Bitcoin spot ETFs recorded another session of outflows on Wednesday, marking the fifth consecutive day of capital withdrawals.

The consistent outflows underscore waning investor confidence in the short term, particularly among institutions.

April ETF Data Shows Investors Cooling on Bitcoin

So far in April, these funds have registered inflows on only a single trading day. This trend confirms that institutional investors are pulling back capital from spot Bitcoin ETFs in response to quickly shifting macroeconomic conditions.

On Wednesday, capital exit from spot BTC ETFs totaled $127.12 million. According to SosoValue, Bitwise’s ETF BITB recorded the highest net inflow on that day, totaling $6.71 million, bringing the fund’s historical net inflow to $1.98 billion.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

BlackRock’s ETF IBIT saw the highest net outflow on Wednesday, totaling $252.29 million. As of this writing, its total historical net inflow still stands at $39.57 billion.

This trend of institutional investors removing their capital from spot BTC ETFs means that confidence in the coin’s short-term price trajectory is weakening, primarily due to macroeconomic uncertainty amid Donald Trump’s ongoing global trade wars.

BTC Futures Heat Up Despite ETF Outflows

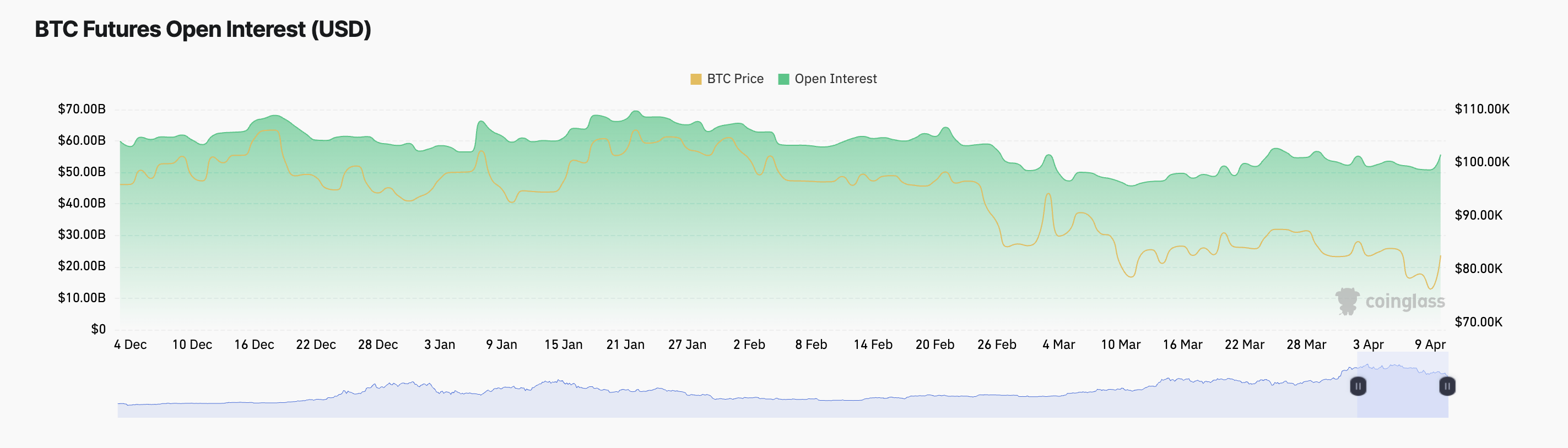

Despite the downtrend in spot ETF flows, the broader derivatives market is showing signs of resilience. Open interest in BTC futures continues to rise, highlighting the uptick in the daily count of new positions being opened.

According to Coinglass, BTC’s futures open interest is at $55 billion, noting a 10% rally over the past day. When an asset’s open interest climbs like this, more new positions are being opened in the derivatives market, indicating increased trading activity and investor interest.

BTC Futures Open Interest. Source: Coinglass

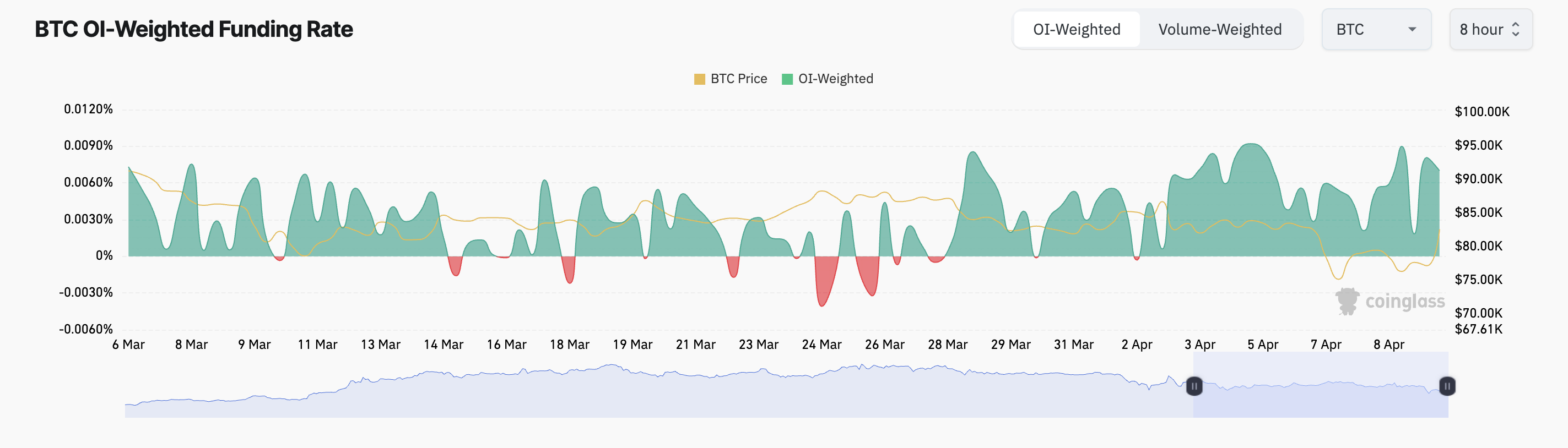

Moreover, the coin’s funding rate has remained positive, even as broader market sentiment dampens. As of this writing, this is at 0.0070%.

BTC Funding Rate. Source: Coinglass

Amid its ongoing price troubles, BTC’s steady positive funding rates signal that its traders remain optimistic and are still willing to pay a premium to maintain long positions. This suggests expectations of a potential rebound in the near term.

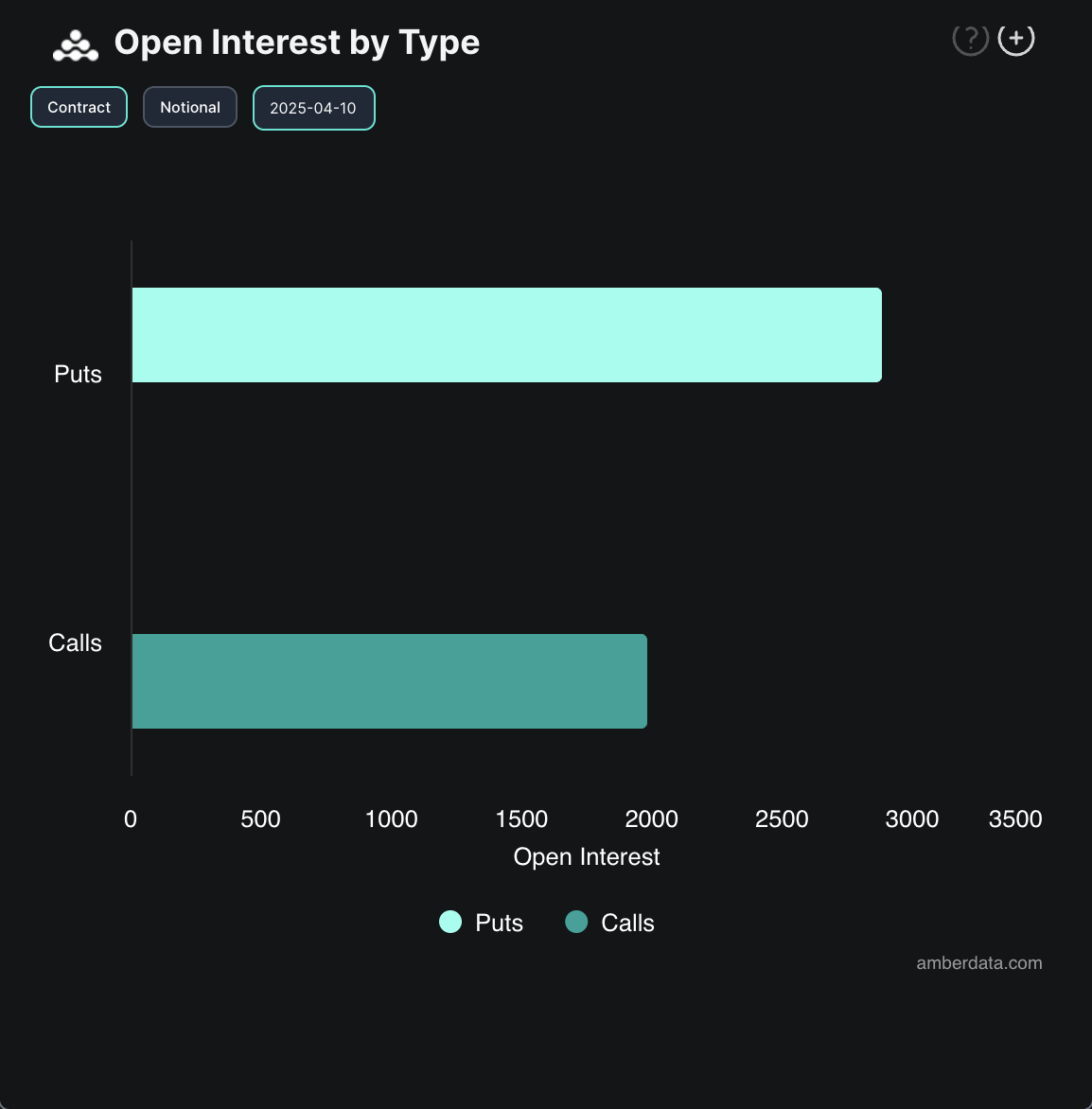

However, caution is advised. Today’s increased demand for call options suggests that traders are still positioning for a drop in BTC’s price.

BTC Options Open Interest. Source: Deribit

The persistent diverging dynamics between BTC ETF flows and its futures market activity highlight an interesting situation, one where short-term caution coexists with long-term bullish speculation.