Key Takeaways

- With Solana whales selling off the SOL bags, Solana’s price could be forced to trade towards $120 if $155 support fails.

- Despite Solana’s price crashing by over 10% in the last 24 hours, the volume on the Solana network remains top with a $3 billion volume.

- Solana trading below 50-day and 200-day EMAs on the daily chart is a worry for bulls as bears dominate the price to the downside.

The price of Solana has fallen by over 10% in the last 24 hours, breaking below its key support region of $165. The price looks weak and could be headed to the key support zone of $150 to $130 following current market uncertainties, with several rug pulls draining liquidity from the market.

Current short-term market sentiment remains bearish for the crypto market after several weeks of uptrend. The market is looking to retest key support zones in the coming weeks, which could give whales and institutions opportunities to buy many altcoins on the cheap.

With big wallet holders of Solana (SOL) planning to offload their SOL bags, this could negatively affect the price of SOL, as bearish sentiment could force the price towards its demand zone of $150 to $130, where the price is expected to hold strong.

Solana (SOL) Market Sentiment

Source – Solana DEX Trading Volume From SolanaFloor on X

Despite the recent market uncertainties forcing many sell-offs on the Solana network, the volume on Solana DEX (Decentralized Exchange) continues to trade at the highest volume compared to other prominent networks like Ethereum and Binance Smartchain, with over $3 billion in trading volume.

Memecoins are huge contributors of volume on the Solana network, and with traders and investors selling off their memecoins, we could see a ripple effect on Solana’s price as the price could be forced to trade around its key support of $160. A break below this region could see prices dominated by bears, forcing prices to trade to lower regions of prices.

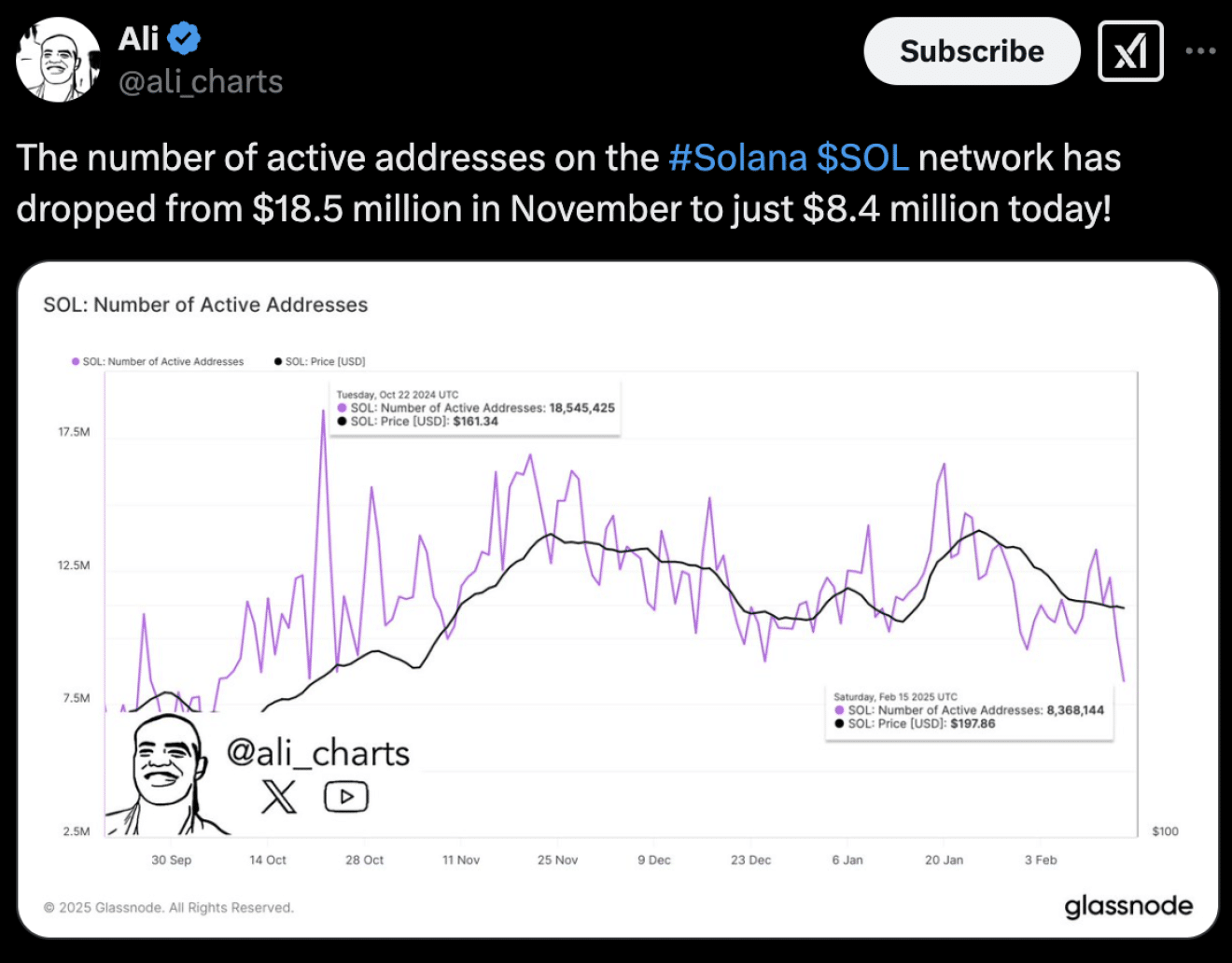

Source – Solana Active Addresses by Ali_charts on X

Top crypto analyst Ali_charts on his X account has hinted at the drastic drop in active addresses for Solana holders, with the address dropping from $18.5 million in November of 2024 to $8.4 million as of today with over $10 million address offloading their Solana tokens leading to the price drop.

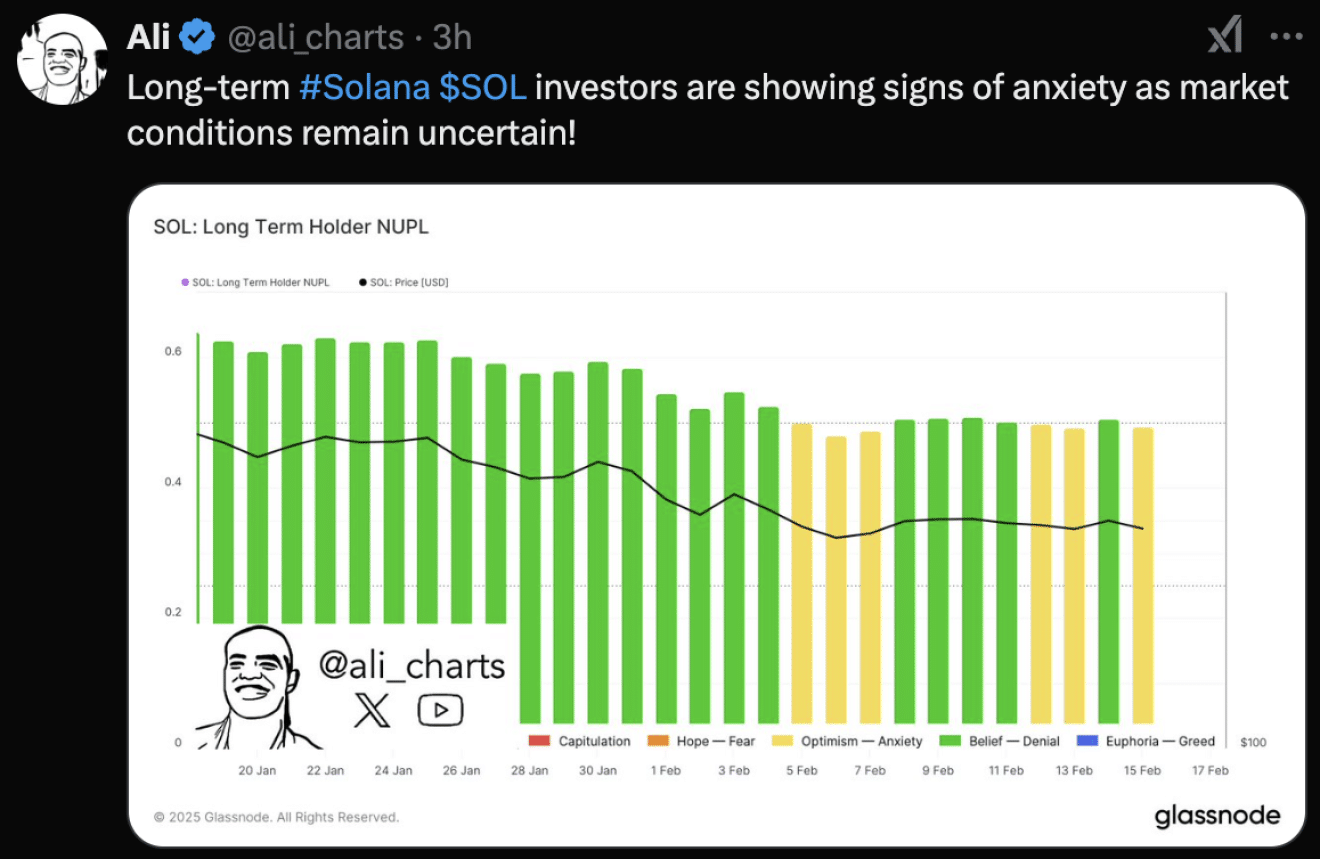

Source – Long-term Solana holders by Ali_charts on X

Ali_charts further expressed how current price action has also affected long-term Solana investors, with anxiety creeping in as the market becomes increasingly uncertain.

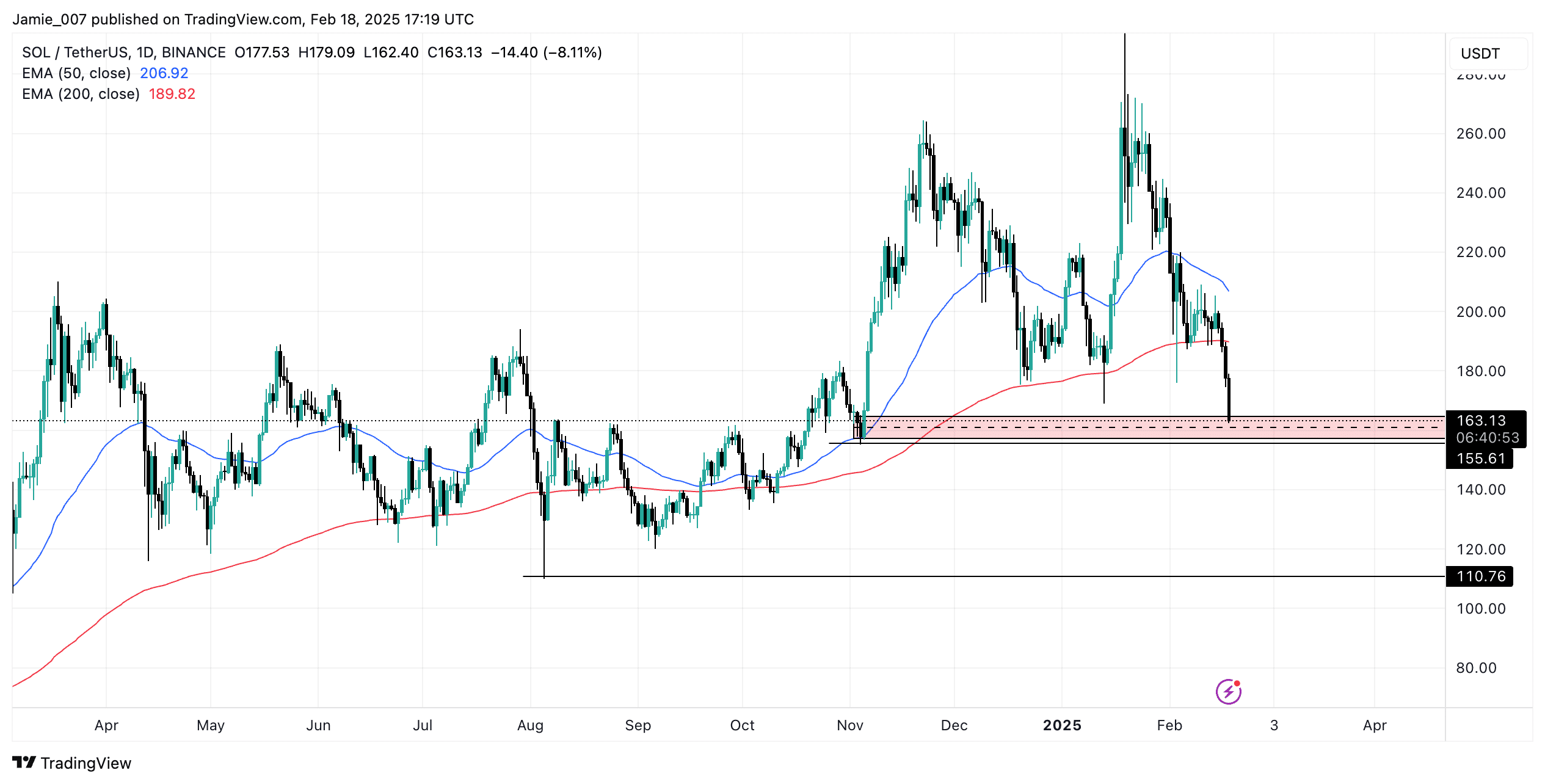

Solana (SOL) Price Analysis As Bears Dominates Price

Source – SOL 1D Price Chart From TradingView

The price of Solana now trades bearishly on the daily timeframe. It is currently trading below the key zone of the 50-day and 200-day EMAs (Exponential Moving Averages), with strong potential to continue in a downtrend towards $130 to $120 if it loses its key support zone of $155.

SOL’s price action has come under scrutiny following whales offloading their Solana holding in the past days after the price of SOL struggled to show a strong bullish rally and was affected by current memecoins rugpull on the Solana network, affecting the general crypto market as a major contributor of liquidity.

Overall, market sentiment for Solana’s price prediction remains bullish. Current market action is just temporary due to excessive panics and sell-offs in the past few days, as the price has the potential to rally to a high of $500 or more before 2025 ends.