As Bitcoin’s price retraces, large holders known as whales are seizing the moment, quietly accumulating while retail investors offload in fear.

This trend, highlighted by data from Santiment, suggests that these influential players are seeing opportunity in the recent market downturn, even as headlines continue to warn of crashes and bear markets.

Bitcoin Whales on a Buying Spree

Brian Quinlivan, Lead Analyst at Santiment, notes a significant uptick in whale accumulation over the past three months. According to Santiment’s data, Bitcoin wallets holding at least 10 BTC have increased their balances by 34,200 BTC, worth roughly $2.15 billion, since June, despite the price volatility.

“On top of people spouting that we’re in a bear market and a crash is coming, we have whales basically scooping up hordes of coins while everyone is panicking,” Quinlivan said.

This indicates that whales are confident in Bitcoin’s long-term potential, even as small-scale investors succumb to market jitters. Researchers at Bybit note that such a bullish trend is also observed in the Bitcoin options markets.

“Bearish sentiment is strong in BTC options markets, with puts now showing more open interest than calls. This trend is also reflected in ETH, though call options remain slightly ahead, hinting at more cautious optimism in Ether markets,” Bybit researchers wrote.

Bitcoin Whales. Source: Santiment

Historically, periods of high fear and panic selling often provide buying opportunities for those who understand market cycles. Quinlivan emphasizes that crowd behavior can be a contrarian signal. When retail investors sell in fear, whales take advantage, buying at lower prices.

This pattern aligns with historical precedents, where significant whale accumulation during downtrends precedes price recoveries.

“We had the biggest spike in negative keywords since that big August crash last month… it ended up being the ultimate time to buy,” Quinlivan added.

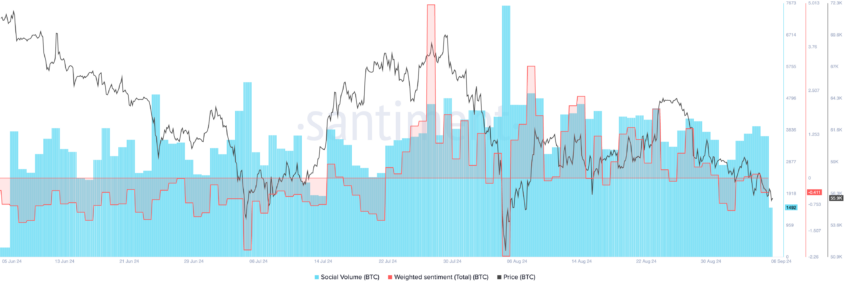

Bitcoin Social Sentiment. Source: Santiment

Another key indicator supporting whale confidence is the decline in the supply of Bitcoin on exchanges. This reflects a long-term hold strategy, as investors move their assets to cold wallets, reducing the risk of panic selling.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Supply on Exchanges. Source: Santiment

While smaller investors may be deterred by recent volatility, data suggests that seasoned market participants are capitalizing on the fear. Their actions indicate optimism about Bitcoin’s future, especially as Q4 historically brings positive price momentum.