Key Takeaways

- Privacy coins offer full anonymity compared to pseudo-anonymous coins like bitcoin.

- Some popular privacy coins include Monero (XMR), Zcash (ZEC), and Dash (DASH).

- Our view: privacy coins are a dying market due to regulatory pressure and delistings. Intelligent investors should avoid them.

Privacy coins are like the curtains you draw to keep your home life private from prying eyes. While traditional cryptocurrencies like bitcoin and Ethereum are similar to having your curtains wide open so anyone can peek in and see your transactions, privacy coins try to protect users from surveillance and unwanted scrutiny. Just as curtains provide a barrier to protect your privacy at home, privacy coins shield your financial activities, ensuring they remain confidential and away from unwelcome observers.

Should you invest in them?

In this guide, we analyze the current state of the privacy coins market and its long-term sustainability, looking at fundamental metrics like revenue, daily active users, and market cap.

What Are Privacy Coins?

Privacy coins are cryptocurrencies that employ advanced cryptographic mechanisms to hide transaction data from the public eye, keeping their users fully anonymous.

Unlike bitcoin, Ethereum and other digital currencies, privacy coins don’t reveal the sender’s and recipient’s addresses, the amount transferred, or even wallet balances.

Popular examples of privacy coins include Monero (XMR), Zcash (ZEC), Dash (DASH), Horizen (ZEN), Verge (XVG), Beam (BEAM), and Grin (GRIN).

Privacy Coins Pros and Cons

One of the key features promoted by bitcoin proponents was privacy and anonymity, but in reality the cryptocurrency has become relatively easy to track, thanks to blockchain intelligence tools that can connect public keys with their owners. This became even easier after regulators enforced KYC policies on crypto exchanges.

Katie Haun, a former prosecutor turned crypto venture capitalist, admitted that blockchain made it easy to trace criminal activity, saying: “Without the technology underlying bitcoin, we never would have been able to catch those people.”

Leaving aside their potential misuse, privacy coins aim to bring a higher degree of financial independence and control to everyday users.

The main benefits of privacy coins are financial privacy, security, and resistance to censorship.

Investors can avoid the tracking and surveillance of their transactions. While this is useful for criminals, it’s also useful for citizens in countries with authoritarian or repressive governments. For example, in China, those who waste money on non-essentials can be penalized: privacy coins can make these transactions discreetly.

Privacy coins can also prevent data breaches, which have become more frequent during the last few years.

The Dangers of Privacy Coins

Due to their potential use for illegal activities, financial watchdogs are tightening the grip on privacy coins.

For example, they are completely banned in Japan, and you can’t trade them on crypto exchanges in South Korea.

Although privacy coins are still legal in the US and the European Union (EU), regulators are watching them very closely and may impose restrictions, citing anti-money laundering (AML) risks. In 2023, leaked documents showed that the EU planned to ban banks and crypto services that deal with privacy coins.

Some major crypto exchanges want to avoid additional scrutiny and have chosen to delist privacy coins, affecting their liquidity. For example, Binance delisted Monero earlier in 2024.

All this makes privacy coins a risky investment for the intelligent investor.

Top Privacy Coins

Here are the top privacy coins by their popularity and market cap:

Monero (XMR)

Monero (XMR)

Monero is one of the oldest privacy coins and the largest by market cap, with over $3.1 billion as of mid-June 2024. It uses ring signatures and stealth addresses to hide senders and recipients.

Ring signatures merge users in a “ring” to make it difficult to identify which user created a given signature.

Stealth addresses allow the generation of a new address for each transaction a user receives.

XMR is facing a challenging period in 2024 as it has been delisted from Binance while Kraken is blocking it in Ireland and Belgium. As a result, the coin’s price hasn’t been able to benefit from the crypto market’s bull run: in our view, a sign of things to come.

The chart above shows that since 2021 Monero has largely decoupled from bitcoin. Rather than following the ups and downs of the world’s largest crypto (as many coins do), Monero has been mired in a flat line – like a dying patient.

Zcash (ZEC)

Zcash (ZEC)

Zcash was launched in 2016 by the Electronic Coin Company (ECC). It is the first project to use so-called zk-SNARK technology, which proves the validity of transactions without revealing their details.

ZEC’s price and fees have been declining during the last few years amid regulatory pressure.

Token Terminal data shows that weekly fees have dropped from several thousands in 2018 to just over $200 as of today. The token price has dropped from $884 in 2018 to the current level of $20, on a market cap of $336 million.

Source: Token Terminal

While Zcash hasn’t died, its usage, fees and revenues are a ghost of its former self.

Dash (DASH)

Dash (DASH)

Dash is less anonymous compared to Monero or Zcash, but its PrivateSend feature mixes transactions to enhance privacy.

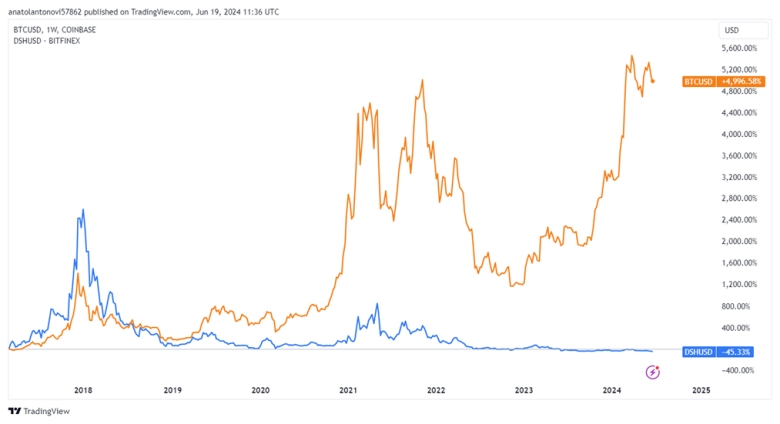

The price of Dash fell from over $1,100 in 2018 to $23 in June 2024. Dash has lost 45% while bitcoin has surged by about 5,000% since 2017.

Like Monero, Dash no longer follows the movements in bitcoin and has fallen to such an extent that it barely registers on the chart above.

Verge (XVG)

Verge (XVG)

Verge coin launched as DogeCoinDark in 2014 and rebranded to Verge in 2016.

During the last four years, XVG has dropped by almost 90%, while bitcoin has gained over 74%. Today, VRG has a market cap of just $68 million.

While the price of Verge is extremely depressed when compared with its glory days, the coin obviously has some followers, as evidenced by the rallies seen in July 2023 and April 2024.

Grin (GRIN)

Grin (GRIN)

Grin launched at the beginning of 2019. It is the first chain to use the privacy-oriented protocol known as mimblewimble.

The coin dealt with a 51% attack in 2020 when one of the miners took control over the network.

The coin has lost 99.7% of its value since 2019 and today has a market cap of $3.1 million.

Holders of the GRIN token have little to smile about as its price has largely flatlined since 2022.

Current Usage of Privacy Coins

Privacy coins have lost investor attention due to their regulatory challenges. Today, only Monero has managed to maintain its position as a top cryptocurrency despite failing to leverage the crypto market’s bull run.

Monero can be used to prevent corporate espionage and keep the privacy of high net worth individuals.

However, privacy coins can also be used for illicit activities, which is what has kept them in the regulatory spotlight.

Can Privacy Coins Survive?

Privacy coins are in a very difficult position due to the regulatory pressure across many important jurisdictions. For long-term investors, this makes them a unattractive option, even if you philosophically agree with the individual’s right to privacy.

However, they will still be operational in the coming years, thanks to the resilience of their underlying technology. Governments can’t shut them down entirely, but they can choke off their sources of liquidity.

Investor Takeaway

Although privacy coins provide benefits like financial privacy, security, and censorship resistance, they face significant regulatory challenges that make them unattractive from an investor’s perspective.

The overall market for privacy coins struggles with delistings and legal pressures and this has been reflected in the price action of major privacy coins.

While the use for legitimate privacy concerns is valid, the association with illicit activities and regulatory scrutiny raises concerns about their future viability.

Investors are recommended to weigh these factors and monitor the regulatory developments regarding privacy coins. If you do have a legitimate need for financial privacy (e.g., you live under an authoritarian government), these coins can be useful. As a way to grow your portfolio, however, it’s best to stay out of the dark.