Solana’s price recently surged to $225, marking a promising milestone as it captures investor attention. Currently trading at $210.69, SOL has experienced a slight pullback of 3.79% in the past day, indicating some resistance near recent highs. Despite this dip, the token’s 24-hour trading volume of $12.4 billion showcases strong activity and liquidity, suggesting that investor confidence remains robust. As SOL’s market cap hovers around $99.43 billion, the question remains whether this retracement is temporary or if the cryptocurrency is poised for another rally, potentially testing new highs.

SOL’s Technicals Hint at Sustained Bullish Trend Ahead

The Ichimoku Cloud further validates this bullish outlook, as the altcoin’s price is above the cloud, implying sustained bullish pressure. The MACD also reverberates the same narrative of positive momentum, with the MACD line at 13.82 crossing the signal line.

There is a strong potential to pursue the all-time high of $260, about 24% away. Should Solana manage to breach $230, the next set target is $250, propelling towards its new record high. On the contrary, $204 and $210 are important support zones while spying on the upper levels. If the price falls to weaker levels below $204, this would indicate a shift in momentum and likely reversal.

Solana Dominates 2024 with 10B Transactions

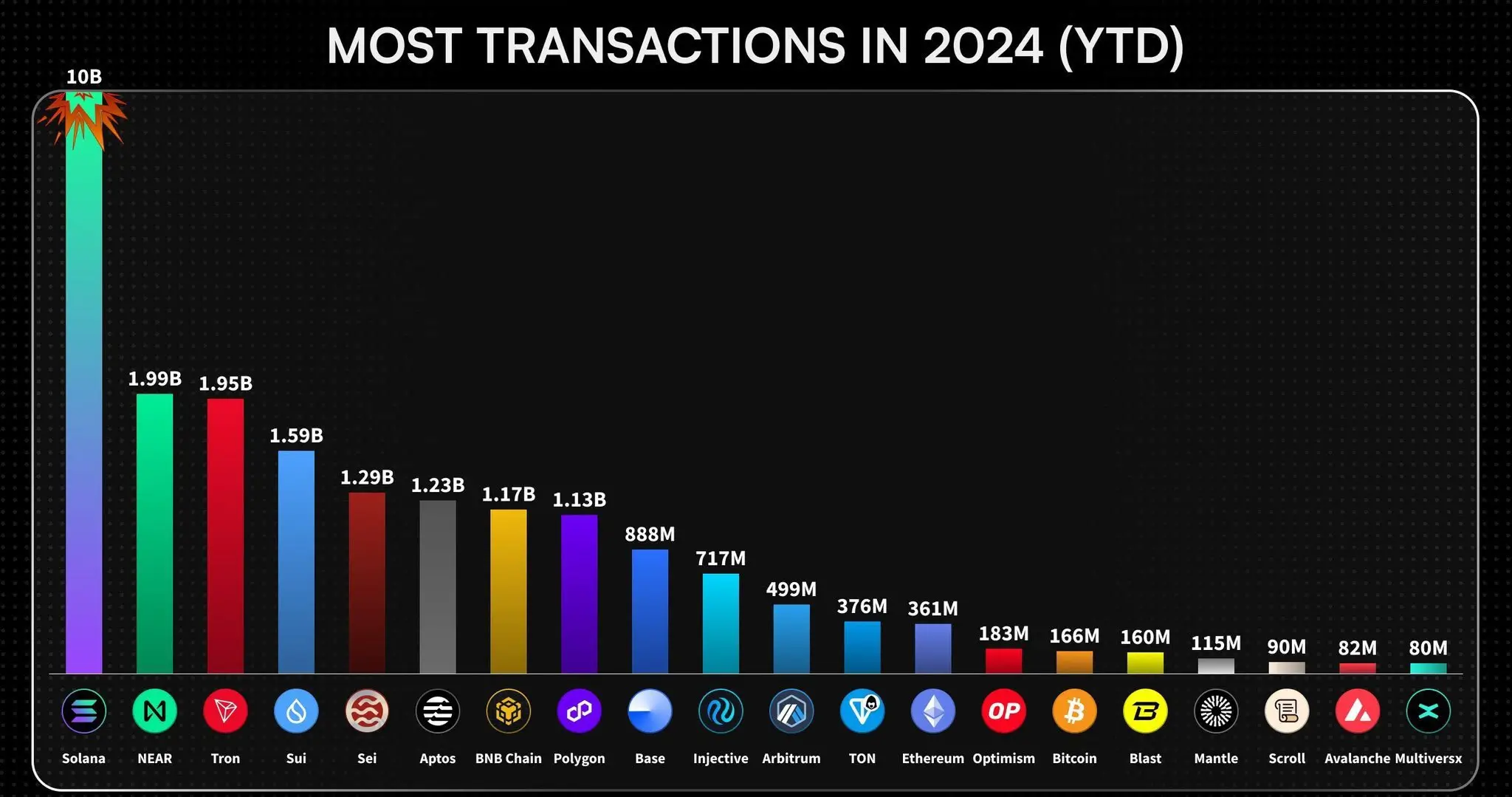

Solana’s prowess is unmatched in the blockchain industry, with transactions worth $10 billion recorded in the 2024 year to date. The medium is far better than other platforms, with Near and Tron being the closest, with 1.9 billion and 1.95 billion transactions, respectively. In terms of network activity as well, the SOL cryptocurrency is way ahead of BNB Chain, Polygon, and Base, which are ranked in transactions ranging from 1.2 billion to 1.1 billion.

The chart incorporates Solana’s huge transaction volume, further validating the token’s activity in the blockchain ecosystem. It emphasizes the high demand for platforms, as Solana is constantly used for decentralized applications and smart contracts. Therefore, it shows how Solana’s ecosystem is intact, and even the network’s scalability and cheap transaction costs are factors for the cryptocurrency’s success in 2024.

Solana Market Sentiment Shows Bullish Outlook

Currently, the sentiment around Solana cryptocurrency seems more positive than negative, with retail and institutional investors revealing hybrid signals. The crowd sentiment for the token stands at 0.08, which is slightly more than neutral, suggesting some degree of optimism prevailing in the market on the part of retail investors. On the contrary, Smart Money Sentiment shows an even better bullish trend at 1.31, reflecting confidence from institutional investors and big traders.

$SOL Sentiment

CROWD = Bearish 🟥

MP | #SmartMoney = Bearish 🟥 #Solana

Check out sentiment and other crypto stats at #cryptotrading #CryptoX pic.twitter.com/8KB02sv9Me— Market Prophit (@MarketProphit) November 11, 2024

This synchronization between retail and institutional sentiment implies that the SOL token has a good outlook in the market and that there is room for more bullish sentiment to take hold. The optimism from both groups indicates a potential for aggressive buying and aspirations for higher prices in the short term.