Market Expert Alex Cobb calls attention to six factors that point to an imminent XRP price blast and says selling XRP now is a “retarded” move.

Cobb made this assertion while recently discussing XRP’s potential on X. The statement comes at a time when XRP is facing a roadblock to its latest rally. Notably, XRP experienced an 8.92% intraday collapse on July 18 after retesting $0.63. XRP has since recouped some of the losses but encounters bearish pressure at $0.60.

XRP Resistance Trendline and XRPBTC Ratio

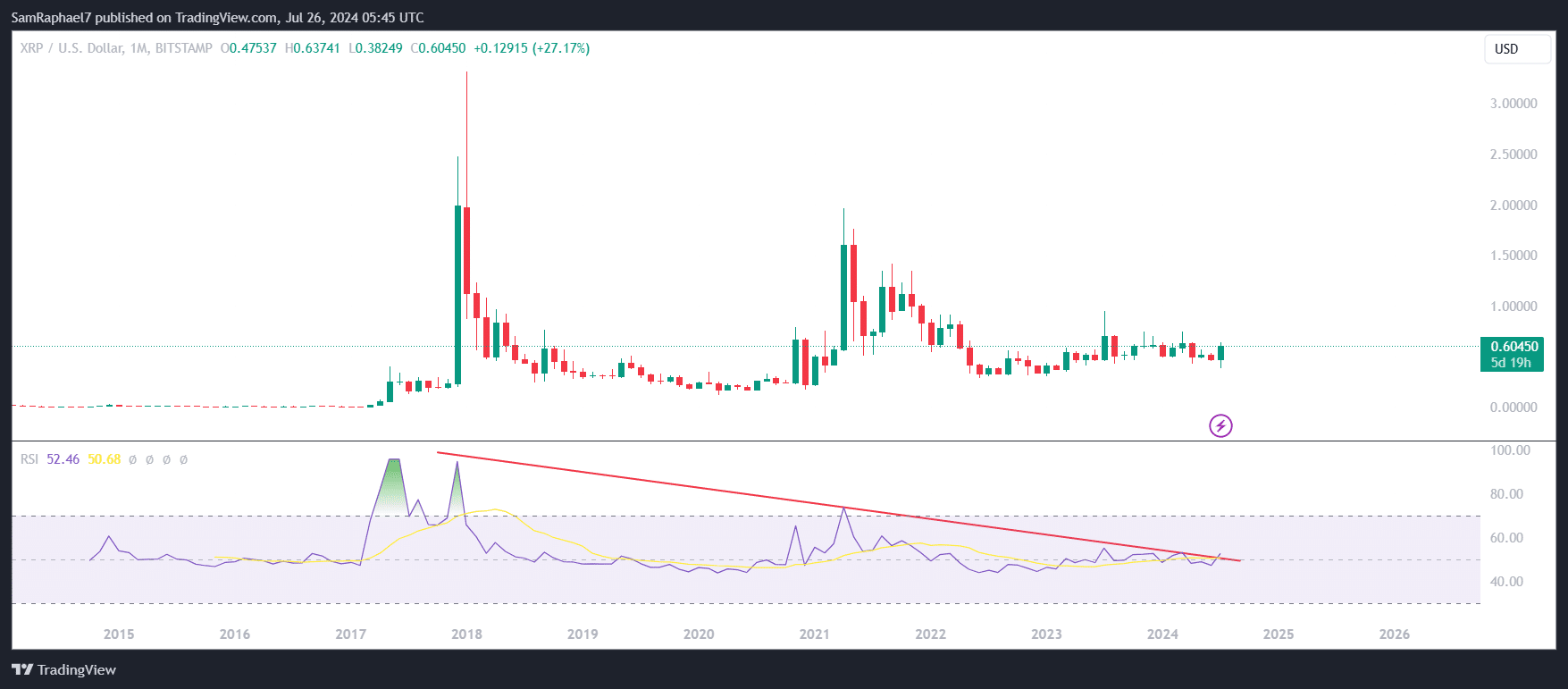

Amid the current price position, Cobb insists all factors are pointing to an exponential increase to ATHs for XRP. The first factor he highlights is XRP’s recent breakout of a monthly trendline resistance. For context, this trendline is one of two converging trendlines that formed XRP’s six-year symmetrical triangle.

Literally everything is pointing to XRP blasting to ATH

>Monthly trendline resistance break

>XRP/BTC bottom bounce

>XRP.D bottom bounce

>7 year RSI trendline break

>Upcoming ETF

>Upcoming SEC case resolutionSelling XRP right now is retarded

— Cobb (@AlexCobb_) July 25, 2024

Notably, XRP has recently broken above the upper resistance trendline, currently sitting above it as it trades for $0.6064. Several analysts have projected lofty price targets for when XRP breaks out and closes above the triangle. XRP would need to defend the $0.60 until month-end to close above the trendline.

XRP Resistance Trendline

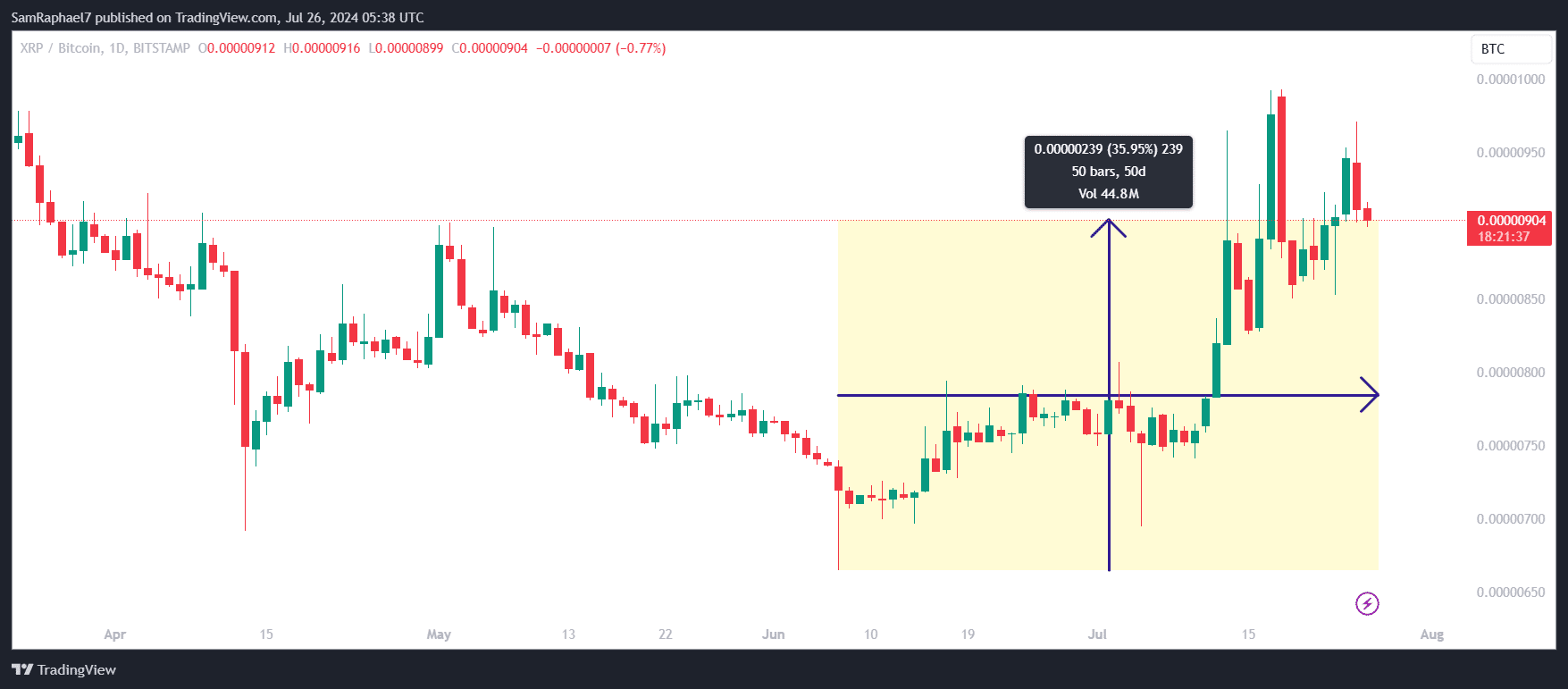

According to Cobb, the second factor pointing to an imminent uptrend is the rebound of the XRPBTC ratio. This ratio, which tracks XRP’s performance against Bitcoin, had continued to collapse since November 2023. Dropping 68% from 0.00002082 on Nov. 6, 2023 to a bottom of 0.00000665 on June 7, 2024, as Bitcoin outperformed XRP.

However, after reaching this floor price, the ratio has recovered, with XRP securing a rebound. XRP has since outpaced Bitcoin by 36% since June, as the XRPBTC ratio jumps to 0.00000904. This confirms that XRP is building momentum against BTC, a precursor for an upward push.

XRPBTC Rebound

XRP Market Dominance and Monthly RSI

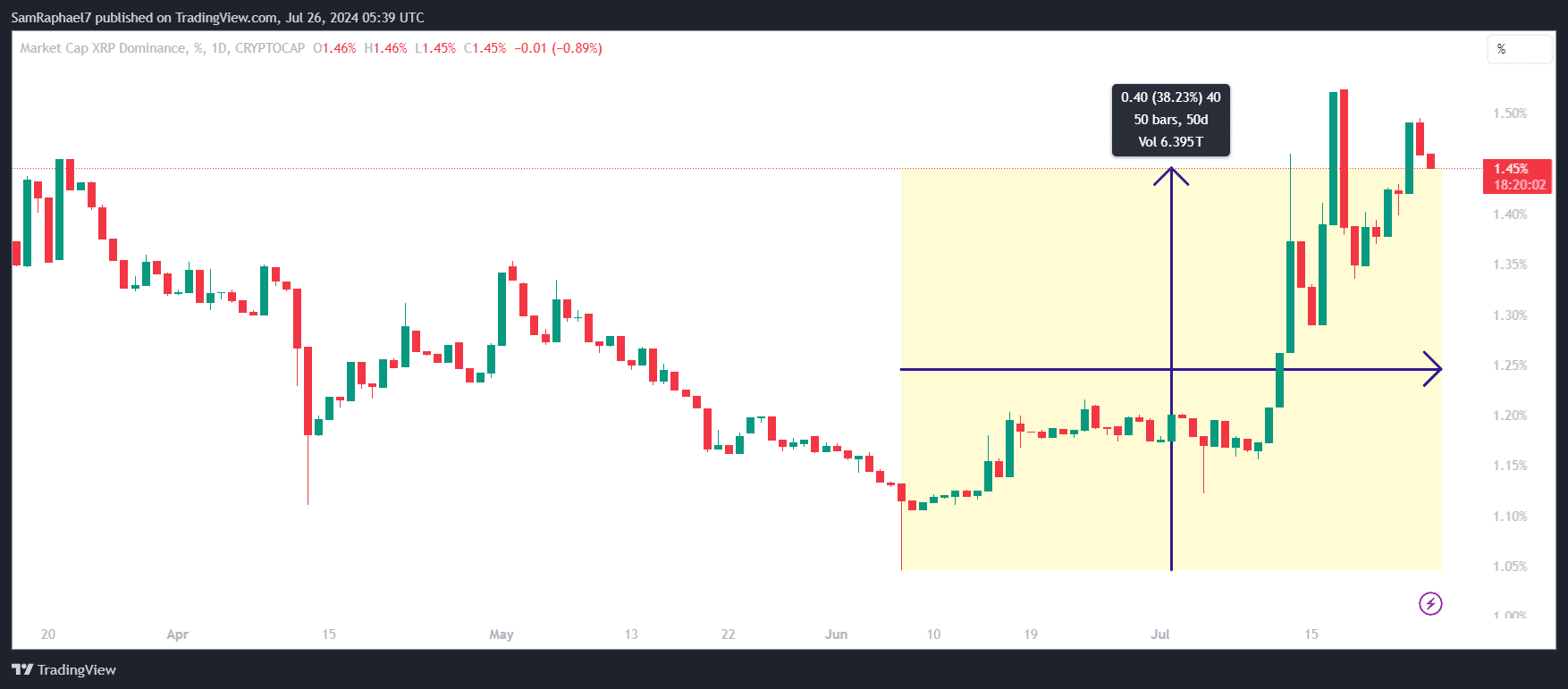

The third factor is the recovery of XRP’s market cap dominance. XRP’s market dominance slumped for ten consecutive months, going from a high of 4.02% in July 2023 to a low of 1.16% in May 2024. It further dropped to 1.05% on June 7, 2024. Interestingly, this market dominance has rebounded by 38.23% since the June low, now at 1.45%.

XRP Market Dominance

Cobb noted that the fourth factor suggesting an XRP price blast is the breach of the seven-year resistance trendline on the monthly RSI. XRP’s monthly RSI had faced a resistance since 2017 when XRP last saw an explosive run. Now, amid a 27.11% increase this month, the RSI has broken above the resistance for the first time ever, now at 52.47.

XRP Monthly RSI

ETF Prospect and Ripple Case

The fifth and sixth factors highlighted by Cobb focus on market and legal developments rather than price movements. These factors are the prospect of an XRP ETF launch, which 21Shares recently said is part of its goal, and the final resolution of the SEC case, predicted by Ripple CEO Brad Garlinghouse to happen by the end of summer.