Telegram-linked Toncoin is experiencing significant growth in its user base. Recent data indicates a surge in the number of TON holders, positioning the network to overtake Ethereum in terms of user adoption by the end of the year.

In addition to a surge in holder count, holding period and whale accumulation have spiked, positioning the altcoin for an extended rally. This analysis delves deeper into the factors at play.

Toncoin To Surpass Ethereum in Holder Count

In a recent report, CryptoQuant analyst Maartun noted that Toncoin “is growing quickly,” and its holder count “is expected to surpass the number of ETH holders around December 20th.”

Currently, Ethereum boasts approximately 137 million holders, while TON has already reached the 112 million mark. Over the past month, TON has averaged 500,000 new holders per day. According to Maartun, if this growth rate persists, it could potentially result in TON overtaking Ethereum as the network with the largest user base by the end of the year.

Read more: What Are Telegram Bot Coins?

TON/ETH Holder Count. Source: CryptoQuant

However, the analyst included a caveat. He said the spike in TON’s holder count has been exponential, but the rate may slow down in the coming months. A more conservative estimate suggests that the crossover point could be pushed back to February 3, 2025.

Moreover, Ethereum’s user base is also growing, albeit slower. While the current data does not reflect this growth, it could impact the projected timeline.

Toncoin Enjoys Bullish Bias

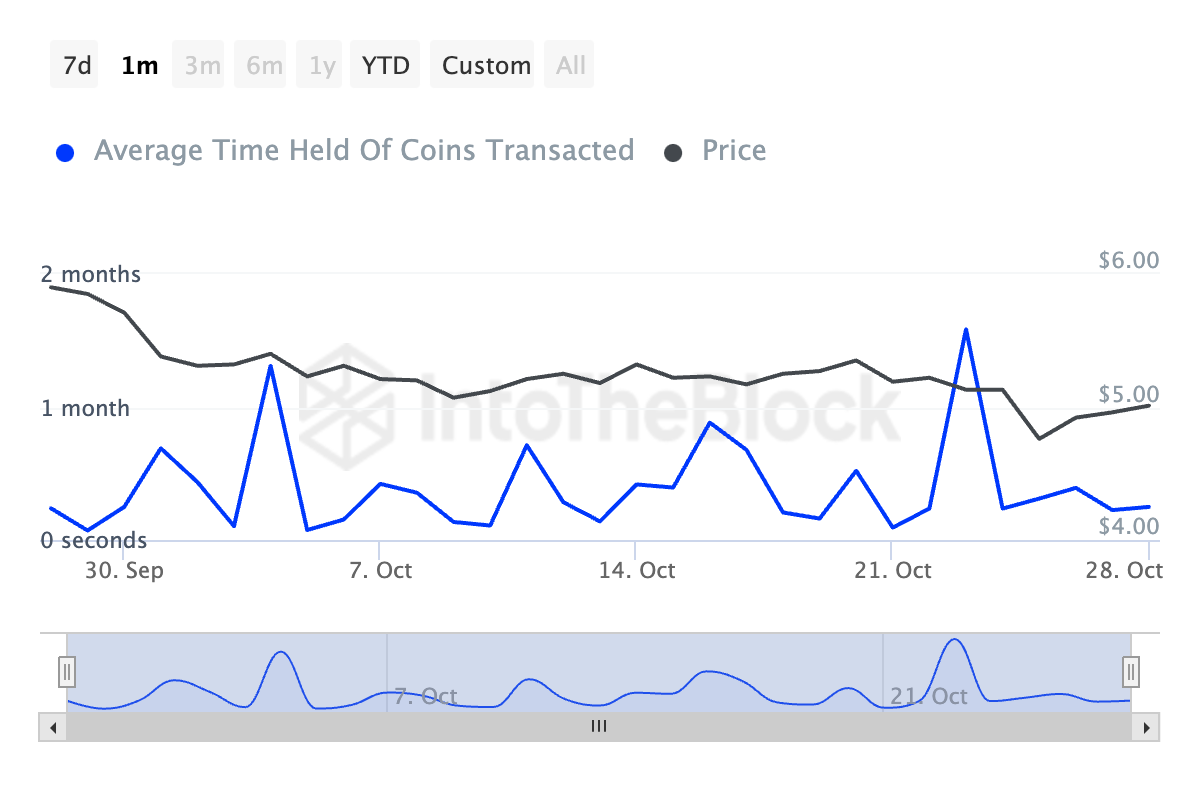

As TON holder count spikes, its holding time has also increased. IntoTheBlock’s data shows that over the past month, the altcoin’s holding time, which tracks the length of time that coins have been held before being traded, has climbed by 249%.

An increase in coin holding time is a bullish signal. This suggests that investors are holding their asset for longer periods on average, indicating greater optimism for its near- and long-term potential.

Toncoin Coin Holding Time. Source: IntoTheBlock

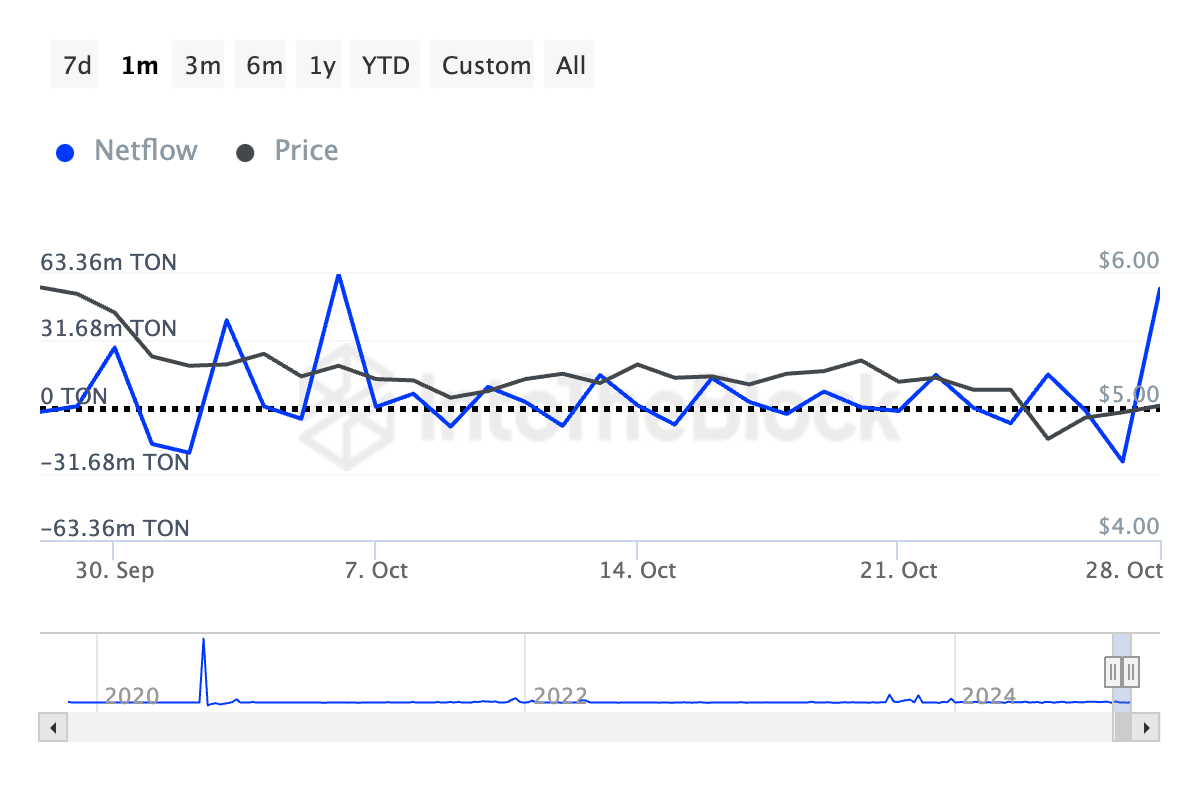

In addition, during the 30-day period in review, TON whales or large investors have increased their accumulation, as evidenced by its rising Large Holders’ Netflow. Per IntoTheBlock’s data, this has surged by over 15,000% in the past month.

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins they buy and the amount they sell over a specific period. When it rises, it signals increased accumulation among this group of investors and is a precursor to a potential price rally.

Toncoin Large Holders Netflow. Source: IntoTheBlock

TON Price Prediction: The Bulls Must Rally

Toncoin is trading at $5.01 at press time, just below the resistance formed at $5.26. If holding time continues to lengthen and whales maintain their accumulation of the altcoin, TON price could break above this resistance, setting a course toward $5.91. A successful breach of this level may propel it further, with the next key resistance at $6.82.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Toncoin Price Analysis. Source: TradingView

Conversely, if market sentiment shifts and selling pressure intensifies, Toncoin’s price may struggle to break past $5.26, potentially leading it to trend downward toward the support level at $4.44.