After a drab week characterized by Bitcoin, Ethereum, and Solana prices either dumping or moving sideways, prices bounced off strongly by the end of last week.

Of note, losses in Ethereum were arrested as prices recovered, rising from around $3,000. At the same time, Bitcoin and Solana pushed higher, closing in on $70,000 and $200, respectively.

Interest In Bitcoin, Ethereum, And Solana Spikes

According to Santiment data, despite weakness across the scene, there were hints of strength at the tail end of last week. Of note was renewed interest, where Solana, Bitcoin, and Ethereum saw a marked spike in trading volume.

When trading volume surges, it often suggests that market participants are curious and willing to engage, especially if prices are rising. Since these top coins were firm, rejecting losses, especially from Friday, July 26, buyers were in the equation, looking to capitalize.

As Santiment analysts noted, how Bitcoin, Ethereum, and Solana perform tends to impact the general market. If Ethereum rallies, for example, it would benefit the broader layer-2 and 3 ecosystems. This will push meme coins and even decentralized finance (DeFi) activity even higher.

There were multiple factors behind this interest. In Bitcoin’s case, shifting regulatory perspective on the world’s most valuable coin and increasing endorsement from politicians, especially in the United States, could explain why more are willing to learn about the coin.

The Impact Of Trump, Spot Ethereum ETFs, And SOL Flipping BNB

Over the weekend, Donald Trump, the former president and the presidential candidate in the upcoming November election, delivered a keynote address at the recently concluded Bitcoin conference in Nashville. Trump expressed his support for Bitcoin, saying he would make America the home of crypto.

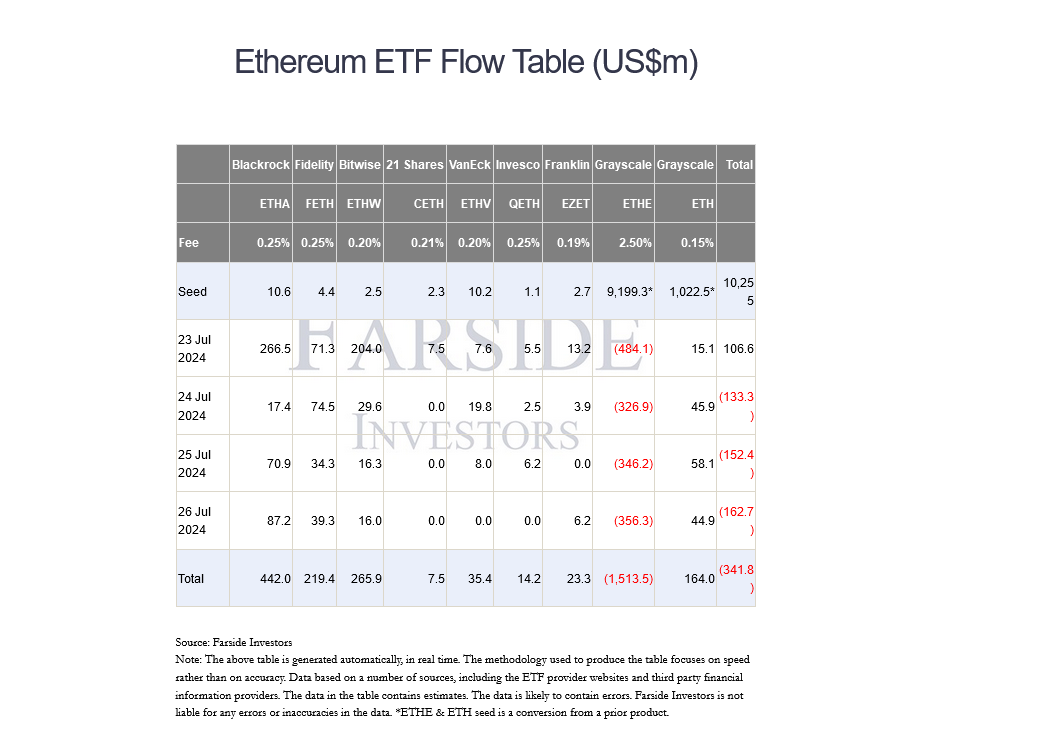

Meanwhile, eyes were on Ethereum following the approval of spot ETFs by the United States Securities and Exchange Commission (SEC). Though the derivative product began trading at leading bourses, including the NYSE and Cboe, inflows remain low.

If anything, Farside data showed that by Friday, spot Ethereum ETFs had posted outflows for three consecutive days. Outflows from Grayscale’s ETHE chiefly drove this. Even amid this unexpected development, BlackRock’s spot Ethereum ETF product saw over $87 million inflows on July 26.

Traders also tracked Solana after the coin flipped BNB as the third most valuable cryptocurrency, excluding stablecoins. According to July 29, SOL commanded a market cap of $88.5 billion, while BNB stood at $86.5 billion, according to CoinMarketCap data.

Over the past few weeks, SOL has been edging higher. To put in the numbers, SOL is up 56% from July lows. It will likely register fresh Q3 2024 highs if buyers breach $200.