Fantom (FTM) has recorded impressive price actions over the past few sessions, gaining 8% and 55% on its weekly and monthly charts, respectively.

While enhanced broad market sentiments amidst the Uptober narrative fueled the uptrends, whale activity and short seller liquidations extended FTM’s rally.

Fantom’s whale activity explodes

An uptick in large-scale transfers influenced FTM’s performance towards monthly highs.

IntoTheBlock data shows transactions worth over $100,00 increased from 4.38 million to 50.78 million – a staggering 1,056% increase.

Source – IntoTheBlock

The massive jump in whale activity with price surges indicates asset purchases by large-scale investors, confirming their confidence in Fantom’s potential.

Nevertheless, further details show nearly 90% of FTM investors are large holders, making the altcoin prone to significant price volatility amid massive transactions.

Short liquidations mount

FTM’s upside move saw sellers suffering losses as short liquidations surpassed $1 million within a day – marking the second-largest short liquidations in October.

Traders (forcibly) purchase the tokens to secure their positions when the price jumps to a short liquidation level.

That explains the buying momentum that drove FTM’s upside.

The liquidation chart shows FTM experienced significant liquidations in the $0.76 – $0.78 range.

Forced purchases by short sellers catalyzed upside strength as FTM hit the region yesterday.

Fantom’s 24-hour short liquidations stood at $883.3K at press time, according to Coinalyze.

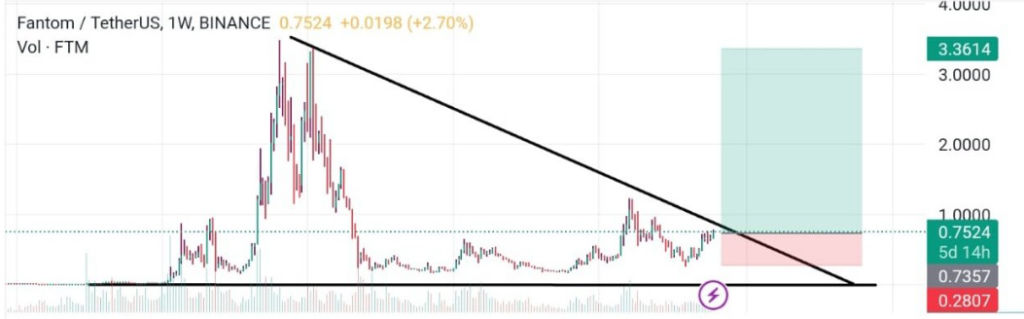

FTM price performance – is $1 next?

Fantom recorded notable uptrends over the past day, climbing from $0.7292 to $0.7889.

It trades at $0.7636 during this publication, with holders’ portfolios increasing by 5% within the previous day.

Source – Coinmarketcap

The 65% increase in daily trading volume suggests improved sentiments among traders, suggesting more gains for FTM.

Fantom flipped to bullishness early this week after the 50-d SMA jumped above the 150-d Simple Moving Average.

The former approaches the 200-d SMA – a cross above which will print a golden cross for FTM, magnifying the bullish impetus.

Furthermore, the Relative Strength Index at 64 indicates buyer favoritism.

Maintaining the prevailing momentum while bulls hold above the $0.75 support barrier would catalyze notable jumps toward the sought-after resistance beyond $1.

The Open Interest supports FTM’s upside trajectory.

The metric explores May levels after climbing toward $209 million over the past 24 hours.

However, failure to keep the $0.75 foothold would welcome bearish actions.

FTM could plunge towards $0.6930 before extending to the potential entry zone at $0.28 – $0.60.

Meanwhile, crypto experts and pundits remain optimistic about the prevailing crypto market outlook. For instance, Crypto Rover expects explosive gains that take BTC to $280,000 in the upcoming sessions.

The RSI top isn’t in yet. My #Bitcoin price target for this bull run is $280K!

0:50 am · 16 Oct 2024

He highlighted that the Relative Strength Index is yet to top, indicating massive room for bull actions. A historic ATH for Bitcoin will send altcoins, including FTM, to never-witnessed price peaks.

The post What’s next for Fantom (FTM) price as whale transactions jump 1,000% appeared first on Invezz