It’s all about governance bro

Governance tokens are in the midst of a reckoning.

UNI and MKR are, in many ways, DeFi’s most important experiments. But right now, the tokens themselves are suffering from the successes of their respective protocols.

Both sit at the very heart of what makes DeFi so compelling: Uniswap enables peer-to-peer trading on an open, neutral platform that can’t be stopped or gatekept. Maker manages an overcollateralized, debt-backed and censorship-resistant stablecoin, DAI, the market’s third-biggest with $5.3 billion in circulation.

Both protocols allow token holders to participate in governance — tweaking the knobs on aspects of the platform, voting on major changes and so on. That hasn’t been enough to keep prices high.

While MKR’s price against bitcoin multiplied between 2018 and 2019, it hasn’t stuck the landing. UNI otherwise charted a similar path: Its bitcoin ratio doubled in its first year before slowly draining out, and it is now 60% below where it was after its massive 2020 airdrop.

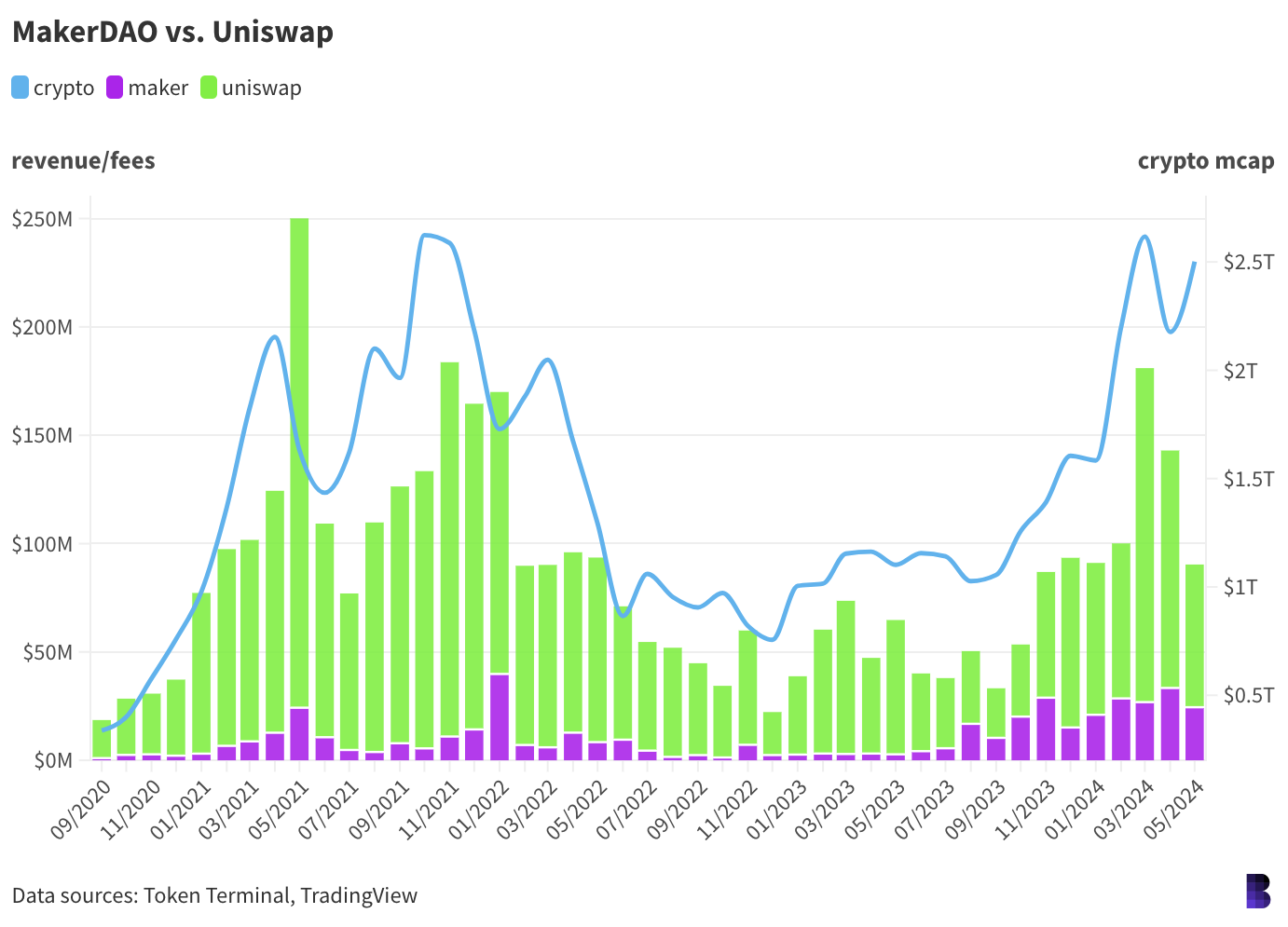

At the same time, Maker and Uniswap are seeing loads of activity. Uniswap perhaps isn’t seeing as much as during the previous bull run — at most $154 million fees were paid in one month during our current cycle compared to more than $200 million in May 2021 — but is still way above where it was this time last year (shown in green on the chart below).

Maker is meanwhile bringing in more revenue than ever before, consistently over $25 million per month, largely thanks to yield from US Treasurys of which it has almost $1.4 billion (and as much as $2.6 billion last September), as well as increased interest in DAI loans.

All that growth, if not shared directly with token holders, cheapens the concept of governance. It’s one thing to vote on desired changes, it’s another to be actually rewarded for buying the token at all, especially if simply holding bitcoin or either instead tends to make better financial sense.

Mapping Uniswap fees to Maker revenue isn’t totally foolproof but still offers a decent comparison

Hence the Uniswap Foundation’s renewed push for a fee-switch that would pay UNI holders a cut of protocol fees moving forward, rather than only to liquidity providers. And Maker’s major overhaul as part of its Endgame plan features a string of changes to its burn mechanisms, alongside other tokenomics measures, geared to expand MKR’s use cases beyond governance matters.

Sharing revenue is a daunting concept in crypto, especially with an antagonistic SEC over in the US.

At the same time, much of Web3’s promise lies in its ability to reclaim ownership of our digital lives from monopolizing tech giants: Read, Write, Own, as Chris Dixon puts it.

Perhaps it should be Read, Write, Own, Earn.

— David Canellis

Data Center

- Uniswap users have paid more than $470 million to use the protocol so far this year.

- Maker’s 2024 revenue has hit $134 million, with monthly revenue growing almost 10 times year-on-year.

- DAI is currently backed by 44% crypto loans, 30% real-world assets and 26% stablecoins.

- The transfer of $9 billion in bitcoin from Mt. Gox’s wallet spooked bitcoin overnight, but it’s since settled around $68,000 early Tuesday.

- Last week saw $1 billion of inflows into crypto investment products, marking a record of nearly $15 billion so far this year, according to CoinShares.

Follow the money…

Let’s take another look at venture capital activity, shall we?

PitchBook senior analyst Robert Le said the overall landscape saw its first quarter-over-quarter uptick since 2021.

The cold hard numbers: We’re looking at a 40% increase in invested capital, and a nearly 45% increase in deal volume.

Alex Saleh, Coincover’s head of partnerships, said the increase in funding could be a sign that the market’s maturing.

Additionally: “We believe the recovery in publicly traded tokens and continued rise in institutional adoption will drive increased VC funding,” Le wrote.

Le previously told Blockworks he expects money to go toward infrastructure, and that showed this quarter. EigenLayer, for example, led with its $100 million Series B round.

His report showed two big opportunities: Social finance and fully homomorphic encryption.

“We view SocialFi as an emerging investment opportunity poised to attract increasing investor attention. Historically, each crypto bull cycle has witnessed robust investments and significant user growth at the retail app layer. We believe SocialFi is well-positioned to potentially fulfill this role in the current cycle. However, the infrastructure requires further improvement,” Le told Blockworks.

Funnily enough, Le’s analysis was published right before Farcaster announced its impressive $150 million raise. The raise earned Farcaster unicorn status, with its valuation topping $1 billion.

“Farcaster’s ecosystem is not limited to social interactions; it also encompasses economic activities through its native tokens and NFTs, which are used to reward community members and enhance user engagement,” Le said.

He added that PitchBook believes Farcaster could become a bigger player in its space because it can combine social media functionality with the transparent and security features that come with blockchain technology.

But these types of platforms also have some challenges, including “stickiness” or retaining users. Seems like a ‘time-will-tell’ type issue.

As 2024 continues, PitchBook added that consolidation activity could pick up specifically for exchanges, custodians and infrastructure providers.

Of course, I have to caveat that this data is focused on the first quarter of 2024, but that’s not to say we’re seeing any slowdown, especially based on the size of Farcaster’s raise.

And it’s not the only one. BeraChain joined the unicorn club just last month.

— Katherine Ross

The Works

- Riot Platforms is looking to acquire Bitfarms, according to Bloomberg.

- Former Mt. Gox CEO Mark Karpelès said the sudden movement of bitcoin is in preparation for distribution to creditors later this year.

- Researchers were able to exploit a flaw in an old version of the RoboForm password manager to access an 11-year old wallet containing $3 million, Wired reported.

- Nick van Eck wrote that Agora’s stablecoin is set to launch in June and will mark the third era of stablecoins.

- Russian firms are looking to stablecoins to settle cross-border transactions with their Chinese counterparts, Bloomberg reported.

The Morning Riff

Looks like former President Donald Trump’s splash into crypto caused unexpected waves.

I’m talking specifically about Caitlyn Jenner’s sudden bullish stance on crypto, and her new token JENNER.

At first, folks were concerned that Jenner was hacked after her account began to pump JENNER on X. She quickly clarified that the token, which deployed through Solana-powered memecoin launchpad Pump.fun, was very much real.

Part of her interest in crypto was sparked by none other than Trump. Jenner’s been a public supporter of the former president.

This saga actually makes some sense if you look at it: Trump’s recent interest in crypto opened the doors for celebrities to jump right into the industry right at the upswing in the market, and there are quite a few opportunities.

Jenner may be bullish on crypto — with a current focus on Solana though — but right now her page is filled with shilling of JENNER.

I’m getting slight deja vu. Remember when another member of the Kardashian clan shilled a token? Yeah, me too.

Though, this time at least, Jenner warned that crypto isn’t the “correct investment for all individuals” in what seems to be an attempt to ward off a potential settlement with Gary Gensler’s SEC.

It certainly feels like Trump has opened doors for influential figures to make easy money shilling shit. Whether his interest in crypto will spur actual policy — and help crypto be taken seriously — remains to be seen.

How far away are we from “Make Crypto Great Again” hats as NFTs? It doesn’t have the same ring to it as “Make America Great Again” (and it certainly won’t look as good on a bright red hat), but I’m now hooked on where this saga might go.

After all, Jenner teased a big announcement sometime today.

— Katherine Ross