Chainlink price retracted 5% on Thursday, June 20, 2024, as bulls failed to build on the 10% rebound recorded 48 hours prior; on-chain data shows that whale investors offloading behind the scenes could be behind the latest pull-back.

Chainlink Dips 5% as Bears Halt Rebound Phase

Chainlink price entered double-digit gains between June 18 and June 19, as SEC dropping investigations into Ethereum triggered a brief rebound phase across the crypto markets.

But as the US S&P 500, led by chip-manufacturing giant NVIDIA, surged to new peaks on Wednesday, it attracted the attention of savvy crypto traders, some of whom appear to have now redirected the short-term gains toward the roaring stock markets.

As things stand at the time of writing on June 20, the LINK price has succumbed to another wave of bearish pressure.

Chainlink price action | LINKUSD | TradingView

The chart above shows how LINK price had gained 14.33% after having tumbled toward $12.98 on June 18. Notably, that was the first time in 32-days, dating back to May 15, that Chainlink price had fallen below critical $13 mark.

This brief Chainlink price rebound was evidently fuelled by the bullish sentiment surrounding the SEC’s softened stance toward Ethereum. However, after hitting a major resistance cluster around the $15 mark, bears are now back in the driving seat.

Chainlink Whales Offload $40M as SEC Ends Ethereum Investigations

The latest price data shows LINK wobbled 5% within the daily timeframe as it rapidly retraced toward the $14 territory at the time of writing on June 20. Looking at the underlying on-chain data, it appears that Chainlink whale investors took advantage of the brief market recovery to the stage and offload some of their holdings.

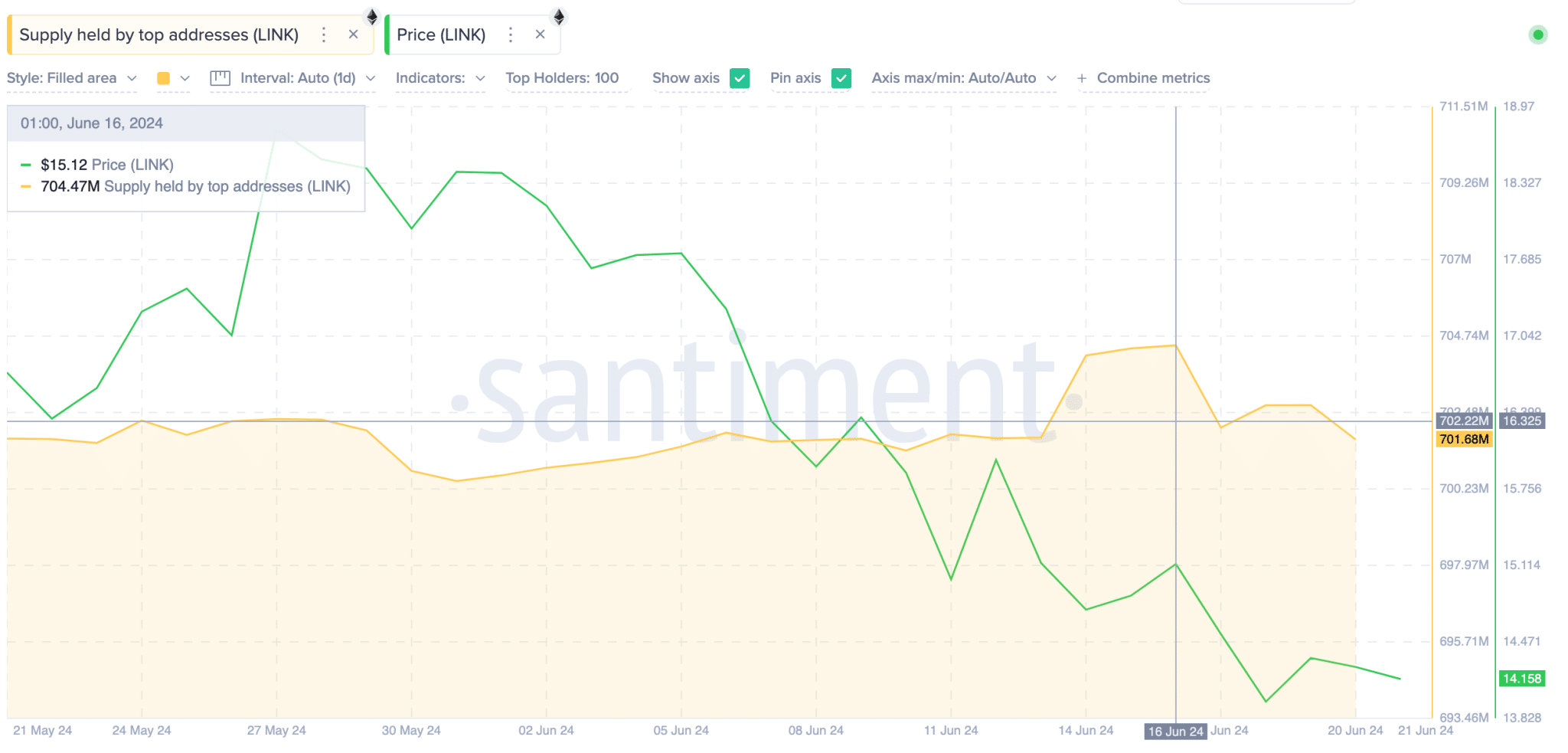

The Santiment chart below tracks real-time changes in the balance of LINK tokens held by Chainlink’s top 1,000 largest whale wallets.

Chainlink price vs LINK Whales Balances | Santiment

The yellow-shaded trendline in the chart above shows how the top 100 whale wallets held a total of 704.47 million LINK tokens as of June 16, having sat firmly on to their holdings as the month-long crypto market correction phase ensued.

But on June 17, when the news of Ethereum’s landmark legal clearance from the SEC broke, the Chainlink whales instantly entered a selling frenzy. At the time of publication on June 20, the top 100 largest LINK whales now hold a cumulative balance of 702.22 million LINK.

This effectively means that Chainlink whales sold off about 2.25 million LINK tokens between June 17 and June 20. Valued at the current price of about $14.20 per coin, the recently offloaded coins are worth approximately $40 million.

Such a rapid selling trend among whale investors is often regarded as a major bearish signal. Unsurprisingly, the whales’ selling frenzy coincided with the 5% price correction recorded on Thursday.

Chainlink price forecast: $13 Support at Risk Again

Despite the 5% correction toward $14.2, Chainlink’s price is still a healthy distance from the weekly timeframe bottom of $12.98 recorded on June 18. But when whale investors sell off such a large amount of coins within a short period, it sends bearish signals to other strategic retail traders within the ecosystem.

Having breached the $13 support earlier in the week, bears could now target a much larger downswing toward $12.

Chainlink Price forecast | LINKUSD

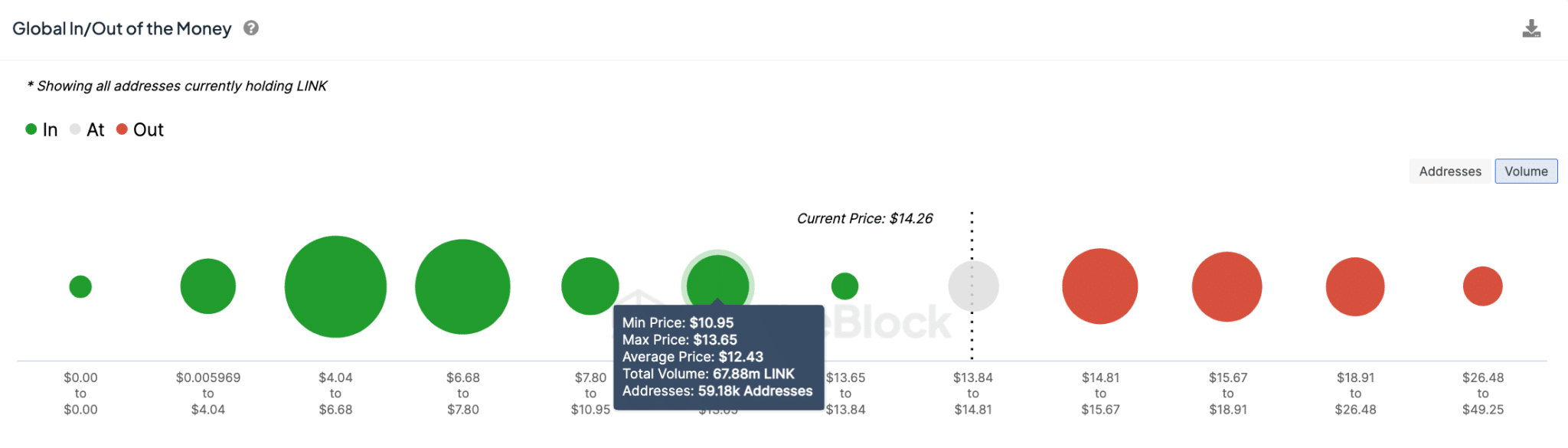

However, IntoTheBlock’s GIOM chart shows that LINK bulls will like move the support buy-wall toward the $12.40 area. As seen above, 59,180 active addresses had acquired 67,88 million LINK at the average price of $12.43. To avoid massive loss liquidations bull traders could start staging covering purchases once LINK price start tumbling towards the $12.40 area.

But if that support buy-wall caves in, Chainlink’s price could experience further downside toward the $11 mark.

On the flip side, bulls could gain a foothold in the markets again if Chainlink can reclaim the $15 psychological resistance in the days ahead.