NEIRO’s entry into the top 100 cryptos coincides with a time of market volatility, with over 29 million tokens accumulated by whales. A potential 50% surge lies within, based on a bullish EMA crossover and technical breakout.

NEIRO’s Position Among Top Gainers Amid Market Volatility

NEIRO has been a performer this past week despite broader market uncertainty. The token has risen 65.86% over the past week, with an impressive 24-hour trading volume of $605 million, and the token’s market cap has now reached $743 million.

NEIRO’s entry into the top 100 cryptocurrencies in terms of market cap, as it sits currently at 85th place, represents an achievement for the market’s top performing assets.

– Advertisement –

Source: CoinMarketCap

NEIRO looks to be heading higher now as whales are taking notice and technicals continue to shine green for further upside for the token, but investors should be mindful of volatility in the market.

Whale Accumulations Drive Recent Price Gains

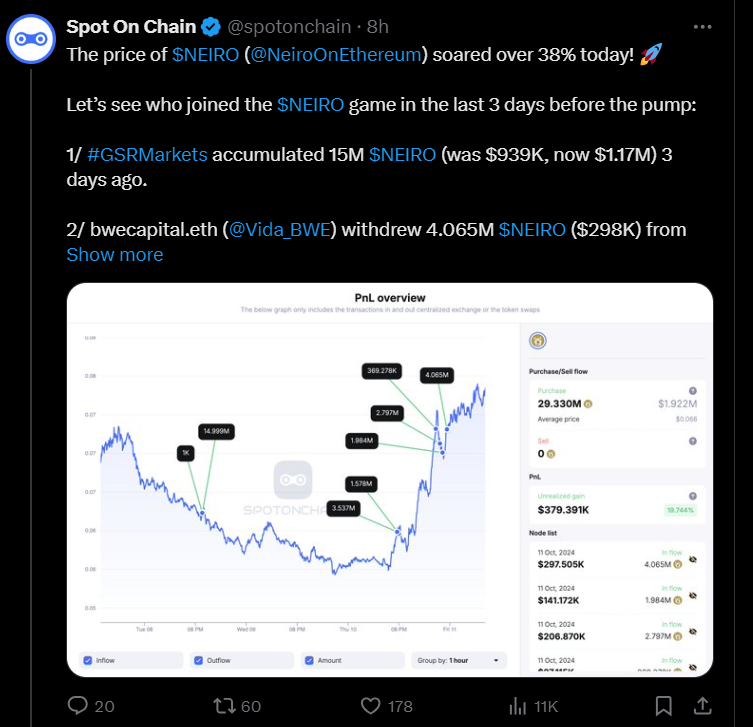

Over the last 3 days alone, big holders accumulated more than 29.1 million NEIRO tokens, whose names include GSRMarkets, which has accumulated 15 million NEIRO tokens. Their holdings previously stood at $939,000, now they’re $1.17 million.

Over the past nine hours, however, bwecapital.eth, withdrew 4.065 million NEIRO, roughly $298,000, from the Bybit exchange.

Source: X

Furthermore, two new whales — address 0xa1d and 0x00d — both netted over 10 million NEIRO in separate Ethereum transactions. And these aren’t just purchasing a token we don’t fully understand yet, these are huge purchases that clearly demonstrate people’s strong interest in the token itself.

Technical Analysis: Key Levels to Watch for NEIRO

With a break above a descending trendline on the NEO/USDT Chart on a 1 hour timeframe, momentum has shifted and could shift upward again. A key area to watch should be the retest to the immediate support level at $0.00166450. If the retest is successful, it could offer an opportunity to buy and reinforce the breakout moving above the current price of $0.00176148, which should continue to support the bull trend.

$0.00250000 is a very important psychological resistance level. A surge of approximately 50.42% toward this target if the bullish momentum continues is inevitable.

Source: Tradingview

Failure to hold above the $0.00166450 support could indicate a need for more consolidation before another upward attempt.

Technical Indicators Point to a Bullish Momentum

Currently, the Relative Strength Index for NEIRO is at 60.04, which suggests mild bullish momentum as it sits above the neutral 50 level.el. There is some buying pressure but not quite yet at overbought territory above 70, indicating there’s still room for further upward movement.

Source: Tradingview

MACD at bullish Crossover, MACD line is presently (0.00002030) higher than the signal line (0.00001942).2. If this bullish sentiment persists, the positive histogram bars indicate increasing momentum, and we could consider an upward continuation of the trend in this case.

Third, the short term bullish bias is reflected by the 50 EMA at 0.00168674 and 100 EMA at 0.00162767; the 50 EMA lies above the 100 EMA. This crossover has also confirmed the recent breakout and if price stays above these moving averages, this trend should continue.