Shiba Inu (SHIB) is back at $0.000014 after a 4.50% increase in the past 24 hours, with the burn rate spiking by 1088%. Typically, an increased burn rate reduces supply and can boost the price.

However, historical data shows that price doesn’t always correlate directly with burn rate spikes. Will this time be different? That remains to be seen.

More Shiba Inu Tokens “Dead” as Returns Improve

The Shiba Inu team’s strategy of consistently burning tokens is aimed at reducing the large supply to drive up the value of SHIB. The burning process involves sending tokens to a dead wallet, permanently removing them from circulation.

In theory, reducing supply should make an asset more valuable. However, for SHIB, this only happens when there is a simultaneous increase in demand. As of now, the Shibburn website shows that nearly 100,000 tokens have been burned, bringing the total burned since inception to 410.72 trillion.

Shiba Inu Burn Rate. Source: Shibburn

The recent price increase of Shiba Inu indicates growing demand, which, combined with a rising burn rate, could further boost SHIB’s value — unless interest declines.

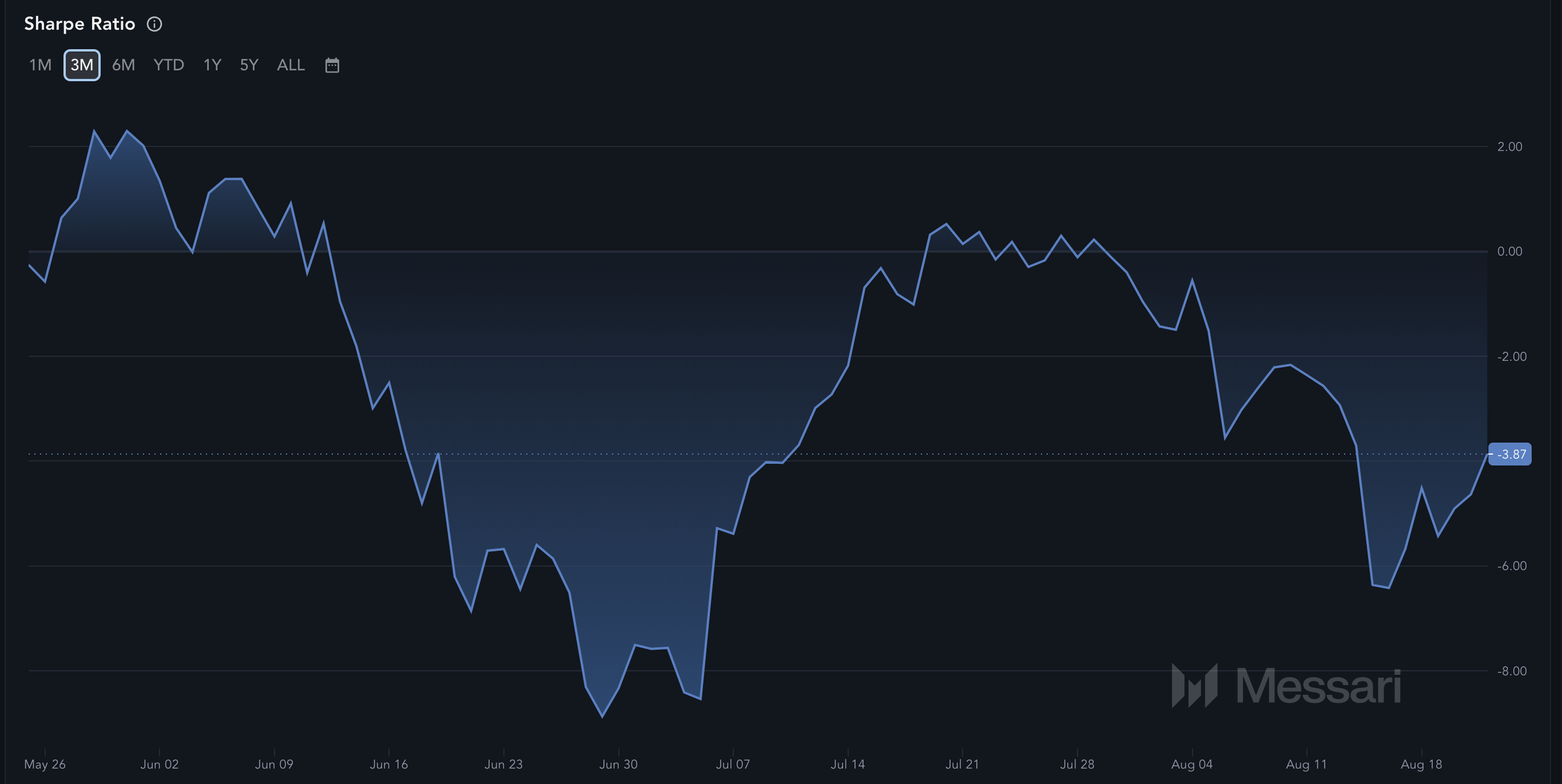

BeInCrypto also examined Shiba Inu’s Sharpe ratio. As one of the widely used metrics to measure risk-adjusted return, the Sharpe ratio shows how good or bad a cryptocurrency remit returns in place for the volatility the asset has. A positive Sharpe ratio suggests a favorable risk-to-reward scenario, while a negative ratio indicates higher risks relative to potential returns.

According to Messari, SHIB’s Sharpe ratio was -5.43 on August 19, coinciding with a price drop to $0.000012. Currently, the ratio has improved to -3.87, signaling that SHIB may be on a path to better profitability for investors.

Shiba Inu Sharpe Ratio. Source: Messari

Should the ratio continue to rise, there is a high chance that SHIB’s price will follow. If it eventually reaches the positive region, the crypto’s value might inch closer to $0.000018.

SHIB Price Prediction: on the Right Track to Another Peak

On the 4-hour chart, SHIB is trading within an ascending channel, also known as a “channel up.” This bullish pattern emerges when two upward trendlines form, indicating consistent buying interest. The lower trendline represents rising support, while the upper trendline shows resistance. If this pattern continues, SHIB’s price could see further upward movement.

Additionally, the Moving Average Convergence Divergence (MACD) indicator is currently positive. The MACD uses the relationship between the 12-period (blue) and 26-period (orange) Exponential Moving Averages (EMAs) to spot potential entry and exit points.

When the 12-period EMA crosses above the 26-period EMA, it indicates that buyers are dominant, which is the case for SHIB at the moment. This suggests that the upward momentum could continue, supporting the bullish outlook.

Shiba Inu 4-Hour Analysis. Source: TradingView

Combined with the MACD positive reading, this trend implies that Shiba Inu’s momentum is bullish. Thus, if the momentum improves, the token’s value might jump.

By the look of things, SHIB could increase toward $0.000016. However, if it fails to break above the overhead resistance at $0.000014, the price could drop to $0.000012, where the 38.2% bear market floor positions.