August 2023: proposed regulations

On Aug. 25, 2023, the US Treasury and the IRS released proposed regulations that would require companies engaged in digital asset-related services to file information returns and furnish payee statements for digital asset dispositions.

The proposed regulations provide clarification on several important aspects, including which digital assets are subject to reporting, who qualifies as a broker, how to calculate basis in a digital asset and the treatment of digital assets as a separate category distinct from securities and commodities.

“A key part of this effort fits in with the larger IRS compliance focus on wealthy taxpayers. We need to make sure digital assets are not used to hide taxable income, and the proposed regulations are designed to provide a clearer line of sight into activities by high-income people as well as others using them,” said IRS Commissioner Danny Werfel.

The regulations define “digital asset middleman” broadly, encompassing entities like trading platforms, wallet providers and payment processors. Under these proposed regulations, brokers would be mandated to report on digital asset sales, with an expanded definition of “digital asset.”

These regulations are slated to take effect for transactions occurring on or after Jan. 1, 2025, with some reporting aspects having later effective dates. It is important to note that these regulations are still in the proposal stage and may undergo further revisions.

Definition of digital assets and brokers

The proposed US Treasury and IRS regulations expand the definition of reportable digital assets to include stablecoins, NFTs and tokenized stocks, excluding virtual assets limited to closed systems like video game tokens.

A digital asset is a representation of value recorded on a secure, distributed ledger. Common types include:

- Convertible virtual currency and cryptocurrency (e.g., Bitcoin, Ethereum).

- Stablecoins, which are cryptocurrencies pegged to a stable asset like a fiat currency (e.g., USD Coin, Tether).

- Non-fungible tokens (NFTs), unique tokens representing ownership of digital assets like art or collectibles.

- These digital assets serve various purposes within blockchain and digital finance systems.

The definition of a “broker” is broadened to cover entities providing “facilitative services” for digital asset sales, requiring detailed transaction reporting including customer information and sale specifics.

Additionally, the Infrastructure Investment & Jobs Act broadened the definition of “broker” to include those facilitating digital asset transfers for others. This applies to any digital representation of value recorded on a distributed ledger.

US tax experts have been vocal on the lack of clarity in current tax regulation. For instance, the proposed regulation § 1.6045–1(a)(21)(iii)(A) defines a facilitative service as any service that directly or indirectly enables a sale of digital assets. It excludes persons solely engaged in providing distributed ledger validation services, like proof of work or proof of stake, without offering other functions or services.

According to a Bloomberg Law report, due to a lack of clarity, many proof-of-stake stakers and staking businesses are taking a conservative approach. They report the value of reward tokens as income at the moment they are created, rather than when they actually receive income by selling their reward tokens.

Tracking crypto income via application forms

The IRS is now tracking cryptocurrency income by asking taxpayers on Form 1040 about their crypto activities. The form specifically inquires whether individuals engaged in receiving, selling, sending, exchanging, or acquiring virtual currency. Providing false information can lead to penalties, as tax returns are legally binding statements.

On Jan. 22, 2024, the IRS reminded taxpayers that they need to answer a digital asset question and report any related income when filing their 2023 federal income tax returns, similar to what was required for the 2022 tax returns.

The question appears at the top of forms:

- 1040, Individual Income Tax Return;

- 1040-SR, U.S. Tax Return for Seniors;

- 1040-NR, U.S. Nonresident Alien Income Tax Return.

- 1041, U.S. Income Tax Return for Estates and Trusts;

- 1065, U.S. Return of Partnership Income;

- 1120, U.S. Corporation Income Tax Return;

- 1120-S, U.S. Income Tax Return for an S Corporation.

The digital assets question asks taxpayers whether, at any time during 2023, they received digital assets as a reward, award, or payment for property or services, or if they sold, exchanged, or otherwise disposed of a digital asset or a financial interest in a digital asset.

The question may vary slightly depending on the type of taxpayer (individual, corporate, partnership, or estate/trust). In addition to checking the box, taxpayers must report all income related to digital asset transactions.

April 2024: 1099-DA draft form

On April 18, 2024, the IRS unveiled a draft of Form 1099-DA aimed at calculating taxable gains or losses from brokered digital asset transactions. This form includes token codes and fields for wallet addresses, essential for reporting to both taxpayers and the IRS.

Form 1099-DA includes individual token codes, spaces for wallet addresses and details on how to locate transactions on the blockchain. Brokers are required to report digital asset dispositions on this form to both taxpayers and the IRS, potentially leading to recognized gains for taxpayers.

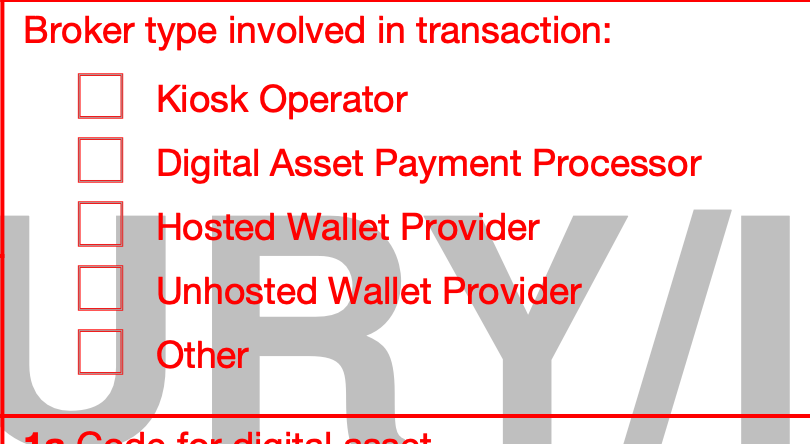

However, the cryptocurrency industry remains uncertain about how the IRS will identify brokers subject to these regulations, especially concerning different types of activities like kiosks, payment processors and wallet providers. The absence of a formal digital asset registry complicates compliance for brokers, including centralized exchanges and decentralized platforms.

Problem of digital asset middleman

The broad definition of “digital asset middleman” in the proposed regulations could involve multiple brokers in a single transaction. For example, if a user uses a self-hosted wallet with a DeFi platform for a token swap, both the wallet provider and DeFi platform might be considered middlemen.

Unlike securities rules, there’s no exemption for multiple middlemen, so each must file their own Form 1099-DA with the IRS and taxpayer. This could confuse taxpayers, leading to over-reporting or discrepancies with IRS data, adding to taxpayer burden.

Additionally, proposed regulations’ wallet-by-wallet identification approach could pose challenges for taxpayers holding assets with low bases in specific wallets. They may need to transfer high-basis assets to those wallets to identify them.

Crypto brokers: Who are they?

The Infrastructure Investment and Jobs Act, effective from Jan. 1, 2024, requires crypto brokers to report transactions over $10,000 to the IRS. This has sparked controversy due to perceived burdens and implementation challenges.

Brokers must submit detailed reports to the IRS within 15 days of qualifying transactions, including sender information. Lack of IRS guidance leaves users unsure about compliance, especially regarding miners, validators, decentralized exchanges and anonymous transactions.

Starting Jan. 1, 2025, proposed regulations would mandate brokers like digital asset trading platforms, payment processors and specific hosted wallet providers to report gross proceeds using Form 1099-DA and furnish payee statements to customers.

Additionally, under certain conditions, brokers would need to include gain/loss and basis details for sales occurring after Jan. 1, 2026, on these returns and statements to assist customers in tax preparation.

According to the PwC report, IRS anticipates receiving an unprecedented volume of “eight billion” 1099-DA reports annually, with associated costs projected in the billions. Businesses will face challenges implementing the proposed regulations if the effective dates remain unchanged.

Crypto industry reaction to IRS

Variant’s Jake Chervinsky called out IRS proposed regulations as rules that “don’t make sense.”

He believes the IRS’s approach is driven by a perception of tax evasion, leading them to rely on financial surveillance. Chervinsky argues that the IRS overlooks technology enabling peer-to-peer transactions without intermediaries capable of conducting KYC checks and reporting transactions.

Bad news: despite years of industry engagement with IRS explaining why “unhosted wallets” can’t be brokers, the message somehow hasn’t landed.

Good news: rules that make literally no sense at all rarely survive scrutiny in the courts.

Great news: we really like filing lawsuits.

— Jake Chervinsky (@jchervinsky) April 21, 2024

Jason Schwartz, tax partner and digital assets co-head at Fried Frank, noted how the novel definition of digital assets middleman does not help to differentiate brokers.

18/ INITIAL REACTIONS. The proposed regs’ definition of digital assets middleman would turn website developers into brokers if the websites “facilitate” digital asset sales.

That’s bad law and bad policy.

— CryptoTaxGuy.ETH 🦇🔊🛡️ (@CryptoTaxGuyETH) August 27, 2023

On Nov. 7, 2023, the DeFi Education Fund (DEF) filed a brief supporting James Harper’s appeal against the IRS, aiming to limit the government’s access to user transaction history on cryptocurrency platforms.

Harper was one of thousands of Coinbase users whose data was disclosed to the IRS in 2017, prompting a legal challenge for stronger digital privacy rights. DEF argues that regulations proposed on Aug. 27 would expand the definition of “broker” too broadly, impose burdens on individuals and entities unable to comply, while jeopardizing privacy.

The IRS’s “broker rule” hasn’t been finalized, but it looks like Treasury is really going to take the position that “unhosted wallet providers” are “brokers” 🤦♂️🤦♂️

IRS released draft 1099 form for digital asset “brokers”: pic.twitter.com/6oVNNmwPXO

— Miller (@millercwl) April 19, 2024

IRS guidance sources

The treatment of cryptocurrency is subject to limited guidance, including:

- Notice 2023-34, offering guidance on certain convertible virtual currencies.

- The Infrastructure Investment and Jobs Act of 2021, which addresses digital asset information reporting for brokers.

- Proposed Regulations on digital asset reporting released Aug. 25, 2023.

- Revenue Ruling 2023-14, which discusses the inclusion of staking rewards in income for cash-method taxpayers.

- Notice 2023-27, clarifying that NFTs should be treated as collectibles.

- Revenue Ruling 2019-24, providing guidance on hard forks and air drops.

- FAQ, as updated on the IRS website.