Main Takeaways

-

Launched earlier this year, spot BTC exchange-traded funds (ETFs) have attracted retail and institutional investors alike, collectively holding over 938.7K BTC ($63.3 billion), or 5.2% of bitcoin’s total supply.

-

Spot BTC ETFs have surpassed gold ETFs in first-year net inflows, solidifying the narrative of bitcoin’s role as the new “digital gold.” At the same time, ether spot ETFs saw more modest demand and inflows.

-

The rise of spot crypto ETFs paves a way to a broader shift toward tokenization of assets, highlighting a maturing crypto market on its way to a deeper integration with traditional finance.

The approval of U.S. spot exchange-traded funds (ETFs) for bitcoin (BTC) and ether (ETH) has been a significant development in the crypto markets this year. These products provide a regulated and accessible way for investors to gain exposure to digital assets, bypassing the complexities of direct ownership. By broadening access to crypto, they attract both retail and institutional investors, contributing to greater market stability and diversity. Here, we summarize the findings of a recent Binance Research report that assesses the impact of spot ETFs on crypto markets, examining their initial performance, capital flows, and broader market effects.

Ushering in a New Wave

The launch of spot bitcoin ETFs in early 2024 has brought a new wave of retail and institutional investors into the crypto market. So far, these products have accumulated some 938.7K BTC worth roughly $63.3 billion, making up a total of 5.2% of BTC’s total supply. Ether (ETH) spot ETFs have seen weaker demand, with 43.7K ETH (approximately US$103.1M) in outflows. Consequently, BTC ETFs exert a significantly greater influence on their respective markets when adjusted for spot trading volume.

By offering a more traditional, regulated entry into crypto, these products provide an investment structure similar to traditional finance (TradFi), helping less tech-savvy and more conservative investors get crypto exposure without the hassle of direct ownership. The popularity of these ETFs highlights the strong interest in and demand for digital assets. BTC ETFs saw positive flows in 24 of 40 weeks since the launch – removing an average of 1.1K BTC from the market daily. In contrast, ETH ETFs had negative flows in 8 out of the last 11 weeks.

While early performance might appear stronger for BTC than ETH-based ETFs, the introduction of both these product types marks a truly transformative moment for crypto and is expected to have profound effects on digital-asset markets and adoption in the long term.

Institutional and Retail Demand

While institutions are arguably more conspicuous at the helm of crypto ETFs adoption, in fact, roughly 80% of BTC ETF demand comes from non-institutional users, with easy access to digital assets that ETFs provide proving to be a compelling feature for retail investors.

At the same time, the number of institutional players investing in BTC ETFs has jumped by 30% since Q1 this year. The warming up to crypto ETFs from financial institutions such as Morgan Stanley and Goldman Sachs not only enhanced digital assets’ legitimacy, but also helped further embed crypto into investment portfolios, advancing adoption and market maturation.

Cementing the Digital Gold Narrative

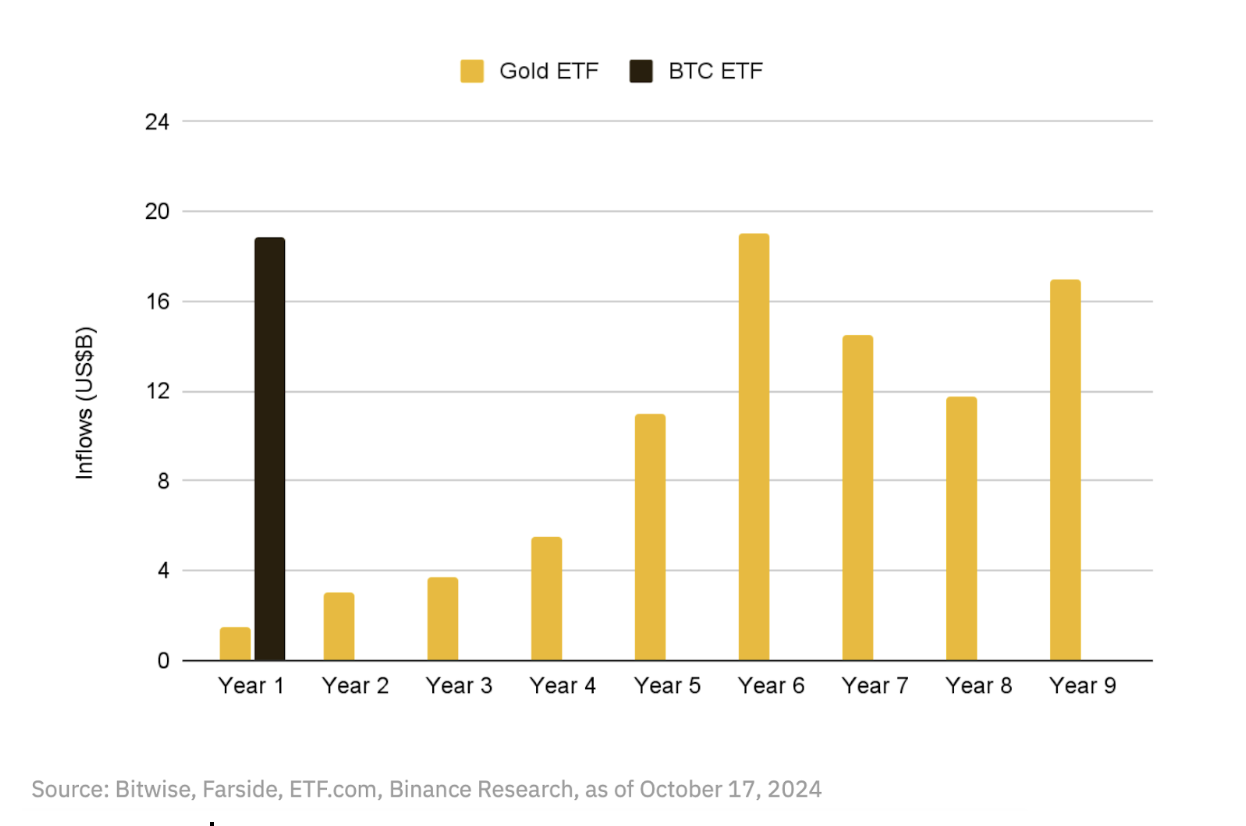

Spot bitcoin ETFs outperformed gold ETFs in their comparably early stages. Within just a year of the launch, BTC ETFs accumulated a substantial $18.9 billion in net inflows – significantly more than the $1.5 billion that gold ETFs attracted in their first year. This favorable comparison could add to bitcoin’s appeal as the new “digital gold,” as the narrative around BTC serving as a commodity with certain gold-like qualities remains strong within the crypto community and beyond.

Institutional support is one of the main reasons behind the exceptional performance of BTC ETFs. Over 1,200 institutions are currently invested in BTC ETFs, as evidenced by 13F filings, in contrast to gold ETFs’ 95 institutional investors in their first year after launch.

While these dynamics are indeed impressive, it’s crucial to acknowledge the considerable time gaps between the launches. The market conditions, the time value of money, and other factors influencing adoption were significantly different, which makes direct comparisons between BTC and gold less analytically powerful.

Adoption, Tokenization, and Integration

More than just a novel class of investment products, spot crypto ETFs pave the way for broader adoption and acceptance of digital assets. As these ETFs gain massive popularity, we’re seeing the signs of a shift toward tokenization – the process of converting real-world assets into digital tokens on the blockchain. Making TradFi appreciate the advantages of blockchain technology as a result of exposure to premier digital assets can accelerate the tokenization of assets like stocks and Treasury bills.

Deeper integration with traditional finance as a result of ETF advancements exert significant effects on crypto as well. For quite some time, BTC was considered to have a relatively weak correlation with traditional equity markets, which helped maintain its appeal as a hedge against traditional market volatility.

However, this narrative appears to be shifting as the rapid growth of spot ETFs is pulling bitcoin closer to traditional assets in ways we have never seen before. Now, global economic factors like interest rate cuts by the U.S Federal Reserve are increasingly starting to impact bitcoin’s price. These processes reflect the ways in which spot crypto ETFs are bridging digital assets and traditional finance. Over the past year, BTC inflows and outflows have increasingly started to mirror market cycles and trends usually seen in traditional markets.

Final Thoughts

The introduction of spot crypto ETFs has marked a transformative moment in the digital asset landscape, bridging the gap between traditional finance and the burgeoning world of cryptocurrencies. With significant inflows into BTC ETFs and a growing interest from both retail and institutional investors, these products have not only validated digital assets but also paved the way for broader market adoption and integration. As the market continues to mature, the rise of crypto ETFs is expected to drive further innovation and acceptance, solidifying their role in the future of global finance.

Further Reading

-

Spot ETFs in Crypto Markets – Full Report

-

It’s Live – What Now? The Potential Effects of Ether Spot ETFs on the Market and Staking Economics

-

How Spot Bitcoin ETFs Can Benefit Institutional Investors

Disclaimer: Digital asset prices can be volatile. The value of your investment may go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Not financial advice. For more information, see our Terms of Use, Binance Pay Terms of Use and Risk Warning.