On October 19 DYDX price was $0.96. However, in the last 24 hours, the native token of the decentralized protocol has jumped by 30%.

As a result, DYDX is one of the best-performing altcoins today, only behind ApeCoin (APE) out of the top 100. Why is this happening, and what is next for the token?

dYdX Volume Rises Ahead of Major Event

As of this writing, DYDX’s price is $1.22. This is coming ahead of the project’s conference, which is scheduled to start tomorrow, October 21, in Dubai, suggesting that the broader market is enthusiastic about the upcoming event.

Besides this, the altcoin’s volume has surged to $210.53 million. Volume is a key indicator as it measures the relative importance of a market move. A price move with a high volume is considered more significant, while a move with a lower volume is generally viewed as less impactful.

For DYDX, the surge in volume could be linked to the conference and the project’s launch of the Trump Election Perpetual Trading Market. For context, the decentralized platform allows users to leverage positions in a perpetual trading market linked to election outcomes.

Read more: Understanding dYdX: A Guide to the Decentralized Perpetual Exchange

DYDX Volume. Source: Santiment

If the volume continues to increase with the price, then DYDX’s value might continue its upward trend. If not, the price increase will slow down.

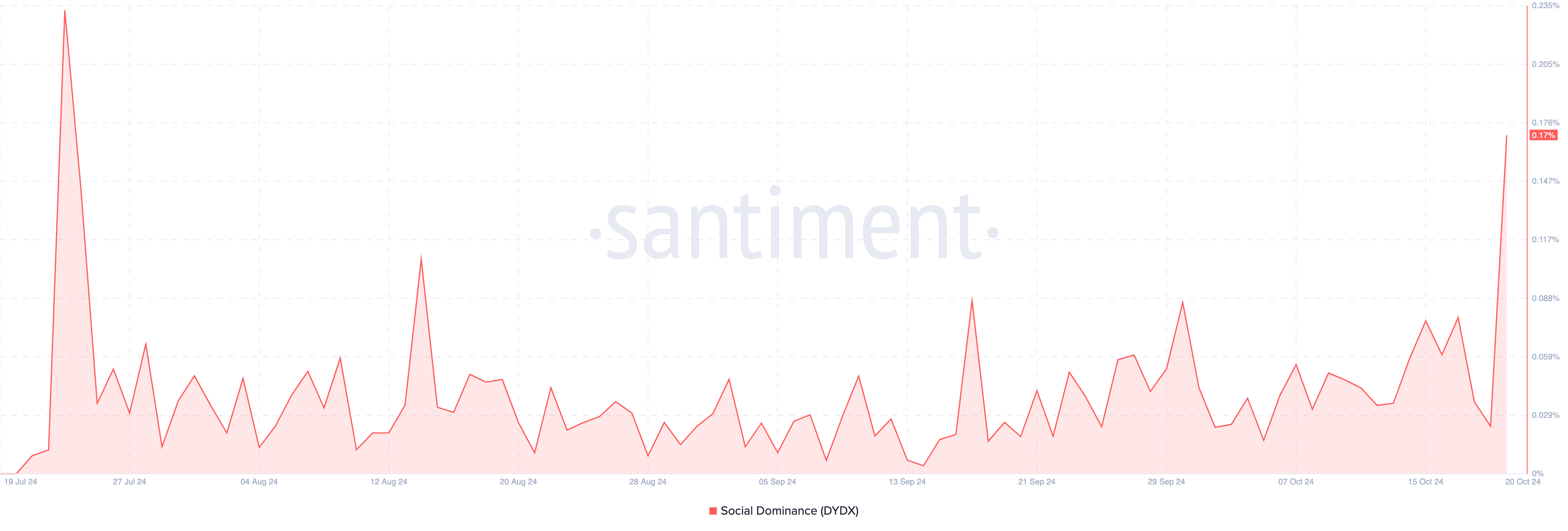

Furthermore, this development has also affected social dominance, which tracks the level of discussion surrounding the token. When social dominance rises along with the price, it can signal growing demand for the token.

Conversely, a drop in social dominance indicates that discussions around DYDX have surpassed those of other top 100 cryptocurrencies. Given the current trend, the altcoin could climb above $1.22 in the coming days.

DYDX Social Dominance. Source: Santiment

DYDX Price Prediction: Higher Highs Next

A look at the 4-hour DYDX/USD chart reveals that the Awesome Oscillator (AO), which was previously in the negative, has now shifted to the positive zone, signaling bullish momentum for the token.

This momentum enabled DYDX’s price to bounce off its $0.94 support level. The Chaikin Money Flow (CMF) has also shown an upward trend, indicating that accumulation around the altcoin is increasing. If buying pressure continues to rise, DYDX could potentially climb to the peak of the wick at $1.35.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

DYDX Price Analysis. Source: TradingView

However, the token’s value might drop if distribution outpaces accumulation. In the short term, this could cause the cryptocurrency’s value to hit $0.94.