BNB price crossed the $631 mark on Tuesday May 21, just 8% shy of reaching new all-time highs, despite Binance’ high-profile legal squabbles with regulators in USA and Nigeria.

BNB Surges, Despite Changpeng Zhao sack, Nigeria FUD

Binance-launched BNB coin price emerged on of the mega-cap crypto top gainers on May 21, as news of imminent Ethereum ETFs approval picks up steam.

BNB’s remarkable 7% price surge in the last 48-hours saw the BNB chain native token rise from each a 65-day peak of $631.

Binance Coin BNB Price Action | Jan May 2024 | TradingView

BNB’s remarkable 105% year-to-date price comes at a period that Binance exchange has been under intense regulatory scrutiny.

Notably, BNB price had crashed 11% on November 26, 2023, when it was announced that US SEC fined Binance $4.6 billion in a settlement that saw Founder/CEO Changpeng Zhao step down.

The negative sentiment grew in 2024 when Nigeria arrested two Binance employees on currency manipulation charges.

Despite rapid withdrawals and dwindling trading volumes, and growing market FUD surrounding Changpeng Zhao sentencing, BNB price action has turn the tide.

With the anticipated approval of the Ethereum ETF, market dynamics are expected to shift favorably for exchange tokens like BNB.

As investor participation surges amidst rising prices, trading volumes and user base is expected to skyrocket across major exchanges such as Binance, increasing the value accruing to BNB holders.

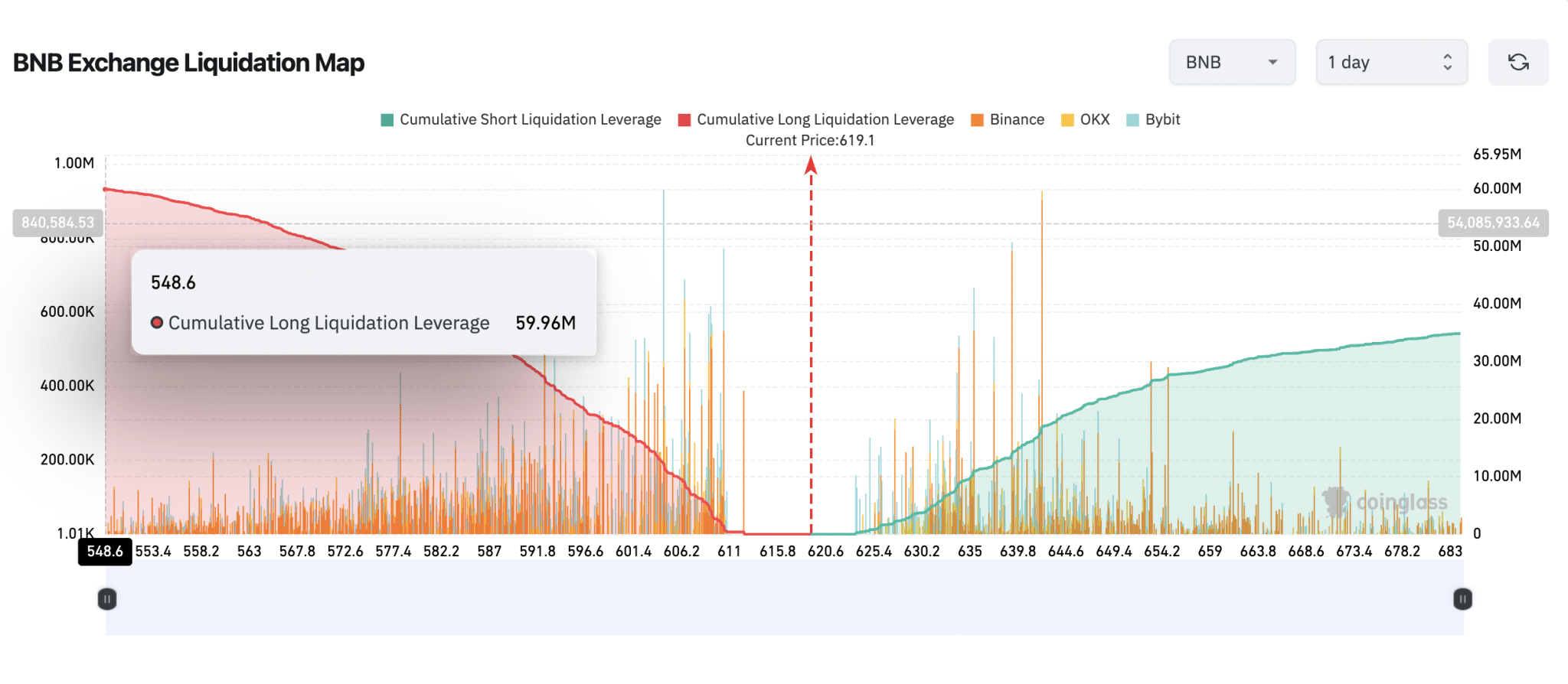

BNB Price Forecast: Bulls to Defend $550 Support Level

BNB price is exchanging hands at $614 at the time of writing on May 24, having retraced mildly from its 24-hour peak of $631. BNB price could breakout to new all-time highs above $690 as investors anticipate the Ethereum ETF approval.

However, as the market enters a consolidation phase ahead of the SEC verdict on ETH ETFs, BNB bulls will likely look to avoid a reversal below $550.

BNB Price Forecast

In affirmation of this stance, BNB traders in the derivatives markets have deployed over $60 million worth of leveraged LONG positions at the $548.6 price mark.

Considering that the $60 million LONG postions far exceed the $35 million active SHORT contracts, bulls are likely to remain in control of the short-term BNB price momentum.

On the upside, bulls could face significant sell-wall around the $650 psychological resistance level.