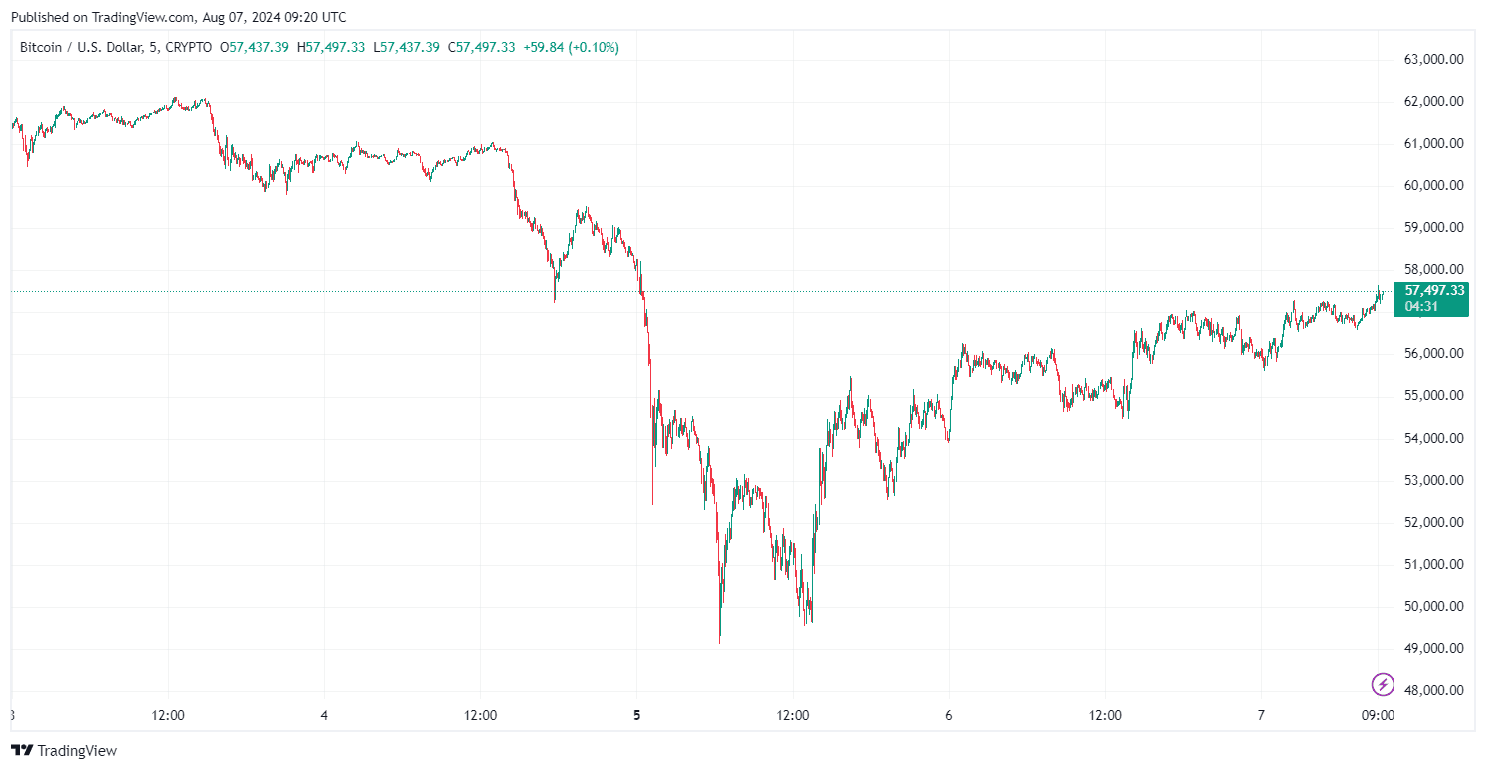

By TradingView – BTCUSD_2024-08-07

The recovery in the Bitcoin price has been partly attributed to reduced selling pressure from holders at a loss and the optimistic market outlook from key analysts. CryptoQuant CEO Ki Young Ju highlights the accumulation of Bitcoin whales as a positive indicator, predicting a new all-time high if Bitcoin stays above $45,000.

Bitcoin Major Activity: Dormant Wallets Spring to Life

The broader crypto market recovery has seen notable activities from dormant Bitcoin wallets. Recently, a miner wallet inactive for 11 years transferred 250 BTC ($13.95 million) to five new wallets. This wallet, originally earning 250 BTC from mining in 2010, achieved a profit of approximately 49,971%. Another dormant wallet containing 26 BTC ($1.5 million) also reactivated after 10.6 years, moving 20.79 BTC to the Gemini exchange, possibly indicating a sell-off.

These activities align with a broader trend of whale reactivation, with similar movements observed in July. Two major dormant wallets, holding a combined 155 BTC, also showed significant returns.

Bitcoin Price Prediction: Bearish Patterns and Market Sentiment

Despite the recent BTC price recovery, analysts have identified bearish signals on Bitcoin’s 10-day chart. A rising wedge pattern suggests a potential downtrend, with technical analysts warning of a possible drop to $51,000 if the pattern breaks down. The analysts pointed out that the key support level for BTC price is at $54,000, which if breached, could lead to a further decline toward $40,000.

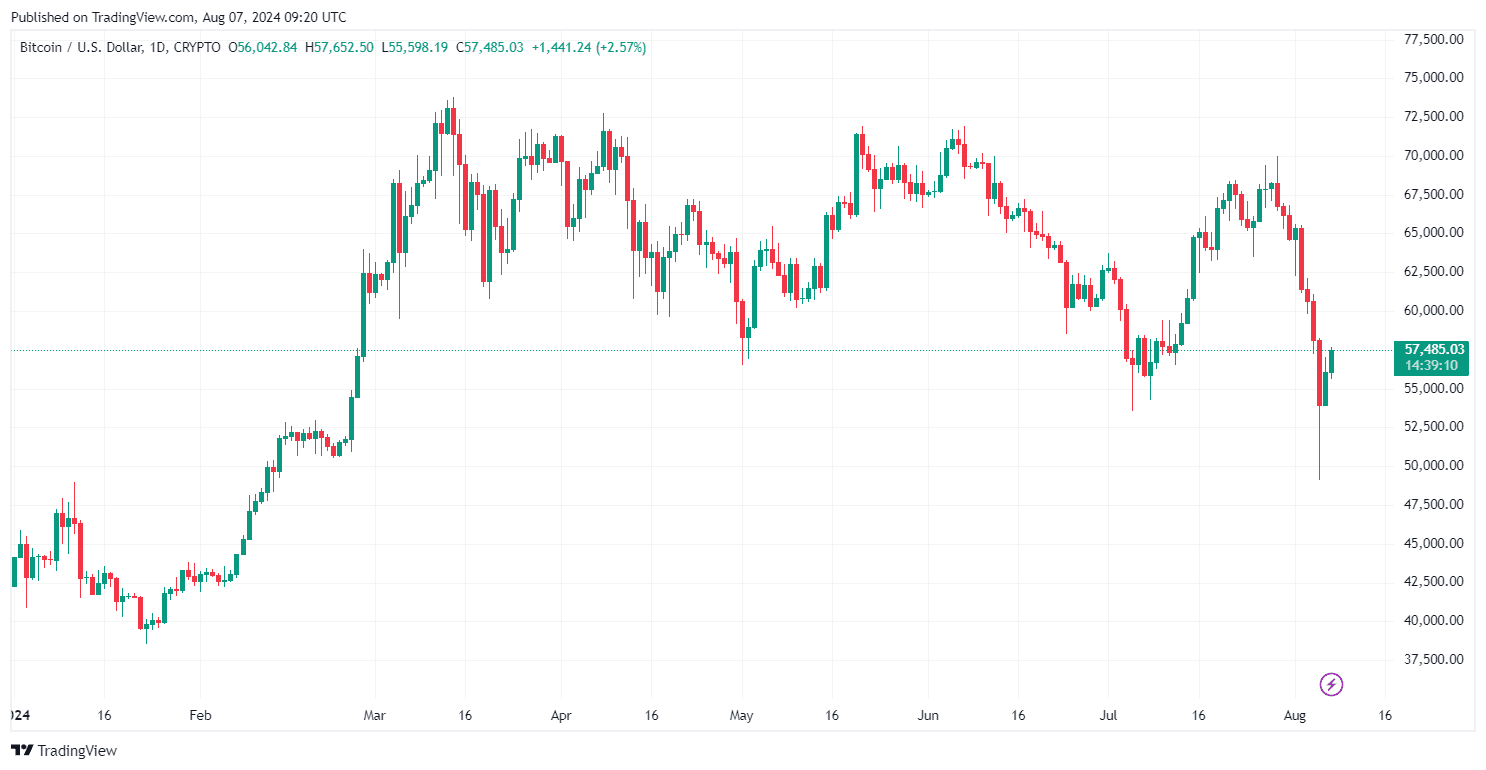

By TradingView – BTCUSD_2024-08-07 (5D)

On the flip side, some signs suggest optimism. Data Analysts note that the recovery in Bitcoin’s hash rate and substantial institutional accumulation indicate that the bull market remains intact. The absence of retail investor-driven speculative activity and reduced selling pressure from long-term holders further support a positive outlook.

By TradingView – BTCUSD_2024-08-07 (YTD)

Bitcoin’s market remains in a state of flux, with significant developments among long-term holders and analysts offering mixed predictions. While the price hovers around $57,000, market watchers are advised to stay informed about potential bearish patterns and the ongoing accumulation by institutional investors, to help get more accurate predictions regarding Bitcoin price.