Avalanche price dropped below $31.50 on Tuesday , June 11, reflecting a 25% decline in the last 20-trading days, vital on-chain trends suggests growing fatigue among AVAX short-term sellers.

Ethereum ETF Approval Sends Avalanche Price into 25% Decline

Avalanche price has struggled for traction in recent weeks. The AVAX markets turbulence can be traced back to the news of spot Ethereum ETFs reported by Bloomberg analysts on May 21.

Following the negative swing in US Non-Farm data, the bearish pressure on Avalance price action has further intensified.

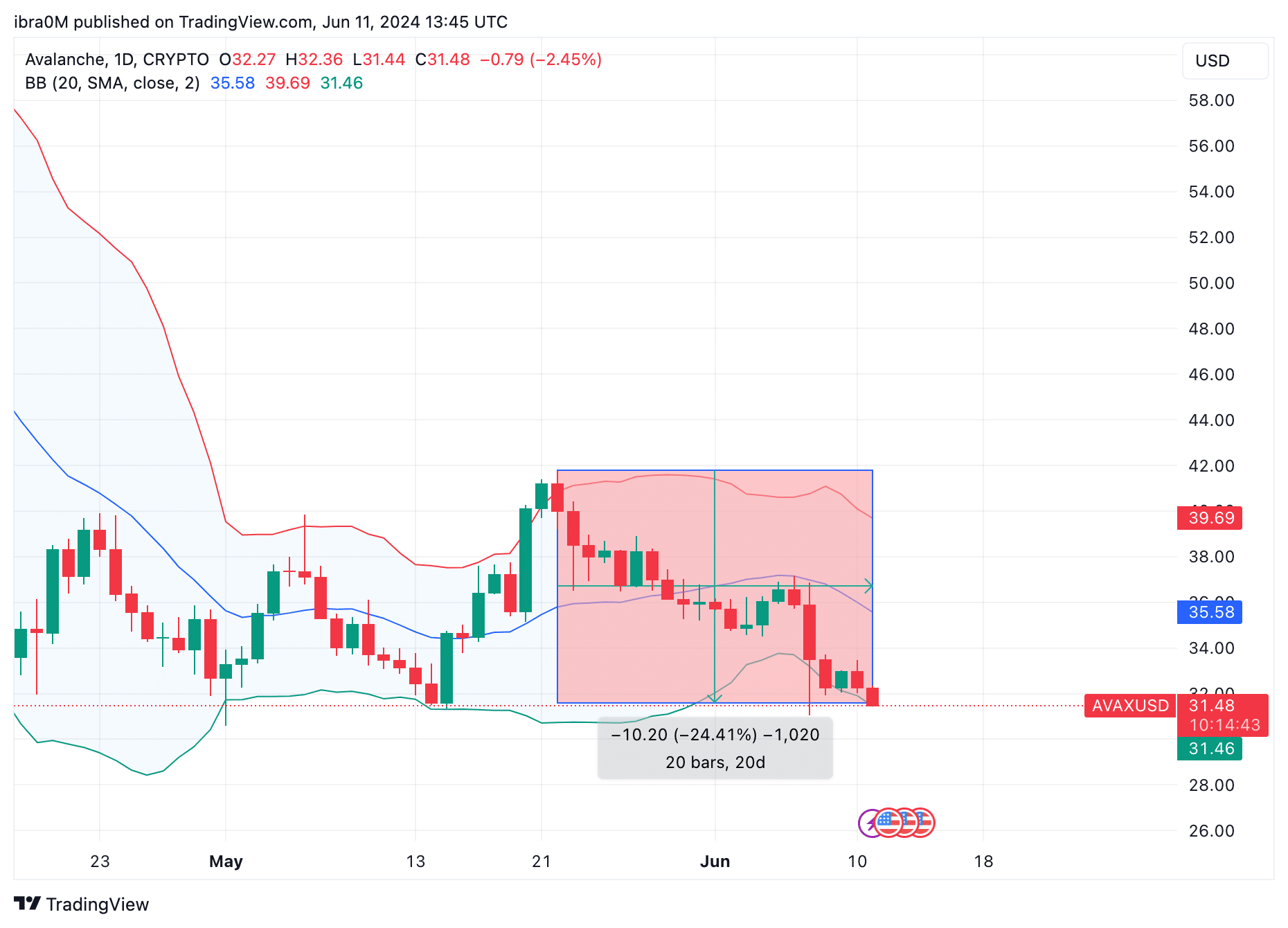

Avalanche price action since Ethereum ETF approval | AVAXUSD | TradingView

As seen in the chart above, AVAX price has slid below $32 mark at the time of writing on June 11, trending at 25-day lows. A closer look at the chart show that AVAX is now on the verge of losing the long-term support level at $30.

But curiously, after nearly 20 days on the back foot, on-chain data shows that Avalanche holders are now growing increasingly unwilling to sell. While the overall sentiment within the ecosystem is still overwhelmingly bearish, this move could trigger a rebound phase in the coming days.

Investors Have Staked AVAX Worth $150 Million Amid Price Dip

Clearly, bears have dominated the AVAX markets since the Ethereum ETF approvals news first broke on May 21. Paper-hand swing traders exited their AVAX positions to seek profitable options within the Ethereum ecosystem ahead of the ETF launch.

However, some core Avalanche investors and node validators have been doubling down, staking their AVAX coins rather than selling into the market FUD (Fear Uncertainty and Doubt)

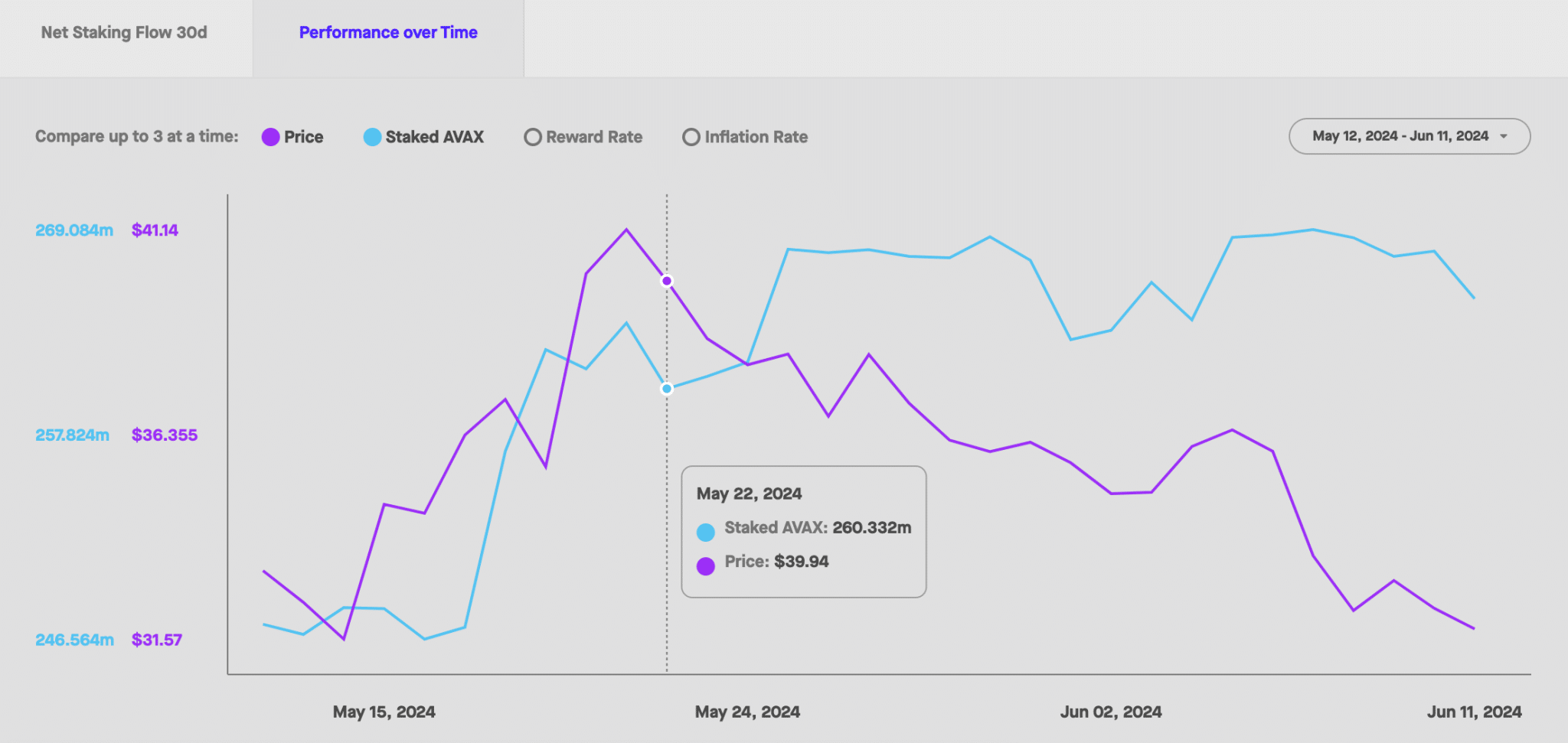

The chart below tracks real-time changes in the number of AVAX coins deposited with the PoS staking smart contracts. An increase in staking often suggests bullish sentiment and long-term optimism among node validators and vice versa.

Avalanche price vs AVAX Staking Trends

As illustrated by the blue trend line inthe chart above, investors held a total of 260.3 million AVAX in staking contracts as of May 22. But as the price downtrend intensified, resilient investors began to stake more coins.

At the time of writing on June 11, the total staked AVAX now stands at 265.4 million AVAX. This essentially means that investors and node validators have staked 5.1 million AVAX in the 20 trading days between May 22 and June 11.

An increase in staking deposits during a price downtrends is often interpreted as a bullish rebound signal for a few reasons. Firstly, by locking up coins in staking contracts, investors essentially reduce the available short-term market supplies, there by cooling the selling pressure.

Valued at the current prices the 5.1 million newly-staked AVAX are worth approximately $150 million on the open market.

More so, it shows that the most aggressive sellers may have exited, while the majority of the current holders are now seeking to tide over the bearish period with passive income from staking.

In summary, by locking a large amount of AVAX within a short period, the node validators could significantly reduce the bearish pressure on Avalanche price action in the days ahead.

AVAX Price Forecast: $30 Support to Stand Firm?

Avalanche price has reached a 20-day low of $31.47 at the time of writing on June 11, down 25% from peaks recorded on May 21. However, the dwindling market supply amid the $150 million staking deposits could set the stage for AVAX price to enter a bullish reversal from the $30 support level.

Avalanche price forecast AVAXUSD

The Bollinger band technical indicator further affirms the bullish price forecast. It shows that AVAX price is on the verge to hitting the lower-limit band at $31.45.

If that key support level holds as predicted, Avalanche price will likely rebound towards $35 in the days ahead.

On the flip side, AVAX bulls could mount the next support buy-wall at the $25 psychological support if the $30 support caves.