Solana (SOL) has been a focal point in the cryptocurrency market, with recent developments reflecting both promising price movements and concerns over declining network activity. As the fifth-largest cryptocurrency by market capitalization, the future of Solana price trajectory and network health are critical for investors and market watchers alike. This article explores the current state of Solana, analyzing its potential price surge and the concerning drop in network usage.

Solana Price Surge Potential: Key Resistance Levels

Solana price has been on an upward trend, closely following Bitcoin’s recovery. Over the past week, SOL has experienced a 7% uptick, bolstered by positive macroeconomic signals from the US Federal Reserve. Fed Chair Jerome Powell’s hints at a possible interest rate cut in September have spurred optimism in the broader market, driving up the prices of major cryptocurrencies, including Solana.

Crypto analysts have identified crucial resistance levels that Solana price must overcome to continue its upward momentum. Currently, SOL price faces significant resistance at $151, a level it has struggled to surpass since mid-August. Should SOL price break through this barrier, it could pave the way for a substantial price increase, potentially reaching $164, and possibly surging to $220, approaching its previous all-time high of $259. However, this bullish scenario hinges on Solana price ability to maintain its upward trajectory and break past these resistance levels.

By TradingView – SOLUSD_2024-08-26 (1M)

SOL Declining Network Activity: A Cause for Concern

While the Solana price prospects appear optimistic, the SOL declining network activity tells a different story. August has seen a sharp decline in network usage, with transaction counts and active addresses reaching their lowest levels in 2024. This drop has significantly impacted the SOL network fees and revenue, which have plunged by over 50% in the past month.

The decrease in active users is particularly alarming, with only 18.09 million unique addresses engaging with the network in August, a 67% decline from July’s figures. Even the hype around new projects like the Pump.fun meme coin platform hasn’t been enough to counteract this downward trend. As transaction volumes decrease, Solana’s revenue streams continue to dwindle, raising questions about the network’s long-term sustainability.

Solana Price Prediction: Consolidation and Future Movements

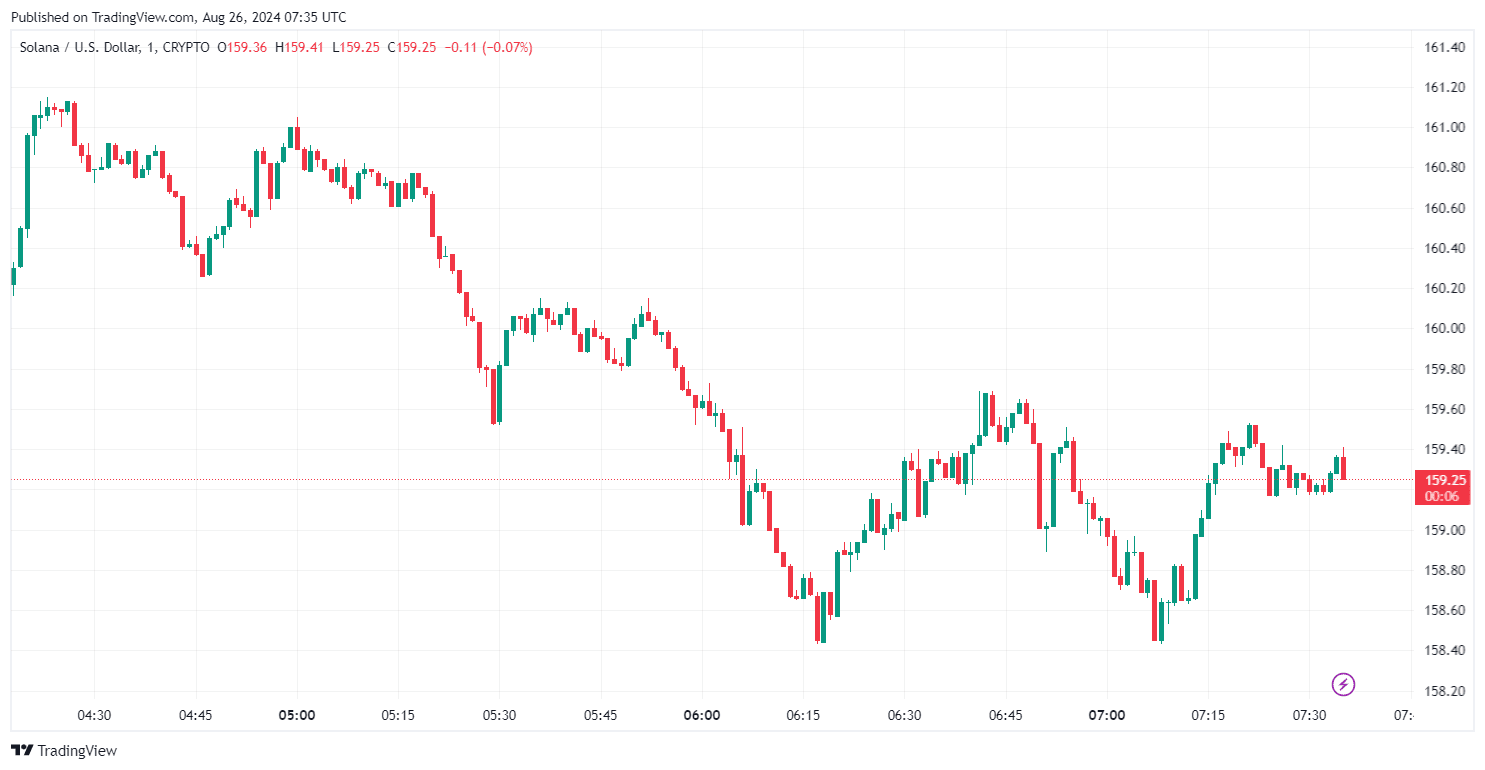

As of the latest data, the Solana price hovers around $145.58, exhibiting a period of consolidation between resistance at $152.12 and support at $137.65. This sideways movement reflects a balance between buying and selling pressures in the market. Should SOL price break above the current resistance line and retest successfully, it could see a 10% price increase, potentially trading at $160.09. Conversely, if selling pressure intensifies, SOL price could dip below its support level, possibly falling to $133.64.

By TradingView – SOLUSD_2024-08-26

Solana price finds itself at a critical juncture, with the potential for significant price gains tempered by declining network activity. Investors should closely monitor both the price resistance levels and the network’s user engagement metrics. A successful breakthrough of resistance could lead to impressive price surges, but the ongoing decline in network usage may pose challenges to the Solana price’s long-term growth.