Chainlink (LINK) price successfully validated a bearish outcome set towards mid-March but is now looking to reclaim losses.

The altcoin is expected to receive support from investors who incurred substantial losses over the past two days, potentially contributing to its recovery.

Chainlink Investors Act Bullish

Following the massive drawdown that resulted in nearly a 30% decline in Chainlink’s price, LINK holders want to take back said losses. Their intention is visible in their recent actions, which primarily target holding off selling.

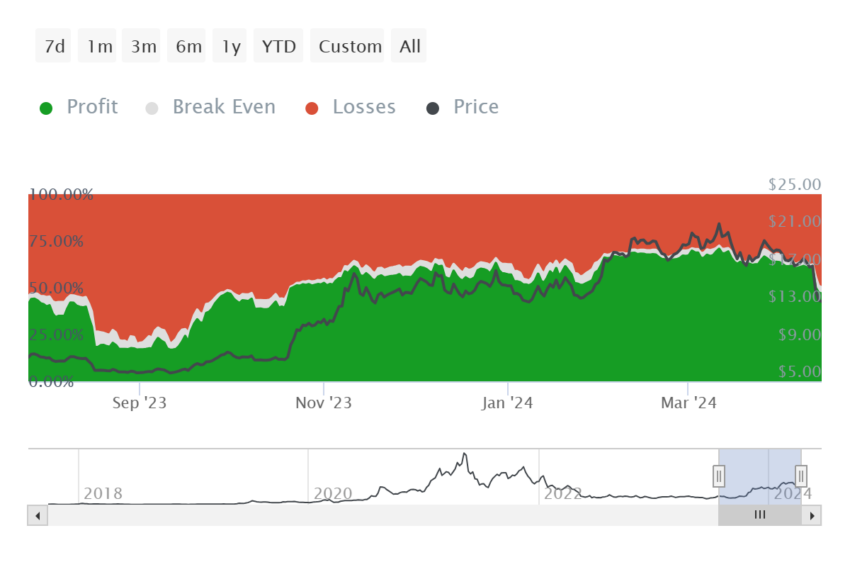

This can be verified by distributing the investors conducting transactions on the network based on their profitability. The active addresses that are in profit only comprise 15% of all participants. The rest, 85%, are the ones that are either bearish losses or are breaking even.

Chainlink Active Addresses by Profitability. Source: IntoTheBlock

The latter two kinds of investors will refrain from selling since they are attempting to make back the money they lost.

Read More: How to Buy Chainlink (LINK) With a Credit Card: A Step-By-Step Guide

Substantiating this is that in the last four days, close to 100,000 addresses, or nearly 14% of all investors holding LINK, have lost their profits. More than 50% of the LINK holders are in losses at the time of writing.

Chainlink Investors at a Loss. Source: IntoTheBlock

Thus, these investors will continue to push price recovery to regain their profits, which could result in Chainlink’s price recovering to key resistance levels once again.

LINK Price Prediction: Targeting the Bearish Pattern

Chainlink’s price hitting the lows of $11.98 during the intra-day trading hours is evidence that the descending triangle was validated. However, its lower trend line at $17 remains a crucial barrier.

LINK would need to first breach through this to continue rising and eventually breaking out of the descending triangle. Trading at $14.54 at the time of writing, the altcoin only needs to breach through two resistances at $14.62 and $15.69.

LINK/USDT 8-hour chart. Source: TradingView

Flipping them into support would enable a rise to $17, marking a 17% increase for LINK.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

However, if this breach fails, a drawdown is also possible, limiting Chainlink’s price rise to $16. If, however, bearishness intensifies and the $14 or $13.55 is lost, the bullish thesis will be invalidated.