Avalanche Rebounds 24.8% as Bull Traders Swoop-In

In the aftermath of the recent crypto market turbulence, marked by rapid liquidations, Avalanche emerged as one of the most adversely affected high-cap altcoins. Particularly, layer-1 Proof of Stake (PoS) assets have seen diminished demand subsequent to the Ethereum ETF’s approval.

Due to this prolonged decline in trading activity, AVAX’s critical support levels weakened as bears staged a rapid correction from last month’s peak.

Avalanche Price Trajectory AVAXUSD | TradingView

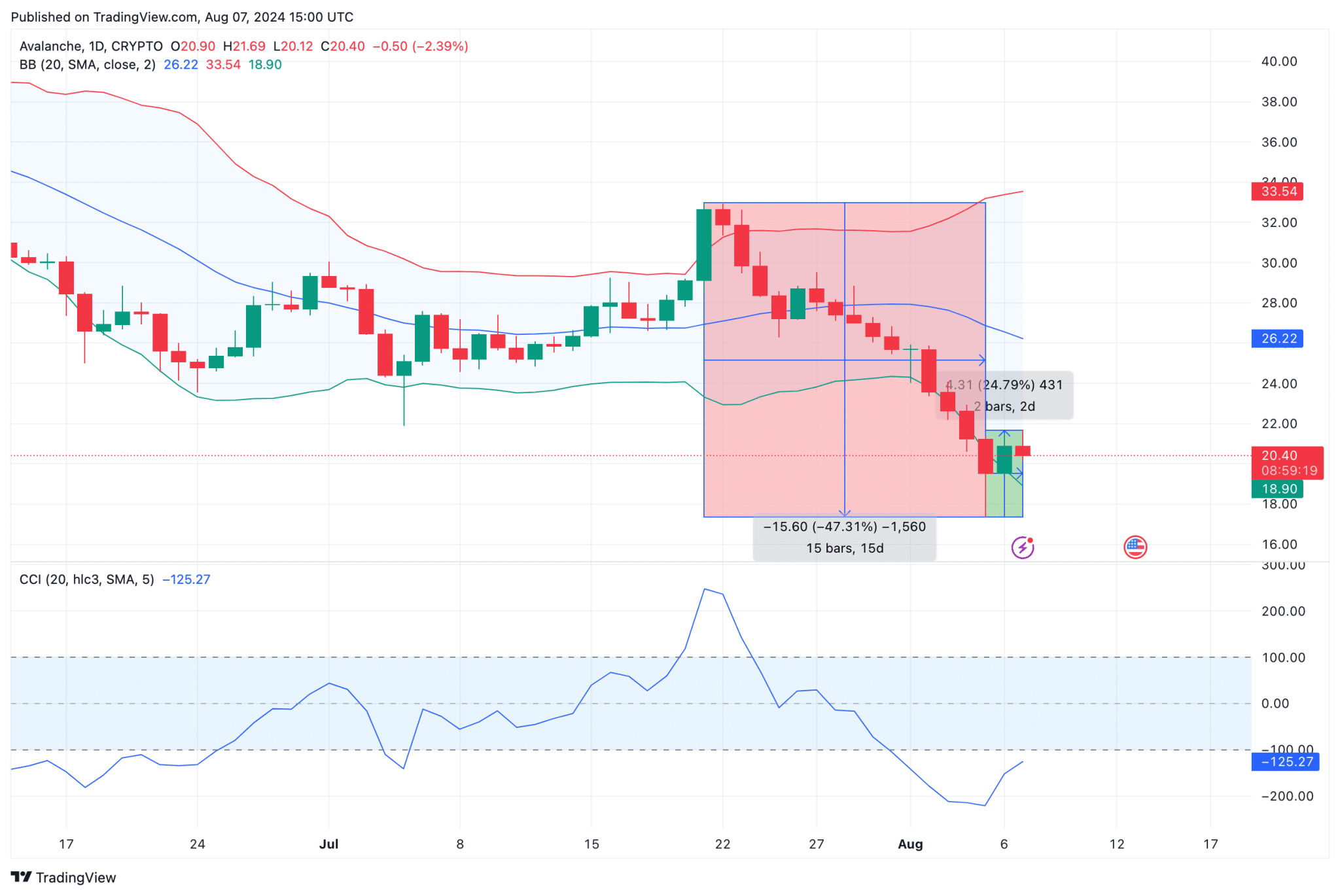

Examining the chart above reveals that AVAX’s price reached a monthly timeframe peak of $32.99 on July 21. But since the Ethereum ETFs launch, demand has dropped significantly, plunging AVAX into a steep downtrend.

But the end of the market crash on Monday, AVAX price had plummeted by 47.31% as it fell below $20 for the first time in 2024.

Conspicuously, the global altcoin market only experienced a 28.66% contraction over the same 15-day period. This discrepancy underscores that Avalanche’s retracement during the crash had exceeded the market average by over 18%.

A prominent asset such as AVAX’s underperforming relative to the broader market often suggests that it is currently undervalued, as the liquidated positions in its high-volume derivatives markets may have resulted in an outsized price correction.

This scenario frequently attracts the attention of bull traders seeking to exploit the low prices to get in early on the asset before the next rebound phase picks up momentum.

Judging by AVAX’s recent price action, early signals of this bullish market outlook have emerged.

Since August 5, Avalanche’s price has rebounded by a whopping 24.8%, as it climbed above critical $20 territory at press time on Wed Aug 7. In contrast, the global altcoin market has achieved a more subdued 19.3% rebound.

This rare market alignment suggests crypto investors are taking advantage of AVAX’s liquidations at the start of the week, to buy the dip at bargain prices. If the buying pressure persist, it positions AVAX to outperform the market average once new bullish catalyst kick in.

AVAX Price Forecast: $25 Resistance Looming Large

Avalanche (AVAX) has recently demonstrated a promising recovery, with the price rebounding from its recent low to hovering around $20.40. This resurgence has been accompanied by several technical indicators that suggest a potential continuation of the bullish trend, aiming for the next significant resistance level at $25.

Examining the Bollinger Bands (BB) on the daily chart, AVAX has been trading within the lower band, indicating that it was previously in an oversold condition. The current price is now approaching the middle band, which acts as a dynamic resistance.

A successful breach above this level, particularly if the price closes above the middle band (currently around $26.22), would confirm a shift in market sentiment and pave the way for a retest of the upper band resistance near $33.54.

Avalanche Price Forecast AVAXUSD

This scenario aligns with the bullish outlook as investors look to capitalize on the rebound from the recent market lows.

The Commodity Channel Index (CCI) further reinforces this bullish sentiment. The CCI has risen from the oversold territory below -100 and is currently at -125.27, suggesting that the downward momentum is weakening.

A continued upward move in the CCI toward the zero line would be indicative of growing buying pressure, which could drive AVAX toward the aforementioned $25 resistance level. This potential shift in momentum reflects increased investor interest and confidence in AVAX’s ability to recover from its recent declines.

In terms of support levels, AVAX has found a solid base around $18.90, as indicated by the lower Bollinger Band. This level is crucial for maintaining the bullish bias; a breakdown below this support could negate the current positive outlook and lead to further declines.

However, as long as AVAX remains above this $18.90 support and continues to gain traction, the path toward the $25 resistance becomes increasingly viable.