As the cryptocurrency industry anticipates the next halving, market analysts and investors keenly observe the potential impacts on Bitcoin’s price.

The halving, a programmed reduction in the rewards miners receive, is expected to occur on April 20. It will cut the reward from 6.25 BTC to 3.125 BTC. Therefore, this event will effectively decrease Bitcoin’s inflation rate from 1.7% to 0.85% annually.

Bitcoin Remains Bullish Before the Halving

Historically, Bitcoin halvings have been associated with volatility in the short term but bullish trends in the long term. Vincent Maliepaard, Marketing Director at IntoTheBlock, told BeInCrypto that the 2016 and 2020 halvings saw Bitcoin rallying into the events, followed by a drop shortly after, but eventually breaking previous all-time highs within months.

This pattern suggests that while traders may try to front-run the halving, leading to short-term fluctuations, the reduced supply positively affects price movement over time.

Another notable trend is the diminishing percentage increase in price post-halving. For instance, Bitcoin’s value surged by 4,802% after the first halving. However, such a rate of increase has declined with subsequent halvings.

“Given Bitcoin’s significantly larger market capitalization today, achieving the same percentage growth would require a substantially larger investment, suggesting that future percentage increases are likely to continue decreasing,” Maliepaard said.

Read more: Bitcoin Halving Countdown

Bitcoin Price Performance by Halving. Source: IntoTheBlock

The upcoming halving also differs from previous ones. Indeed, Bitcoin has already surpassed its all-time high, likely due to substantial institutional investment following the approval of Bitcoin ETFs. This institutional inflow, consistent demand from ETFs, and a decreasing supply could increase Bitcoin’s value.

Moreover, crypto whales have entered an enhanced accumulation and strategic holding in anticipation of price rises. These actions reveal a mix of short-term speculation and a longer-term strategic move to hold Bitcoin as a rare asset.

Overall, these patterns demonstrate a more profound comprehension and adaptation to the impacts of the halving cycle on Bitcoin’s value over time.

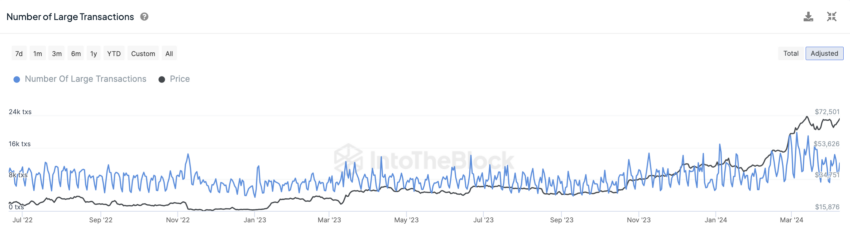

“There is a clear upward trend in the number of large transaction volumes, transactions larger than $100.000, especially since the approval of Bitcoin ETFs. Regarding previous halvings, this metric mostly started going up towards the end of the bull market,” Maliepaard told BeInCrypto.

Number of Large Bitcoin Transactions. Source: IntoTheBlock

Another interesting observation by Maliepaard is the rise in the Miner Flows volume share. In the past year, the percentage volume has climbed from around 4% to over 12%, representing a 200% increase. This rise in Miner Flows volume share is important because it indicates a major change in miner behavior, which could impact Bitcoin’s supply and liquidity dynamics.

While the Bitcoin halving is expected to bring short-term volatility, the long-term outlook remains bullish, driven by reduced supply and continued institutional interest.

“The planned decrease in emissions is one of the key economic measures that distinguishes Bitcoin from fiat currencies. In the months leading up to and following a Bitcoin halving, market sentiment typically shifts from anticipation to optimism as investors speculate on the halving’s impact on Bitcoin’s scarcity and price,” Maliepaard concluded.

Investors should monitor key indicators, such as trading volume and miner behavior, to gauge the halving’s impact on the market.