The global crypto market had been going through a period of notable bullish sentiment leading up to Donald Trump’s inauguration on January 20th. This period saw Bitcoin reach its new ATH over $100,000, which was seen as a strong sign of a long-term rise in crypto prices.

However, hindsight shows that the post-inauguration market has been anything but bullish and the price of Bitcoin has dipped below $85,000 over the course of February. This has spurred debates regarding the tariff strategy imposed by the Trump administration, which had major ripple effects across the stock, forex and crypto markets alike.

The Crypto Fear and Greed Index has also shown a major shift towards bearish sentiment, with the indicator showing a value of 22/100 as of this writing. According to Konstantean, the long-term prospects on numerous crypto projects have also been called into question, with meme coins taking the brunt of the damage over the recent weeks of trading.

Going forward and heading into March, market volatility is likely to persist, as the effects of tariffs and trade wars become more evident on the broader economic health of the world, coupled with the increasing recession fears in the United States.

Top 5 Gainers of February

As the conditions on the global crypto market continue to worsen, major gains are becoming harder to come across. However, February saw several high-profile gainers that defied the seemingly bearish sentiment that dominated the market over the past month of trading.

Story (IP) +118.5%

Story has been one of the rare examples of an ICO in February 2025, as the coin entered the market on Feb 14 and has since gained considerable, reaching $7 at its peak, before dropping closer to $5 by the end of the month.

Much of the bullish momentum on the coin can be attributed to its novelty on the market, which has shielded investors from an otherwise volatile and bearish crypto market in recent weeks.

Going forward, the upwards momentum is likely to slow, as investors rush to secure their gains and cash in on their positions, while the rest of the market struggles to keep up with Story.

The Story project attracted a lot of attention during its presale stages, due to the project whitepaper, which states that Story seeks to tokenize real-world intellectual property, or IP, which is an industry with a market value of over $60 trillion.

However, the real-world application of the blockchain remains to be seen, which makes it a lucrative pick for speculators in the short-term.

Grass (GRASS) +41.2%

Grass entered the market after the news of Donald Trump winning the 2024 Presidential Election had reached the markets, which caused the coin to rise straight away.

However, a steep decline from the $3.66 highs to $1.17 followed soon after, as investors sold off some of their holdings to lock in profits.

The month of February saw the coin bounce back to a valuation above $2, which presented a solid swing trade opportunity for those eyeing the coin.

However, the long-term potential of GRASS is largely dependent on sentiment trading, which requires bullish momentum to turn the Fear and Greed Index into bullish territory.

Mantra (OM) +40.7%

Mantra has been one of the top-performing cryptocurrencies in recent memory, with annual gains of over 2,700% as of this writing.

February has only added to the coin’s brilliant performance, with a 40% gain to continue what has been a near-anomalous bullish push.

However, worsening sentiment can also affect Mantra, which is why investors are likely to cash in on some of their gains in the short-term and buy the dip at a later date.

Overall, OM has proven to be one of, if not the most, successful crypto investment since its 2021 ICO.

Maker (MKR) +40.6%

Maker was one of the hottest trading instruments across 2024, with wild upswings and decline, which now puts the coin at an annual decline of 25%, which comes at a start contrast with February’s 40% gain.

In general, the start of 2025 has not been a great one for Maker investors, as the coin declined from $1,600 to less than $900 by Feb 10, before climbing back up to the $1,600 mark, which is where the February gains come in.

Due to the volatility shown by Maker, investors are unlikely to feel assured that the current short bullish push will indeed continue in the future as well.

Sonic (S) +28.7%

Sonic, previously known as FTM, entered the market at the start of 2025 and has since endured a bumpy road — Falling from its $1 ICO price to as low as $0.37 by the start of February.

Since then, however, the coin has shown remarkable resilience and nearly climbed back to the $1 mark, before slumping again to $0.75. This fall towards the end of the month reduced the gains to 28%, which would have otherwise been another 40% entry on our list.

However, holders of Sonic will be hopeful that this recent slump will not be a long one and that the price will begin to pick up again in March.

Top 5 Losers of February

February has not been a broadly positive month for crypto investors, as only a handful of coins posted gains, while most of the market slumped.

Double-digit losses were common over the past month of trading, as the market sentiment has shown a significant drop.

Raydium (RAY) −68.8%

Raydium is one of the few coins on our list that has a positive annual return of 130%, even though it was the worst-hit cryptocurrency of February, falling by nearly 70%.

The drop-off was gradual and consistent, which could point to broader issues and sentiment towards the coin. However, the short-term reasoning can be tied to a worsening market sentiment, trade wars heating up and the implementation of tariffs adversely affecting the global economy, as well as long-term analyst projections.

Ethena (ENA) −51.4%

Ethena has been a hit or miss coin since its May 2024 ICO, after which the crypto saw massive decline, before surging by the end of 2024 again.

However, the past month of trading has been anything but positive for ENA holders, who saw over 50% in losses over this period.

However, as the market slowly turns around, ENA could be primed for substantial gains, making it a decent pick-up for those that are entering the market right now.

OFFICIAL TRUMP (TRUMP) −48.7%

The meme coin directly tied to the presidency of Donald Trump, Official Trump has been one of the major disappointments among meme coins in 2025.

After its ICO, the market was expecting the coin to serve as a barometer of sorts to measure the success of Trump’s plans in regards to crypto regulations and the potential creation of a strategic crypto reserve, none of which have manifested so far.

For this reason, the combination of lack of tangible crypto news, coupled with bearish market sentiment, TRUMP has fallen by nearly 50% over the course of February and might fall lower before it bounces back on positive news.

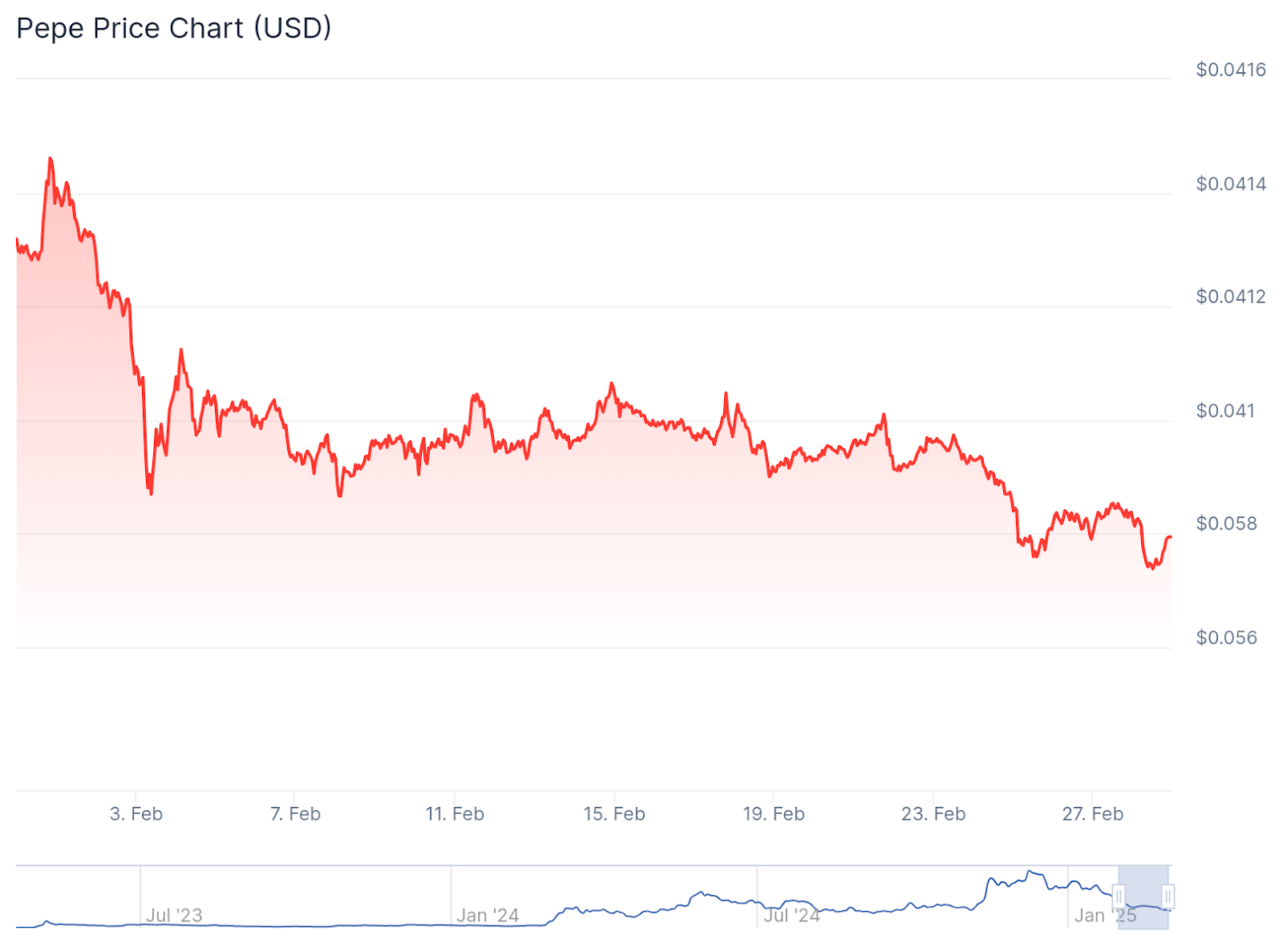

Pepe (PEPE) −47%

Another meme coin that has taken a hit in recent weeks is Pepe, which used to be one of the favorites of crypto traders in 2024. However, worsening market sentiment has greatly affected the returns of PEPE and the month of February alone saw a 47% decline in the asset’s price.

It is also worth noting that most of Pepe’s price action happened towards the start of February, which saw a steep fall, with a further gradual decline by the end of the month.

Due to challenging market conditions, the short-term prospects of Pepe largely rely on a change in sentiment, as opposed to a major economic development or breakthrough.

Dogwifhat (WIF) −47%

Dogwifhat has been one of the best-performing meme stocks across 2024, but has been unable to continue the trend in 2025, which should not come as a surprise, as rising market tensions and uncertainty tend to adversely affect meme coins first and foremost.

WIF has lost over 40% over the past month of trading, which puts its annual performance at a 41% decline, which means that all of the 2024 gains have already been erased for the coin and investors who have not cashed in on their winnings are in for a difficult period up ahead.

Going forward, much firmer bullish sentiment will be required in order for WIF and other meme coins to bounce back in the long run.

Conclusion

The recent developments in global trade and rising concerns regarding the health of the global economy and repercussions of tariff wars, have meant that the global crypto investor community has seemingly lost faith in the short-term bullish prospects.

The month of February 2025 has seen the market take a drastic turn to the bearish, with the Crypto Fear and Greed Index, the go-to sentiment index, has dropped to 22/100 — One of the lowest values since the election of Donald Trump as the 47th President of the United States.

The future prospects of the crypto market are likely to depend on updates on the strategic crypto reserve plans of the Trump administration and the role of BTC and ETH in the plan, as well as the developments from the stock and forex markets, as the markets grapple with substantial global tariffs.