India has overtaken China in terms of economic growth, signaling a major shift in global economics. This transition, anticipated by many analysts, is now being amplified by stock markets, illustrating not only an economic realignment but also far-reaching geopolitical consequences. As the world’s two most populous countries, each with approximately 1.4 billion inhabitants, China and India are not just Asia’s strongest economies but also political rivals with contrasting government models. China, the sole communist superpower, and India, the world’s largest democracy, represent two opposing ideologies and governance models. The outcome of their economic rivalry is set to profoundly impact global geopolitics.

1. Real GDP Growth Rates: China vs. India

The first graph depicts the real GDP growth rates of China and India from 2020 to 2024, showing a marked divergence between these two economic giants.

- China’s Economic Path (Red Line):

- China experienced a strong post-pandemic rebound in 2021, with GDP growth peaking at around 8%. However, in subsequent years, growth slowed to about 4% by 2023 and 2024. The red dashed trend line shows a clear deceleration, reflecting deeper structural issues such as an aging population, high debt levels, and the impact of regulatory tightening.

- India’s Economic Path (Green Line):

- India, after a sharp contraction in 2020 due to the pandemic, rebounded robustly in 2021 with growth rates exceeding 8%. Although growth tapered off slightly in 2022, India’s economy stabilized around 6% by 2024. The green dashed trend line indicates an upward trajectory, highlighting India’s long-term economic momentum fueled by its youthful demographic, technological advancements, and growing domestic consumption.

Key Observations:

- Rivalry for Growth Leadership: China and India have long been at the forefront of global economic growth, but India has now overtaken China in terms of growth rate. This economic rivalry reflects their broader geopolitical contest, with each country vying for influence in Asia and beyond.

- Contrasting Growth Trends: While China’s growth is slowing, India’s economy is on a steady upward trend, showcasing its resilience and growing prominence on the world stage.

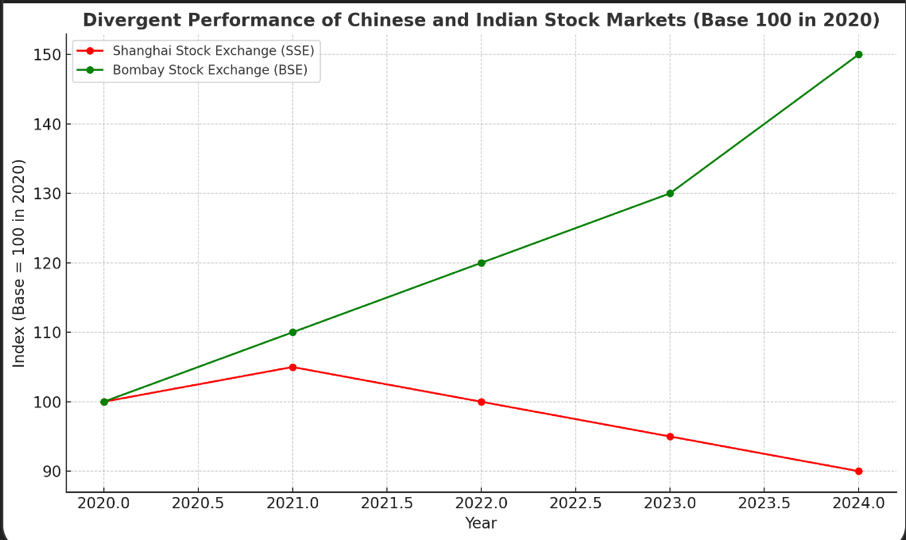

2. Stock Market Performance: Shanghai Stock Exchange vs. Bombay Stock Exchange

The second graph compares the performance of the Shanghai Stock Exchange (SSE) and the Bombay Stock Exchange (BSE) from 2020 to 2024. The divergence in their stock market trajectories mirrors their economic growth patterns.

- Shanghai Stock Exchange (SSE) Performance (Red Line):

- The SSE saw moderate growth in 2021, reflecting China’s brief economic recovery after the pandemic. However, from 2022 onward, the SSE’s performance declined steadily, dipping below its 2020 baseline by 2024. This reflects a combination of economic deceleration, regulatory crackdowns, and investor wariness about China’s growing internal challenges, such as its real estate crisis and rising debt.

- Bombay Stock Exchange (BSE) Performance (Green Line):

- In contrast, the BSE showed consistent growth, rising sharply after 2021 and reaching an index value close to 150 by 2024. India’s stock market performance highlights global investor confidence in the country’s economic prospects, driven by its reform agenda, demographic dividend, and burgeoning digital economy.

Key Observations:

- Market Sentiment Shifts: The growing gap between the SSE and BSE reflects a significant shift in global capital flows. Investors, once heavily focused on China, are now turning to India as a new growth hub, attracted by its democratic stability, reform-driven growth, and a more predictable regulatory environment.

- Stock Markets as a Reflection of Governance Models: The divergence in stock market performance also mirrors the fundamental differences in governance between China and India. China’s centralized, state-controlled system has introduced unpredictability for foreign investors, particularly due to regulatory crackdowns. India’s democratic system, while not without challenges, offers more transparent and market-friendly policies, enhancing investor confidence.

3. Geopolitical Implications: A Contest Between Two Ideologies

The economic and stock market divergence between China and India is not just an economic story—it represents a broader ideological contest between two very different models of governance. China, the only communist superpower, and India, the world’s largest democracy, are engaged in a strategic and economic rivalry that will shape the future of global geopolitics.

- Two Competing Models: China’s authoritarian system emphasizes centralized control and rapid state-led development, while India’s democracy fosters a more decentralized, market-driven approach. The outcome of this rivalry will have significant implications for how countries around the world view these contrasting systems, especially in developing regions that may look to emulate one of these models for their own growth.

- Geopolitical Rivalry: Both countries are competing for influence, not only in Asia but also globally. India’s rise as an economic power strengthens its geopolitical position, particularly within the Quad alliance (comprising the U.S., Japan, Australia, and India) and other global forums. India’s growing economic clout provides an important counterbalance to China’s dominance, both within Asia and on the global stage.

4. Challenges and Risks for India and China

Both nations face unique challenges that could affect their long-term growth trajectories:

- India’s Challenges:

- Infrastructure Deficits: India must address significant infrastructure gaps in transport, energy, and digital connectivity to maintain its growth trajectory.

- Inequality and Job Creation: While India’s economy is growing rapidly, ensuring that growth is inclusive remains a major challenge. The country must generate millions of jobs to accommodate its large and youthful population.

- China’s Challenges:

- Demographic Decline: China’s aging population presents a long-term challenge to its economic dynamism. With a shrinking workforce and rising healthcare costs, China may struggle to maintain high growth rates in the coming decades.

- Debt and Real Estate: China’s economic growth has been driven by heavy investment in real estate and infrastructure, leading to high levels of debt. This reliance on debt-fueled growth is now becoming a significant drag on the economy.

Conclusion

The graphs presented clearly illustrate a defining moment in global economic history—India has overtaken China in terms of economic growth and stock market performance, signaling a major shift in global economic power. As the world’s two most populous nations and Asia’s largest economies, the rivalry between these countries extends far beyond economics. It is a contest between two opposing models of governance—India’s democracy and China’s authoritarianism.

The geopolitical stakes of this rivalry are immense. As India continues to rise, its influence in global economic and political forums will grow, potentially reshaping the balance of power in Asia and beyond. Meanwhile, China’s economic slowdown and internal challenges could lead to a reevaluation of its long-standing dominance. How these two nations navigate their respective challenges will determine not only their future economic trajectories but also the future of global governance.

In this contest between two superpowers with opposing ideologies, the world will closely watch to see which model emerges as the most effective in fostering sustainable and inclusive growth. The outcome of this rivalry will reverberate far beyond the borders of China and India, shaping the future of global economic and geopolitical landscapes for decades to come.

[Photo by Pixabay]

The views and opinions expressed in this article are those of the author.

Sam Rainsy, Cambodia’s finance minister from 1993 to 1994, is the co-founder and acting leader of the opposition Cambodia National Rescue Party (CNRP).

Read the full article here