Bitcoin’s (BTC) price led the crypto market’s crash over the last 48 hours, and ironically, the reason was the bullish sentiment.

However, when it comes to crypto, there is never just one reason behind any incident, and such is the case with BTC.

Bitcoin Investors Are Skeptical but Optimistic

Bitcoin’s price touched the ground below the support of $60,000 after the market turned overtly bullish last week. According to Santiment, BTC noted that heavy, long contracts were opened on dYdX on August 25, which is a sign that traders are demanding/expecting a price rise.

However, as noted historically, large long or short contracts generally favor Bitcoin’s price, taking the opposite route than what the traders want. This is what happened with BTC as well, and the market fell by 7.5% in the following 48 hours.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Bitcoin dYdX Funding Rate. Source: Santiment

While this is one side of the coin, the other is the fear of macro bearishness, which has arisen from the recent FOMC minutes. In an exclusive report shared with BeInCrypto, a 10X Research analyst explained the impact of Powell’s speech.

“Powell’s speech highlighted weaknesses in the labor market, signaling a dovish tone and pointing to (potential) significant risks ahead. Some of the labor market data was just revised lower. This makes the coming week critical for risk assets as new economic data will be released. Despite favorable factors like corporate share buybacks, stocks, particularly the Nasdaq, have struggled to rally over the past week,” 10x Research analyst told BeInCrypto.

This paints a slightly bearish picture for BTC as the market awaits the release of the Personal Consumption Expenditures (PCE) data. The expectation is a rise in the year-on-year PCE from 2.6% in June to 2.7%.

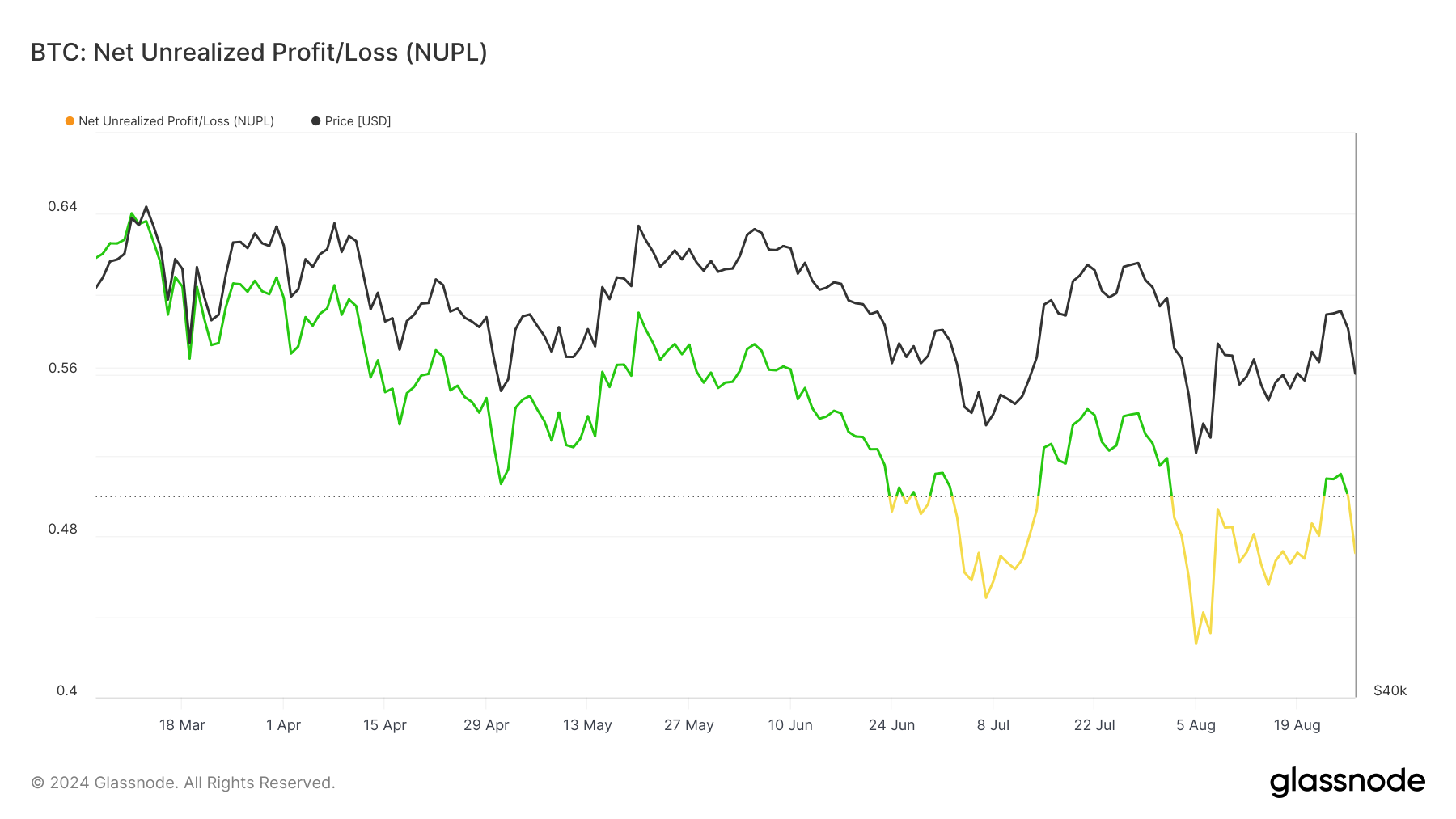

However, even if the short-term bearishness impacts Bitcoin’s price, investors are still holding on to a rise. The Net Unrealized Profit/Loss (NUPL) indicator shows that investors are still optimistic about recovery.

NUPL is an on-chain metric that measures the difference between unrealized profits and losses across all Bitcoin holdings. It helps assess whether the overall market is in a state of profit or loss, indicating potential market sentiment shifts.

At present, NUPL is dipping below 5.0 for the second time this month. During a bearish market, this dip usually signifies that, despite the decline, investors still have a hint of Optimism.

This sentiment will keep them from selling intensely at the moment, preventing another crash. Even if some BTC holders choose to do so, it would not be significant enough to create ripples in the market.

Bitcoin NUPL. Source: Glassnode

BTC Price Prediction: Bullish Eyes Wide Open

Bitcoin’s price, stuck in a downtrend since mid-March, has actually been validating the bullish descending wedge pattern. This pattern suggests that a 22% rise upon breakout is likely, which would take BTC to $84,111.

While this rise is difficult, the breakout could certainly lead to the formation of a new all-time high beyond $73,800. This could take some time, as the current outlook suggests a struggle under $65,000.

Read more: Bitcoin Halving History: Everything You Need To Know

Bitcoin Price Analysis. Source: TradingView

However, the winds could change if $65,000 is flipped into support, enabling a rise towards $67,100. Crossing this level could invalidate the bearish-neutral thesis and lead BTC towards recovery.