Billionaire investor Warren Buffett, known as the “Oracle of Omaha,” has famously expressed his dislike for Bitcoin, as he referred to it as “rat poison squared” in 2018. Buffett emphasized that Bitcoin lacks intrinsic value, likening its allure to playing the roulette wheel.

Berkshire Hathaway Vice Chairman Charlie Munger recently advocated for the U.S. to follow China’s lead and ban it, characterizing Bitcoin as a gambling contract heavily skewed in favor of the house.

With Berkshire Hathaway achieving its highest-ever annual profit last year, it is currently holding crypto assets. Does this signify a big change in how institutional investors perceive digital assets? As noted by cryptocurrency advocate Anthony Scaramucci:

I know Charlie Munger hated crypto. Warren Buffett never bought Microsoft even though he played bridge with Bill Gates every month. And now he owns Apple. Wouldn’t be be ironic if he winds up buying #bitcoin as a hedge for his cash ? Never say never.

— Anthony Scaramucci (@Scaramucci) February 24, 2024

Value investing

Berkshire Hathaway, led by Warren Buffett, stands out as one of the largest S&P 500 stocks by market value, positioning it close to the tech titans in terms of market capitalization.

Despite Berkshire’s impressive stock gains, its diverse business portfolio and strong insurance performance have garnered positive sentiment from analysts.

However, Berkshire’s substantial size presents challenges in pursuing significant acquisitions, as Buffett acknowledged in his letter to shareholders. The conglomerate’s record cash hoard reflects its struggle to find compelling deals at favorable valuations. Buffett tempered expectations, indicating that Berkshire may not deliver “eye-popping performance” in the near term.

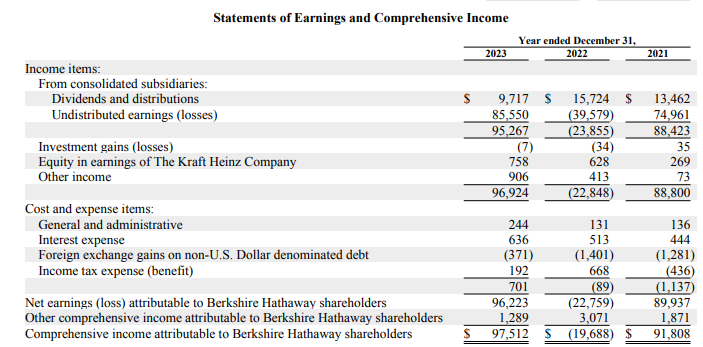

Berkshire’s best year

Berkshire Hathaway recorded its highest-ever annual profit last year. The company disclosed $97.1 billion in net earnings last year, a sharp swing from its $22 billion loss in 2022 because of investment declines.

This past week, Berkshire Hathaway Inc. saw its stock retreat after nearing a record high, bringing its market value closer to $1 trillion. Despite briefly surpassing $925 billion in market capitalization, the stock closed lower by 1.9% after a brief 3.1% gain earlier in the day, marking its biggest one-day jump since August.

Earlier, Berkshire reported higher operating earnings of $8.48 billion for the fourth quarter, up from $6.63 billion a year earlier. This increase was attributed to improved insurance underwriting earnings and investment income, supported by higher interest rates and milder weather conditions.

Despite its impressive performance, Berkshire’s valuation stands in contrast to the tech giants dominating today’s market, with its stock trading in two classes, including the highly priced Class A shares.

Recently Berkshire reported a net profit of $12.7 billion for the first quarter, a 64% decrease from $35.5 billion the previous year. Despite this, the company has earned nearly $7 billion from its portfolio over the past year. Berkshire’s shares have risen 11% in 2024, surpassing the S&P 500’s 8% total return.

Nubank

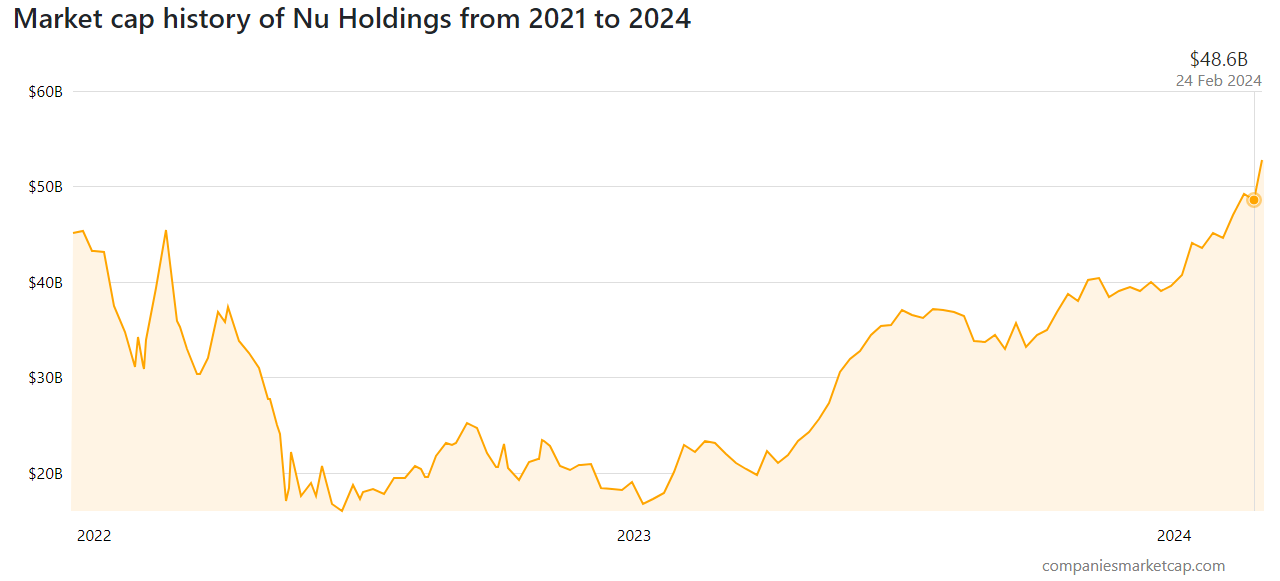

Brazil’s Nu Holdings has introduced innovative products like Nucripto, allowing users to trade in cryptocurrencies like Bitcoin and Ethereum. In June 2021, Buffett’s Berkshire Hathaway invested $500 million in Nubank, later adding another $250 million during its IPO, bringing the total investment to $1 billion in 2021.

In 2023, Nu Holdings saw a price increase of over 100%, outperforming Buffett’s other holdings like Amazon, Apple, Coca-Cola, Bank of America and making it the most profitable investment in Berkshire Hathaway’s portfolio last year. Despite Buffett’s traditional aversion to crypto, his continued holding of Nu Holdings suggests a bullish outlook on the stock’s future.

Nubank offers digital financial services, including access to a Bitcoin ETF through its investment unit, NuInvest. It aims to capitalize on this market by offering innovative financial services and addressing customer dissatisfaction with high fees and poor experiences.

While cryptocurrencies do not align with Buffett’s investment principles, their substantial gains, such as Bitcoin’s 150% surge in 2023, may influence Berkshire’s future investment decisions. Berkshire’s investment in Nubank suggests a strategic move into the digital finance sector, despite personal reservations about crypto.

Cashing in

Berkshire’s cash reserves reached a record $189 billion in Q1, 2024, as the conglomerate continued to divest stocks, including a significant portion of its Apple holdings.

The company disclosed it sold nearly $20 billion worth of stocks in the first three months of the year while buying only $2.7 billion, reducing the value of its stock portfolio from $354 billion at the end of 2023 to $336 billion.

Bitcoin ETF effect

With the success of spot Bitcoin ETFs’ launch earlier this year, investment firms are looking closely at digital assets and crypto businesses. BlackRock CEO Larry Fink, once a skeptic, now expresses strong belief in Bitcoin as an asset class, likening its role to that of gold in protecting wealth.

Similarly, Fidelity, known for its efforts in developing a crypto ecosystem encompassing trading, ETFs and custody services, promotes resources to help individuals “trade crypto with clarity,” signaling growing acceptance and interest in cryptocurrency among traditional financial institutions.

Wall Street’s next major foray into digital assets will likely come in May. That’s when the SEC faces a deadline to approve or deny the first ETFs to hold Ether, the second-largest crypto, with a $393 billion market value.

Firms including Fidelity, BlackRock and Invesco have applied to launch Ether ETFs. A Bernstein Research report in February said it was nearly certain that the products will win approval in the next year.