The price of Solana is nearing the $130 support level amid network slowdowns and rising fears, suggesting a possible retest of the $117 mark.

As the crypto market experiences $330 million in liquidations over the past 24 hours, Solana faces a surge in supply. Solana‘s market price has dropped by nearly 5% in the past 24 hours and is currently trading at $132.

Amid increasing selling pressure, this decline indicates a failure to extend the bullish breakout rally. Could this result in a pullback to the $117 support level?

Solana Analysis Reveals Potential $117 Retest

On the 4-hour price chart, Solana’s price trend showed a bullish breakout of a falling channel pattern. However, the breakout rally failed to surpass the dynamic resistance of the 200-Exponential Moving Average (EMA) line.

After a bearish reversal from the $145 mark, the SOL price trend has now fallen to $132. The price has dropped by 2.97% in the past 4 hours, breaking below the 50 and 100 EMA lines.

As the price drops below these crucial moving averages, the 4-hour Relative Strength Index (RSI) has plunged to 37.84, reflecting increasing bearish momentum.

Upon closer inspection, the short-term price movement suggests the breakdown of a head-and-shoulders pattern. The pattern’s decline aligns with the $135 support level.

With this bearish pattern breakdown, the ongoing decline suggests a potential retest of the $117 swing low.

Bearish Sentiments Rise in Solana Futures

As bearish momentum gradually increases, Solana’s derivatives market has seen a decrease in open interest. Solana’s open interest has fallen by 3.96% to $4.93 billion.

Solana Derivatives

With the decline in open interest, bullish positions have dropped, alongside liquidations of $9.96 million in the past 24 hours, signaling a reduction in bullish sentiment.

This has caused the long-to-short ratio to drop to 0.9384, while the funding rate has turned negative at -0.0012%. As a result, the derivatives market has seen an increase in bearish sentiment.

Crypto analyst Ali Martinez notes that the short-term price movement is a leverage-driven correction. The analyst anticipates liquidations of $69 million in short liquidations if Solana experiences an upswing to $140.

An upswing to $140 for #Solana $SOL would liquidate $69 million in short positions! pic.twitter.com/YaFw6GAnno

— Ali (@ali_charts) March 28, 2025

Network Slowdown Amid Declining SOL Prices

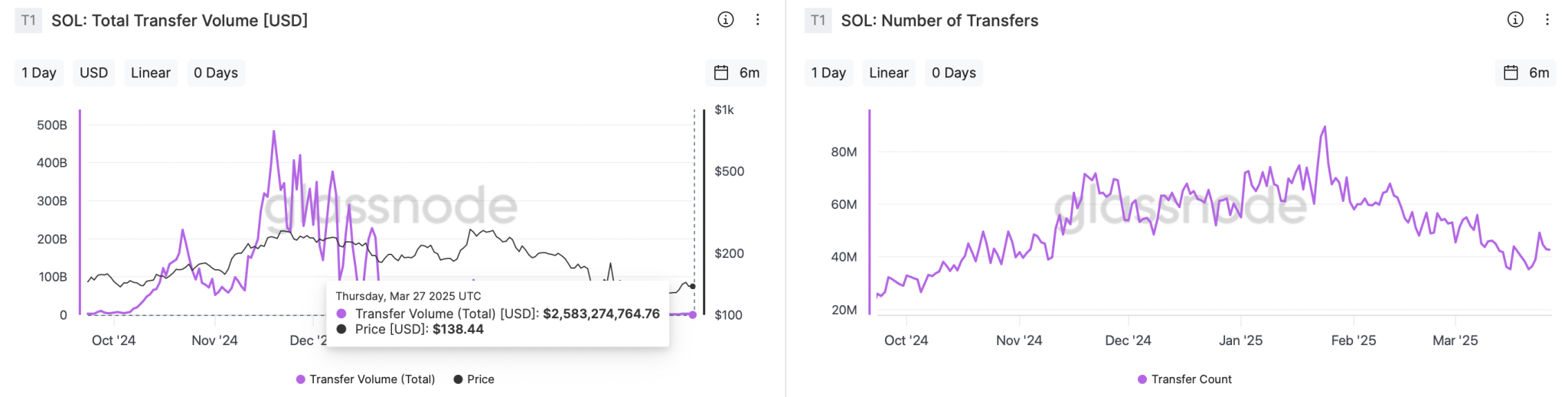

Amid the declining Solana prices, the network’s strength weakens. As per the data from Glassnode, the total transfer volume on the Solana network has sharply dropped to $2.58 billion.

Glassnode Studio

Furthermore, the transaction count is down to 42.70 million. As the Solana network experiences a minor slowdown, the demand for SOL could witness a steeper fall resulting in lower prices.