While I have long argued that volatility does not equal risk, I understand that most would prefer a smoother ride for their investments without sacrificing return. Many are constantly in search of this Holy Grail, yet it can be found in plain sight.

Indeed, Dividend-Paying Stocks have outperformed Non-Dividend-Paying Stocks over the past nine-plus decades by a return score of 10.6% per annum to 9.0% per annum based on portfolios constructed by Professors Eugene F. Fama and Kenneth R. French.

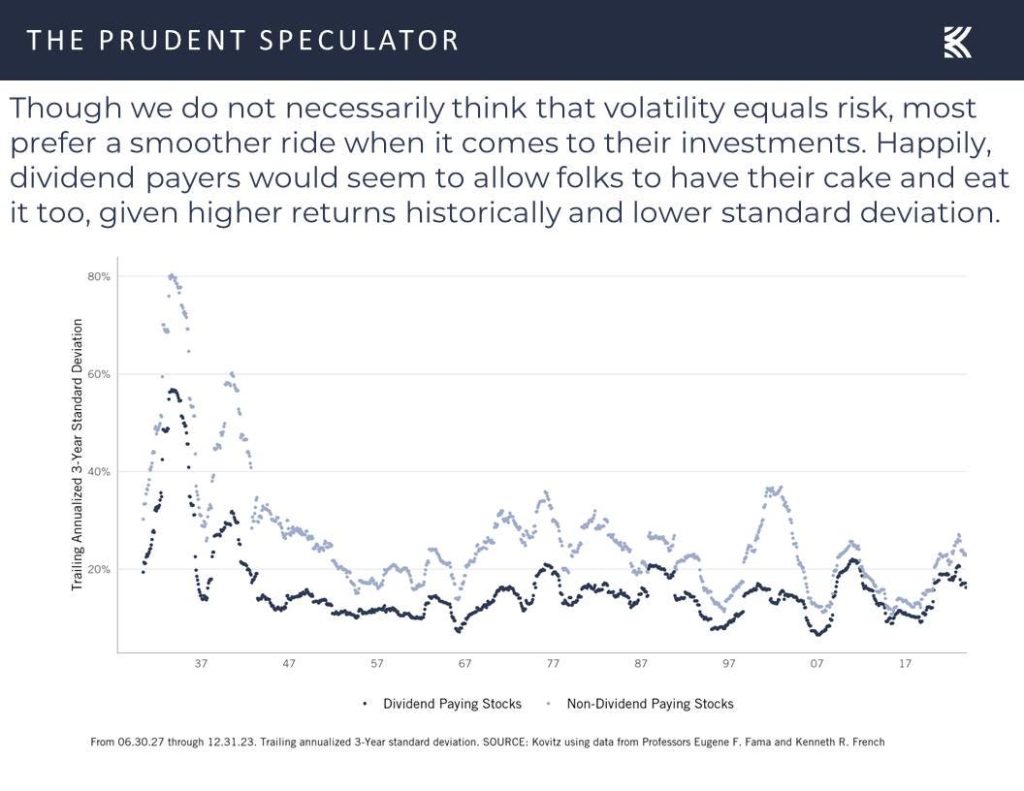

Equally important, Dividend Payers have achieved that performance advantage with lower standard deviation of returns (lower volatility) as depicted in the chart above.

True, I think risk really is permanent loss or impairment of capital and not the measurement of monthly gyrations in prices based on fickle market participants, but it doesn’t hurt that Dividend Payers have provided higher long-term returns with lower volatility.

I recently produced a Webinar on the merits of Dividends and offered 7 stock picks. Click below to learn more about accessing the Webinar and read on for two of those selections!

Income Stocks & Retirement Planning : Webinar Q&A Follow-Up (theprudentspeculator.com)

2 MORE UNDERVALUED HIGHER YIELDING STOCKS

Investors looking to harness the power of dividends in their equity portfolios ought to consider Cisco Systems

CSCO

Cisco is a market leader of enterprise networking with complementary security solutions that are enhanced by the pending acquisition of Splunk. The tech stalwart has maintained its networking leadership amidst cloud adoption and is a sleeper beneficiary of A.I. as data center operators move further toward ethernet networking protocol. Consolidation for the stock over the past 5 years leaves it reasonably priced at 14 times the consensus NTM EPS projection, well below other Big-Tech names. Tremendous cash flow generation supports future share repurchases and a dividend that presently provides a yield of 3.2%.

In its 80th year of operation, Air Products is one of a handful of global industrial gas companies involved in the recovery and distribution of oxygen, nitrogen, helium and hydrogen across an array of end markets like energy, manufacturing, health care, food & beverage, metals and chemicals. Industrial gases are often an indispensable input, yet they account for a small fraction of overall costs for those who use them. This leads customers to pay up for reliability and to pursue long-term contracts to assure uninterrupted and timely supply.

A negative reaction to larger-than-anticipated volume declines in China and lower helium demand globally pushed the stock lower by 15% in early February. I find the plunge to be excessive and view the headwinds as mostly temporary, making me think the characteristics that underpin the company’s competitive advantages remain intact, meriting a premium P/E multiple. Shares trade for 19 times NTM earnings, with EPS estimates climbing to north of $17 a few years out. The dividend has grown for 41 consecutive years and the yield is 2.9%.

Read the full article here