Highly capitalized investors have been accumulating Bitcoin (BTC) since the year started, driving the asset’s price to an all-time high. These investment activities are observable through Bitcoin wallet addresses holding large amounts of the coin, also known as whales.

In particular, a Bitcoin whale has stacked 1,308 BTC, worth nearly $90 million since March 6. The address ‘bc1qag725vjxxpkkl5gshfkye9xn4p5vklrlhgkw5w’ currently holds this amount at a dollar-cost average of $68,617 per coin, according to Lookonchain’s post.

Notably, its last purchase was on April 7, for a 113.735 BTC Binance withdrawal, worth over $7.85 million. This was the Bitcoin whale’s second-largest transaction during this month of accumulation. The largest single purchase was 123.128 BTC, with a value superior to $8 million on April 3.

BTC price analysis

As of writing, the leading cryptocurrency is trading at $70,117, back inside a price range lost on April 2. Essentially, the range’s highs and lows are now key resistance and support levels, of $71,500 and $68,500, respectively.

From a technical analysis perspective, Bitcoin displays a short-term uptrend targeting $71,500 and further deciding from there. Moreover, the Relative Strength Index (RSI) in the 4-hour time frame suggests strong momentum and a bullish signal for Bitcoin whales to invest in.

More bullish signals for Bitcoin whales and investors

In the meantime, Finbold has been reporting multiple bullish signals for Bitcoin whales and investors throughout the week. For example, a market cycle analysis that calls for the “most aggressive bull cycle” in BTC history, with new highs.

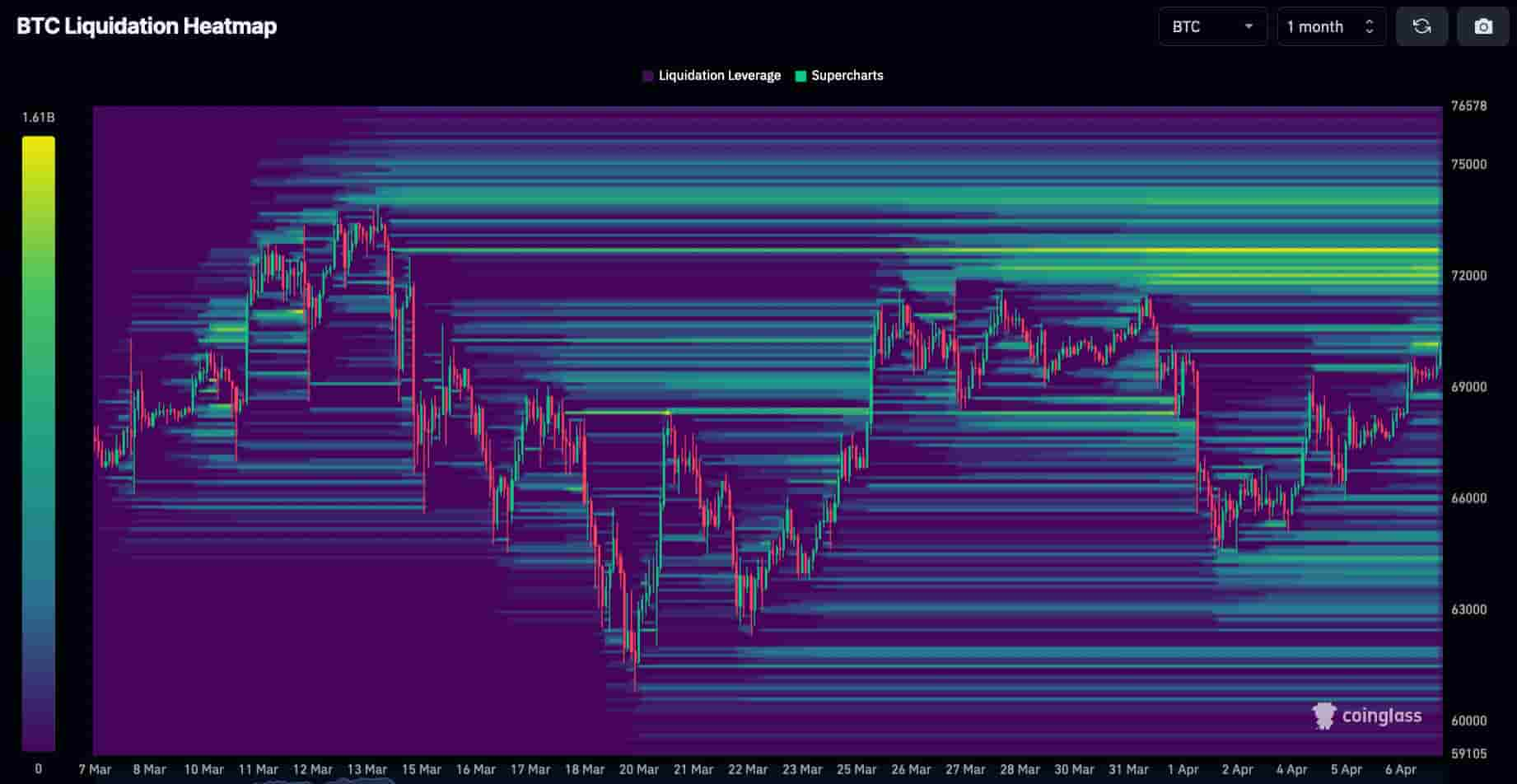

Interestingly, data retrieved from CoinGlass by press time hints at a potential BTC short squeeze above $72,000. This is due to the large amount of leveraged liquidations accumulated in this zone, which Bitcoin whales could make a target for increased profits in a possible resistance-breaking surge.

Nevertheless, the Bitcoin community faces fundamental uncertainties despite all the positive whale activity and technical bullish signals. This is due to the launch of Roger Ver’s new book ‘Hijacking Bitcoin: The Hidden History of BTC.’ The book was launched on April 5 and became a best-seller on Amazon within just two days, shaking historical beliefs.

Yet, the upcoming Bitcoin halving expected to April 20 could drive the investor’s attention to bullish economic fundamentals.

All things considered, Bitcoin’s future price action remains uncertain, while mostly favoring a bullish bias. Investors must do their due diligence and understand the underlying risks and opportunities of investing in BTC.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.