Patrick Hansen, Circle’s European strategy director, predicted major leaps in the EU’s crypto and stablecoin market by late 2025.

At the European Blockchain Convention in Barcelona, Hansen shared expectations of advancements in the crypto market structure across the European Union. The bloc’s Markets in Crypto-Assets Regulation, known as Markets in Crypto-Assets Regulation, would be the primary catalyst for this growth, said Hansen during a panel titled “What is Going on Behind the Scenes – Post MiCA?”

MiCA signaled a shift in the EU’s crypto regulatory strategy, providing comprehensive guidelines for governments, institutions, and investors regarding digital assets.

Indeed, MiCA outlined requirements for crypto exchanges and thresholds for stablecoin reserves. Circle (USDC) was one of the first stablecoin beneficiaries of this new regime and snagged MiCA’s inaugural stablecoin license.

Image credit: crypto.news

You might also like: MiCA is live: How new EU regulation will affect the global crypto market

Hansen disclosed that MiCA compliance and the eventual regulatory approval involved a process different from those in other regions. For instance, USDC’s issuer liaised with regulators for up to 24 months before obtaining approval.

Circle also applied for its Electronic Money Institution license in France, which was accepted by the Autorité de Contrôle Prudentiel et de Résolution, the French banking watchdog.

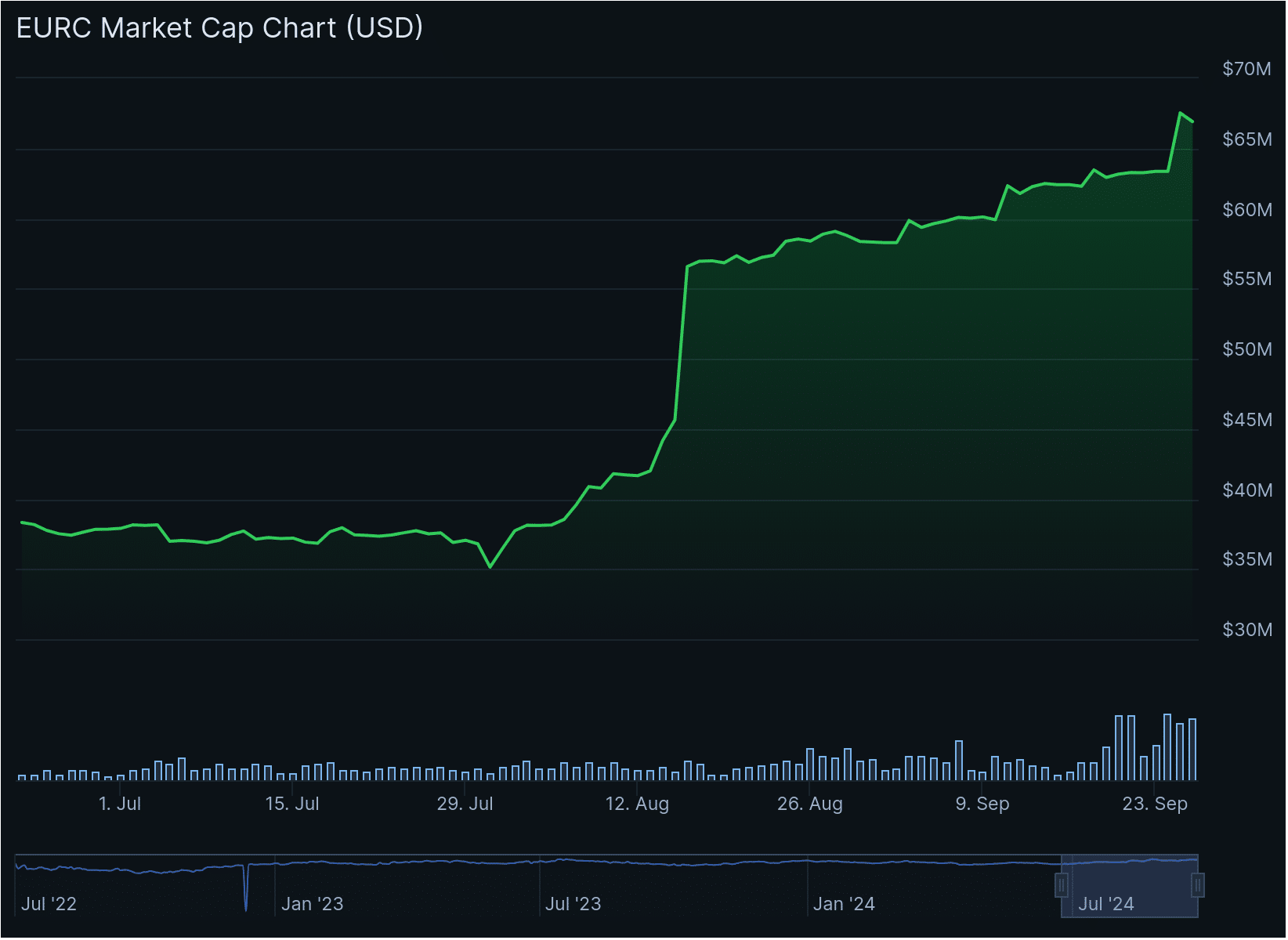

According to Hansen, the firm’s euro-pegged stablecoin, EURC, has jumped 60-70% since July when approval was issued. The token now boasts over 67 million euros in market cap. Hansen foresees continued growth for EURC and other stablecoins in the EU, driven by MiCA’s rules.

We believe that in the European Union, for our euro stablecoin, but for euro stablecoins overall, we can expect at least significant growth in the next 12 months.

Patrick Hansen, Circle’s EU senior director, strategy & policy

3-month EURC market cap data, July 1 – Sept. 23 | Source: CoinGecko

As the USDC operator solidified its European foothold, CEO Jeremy Allaire advanced plans for an initial public offering in the U.S. The digital payment provider relocated its global headquarters to the heart of New York City as part of a roadmap to go public. Circle’s new office is located in the One World Trade Center, alongside some of Wall Street’s biggest names like Goldman Sachs.

Read more: Circle activates USDC in Brazil and Mexico